The problem of overly persistent collectors of overdue debts on the territory of the Russian Federation is growing. Despite recent amendments to legislation and the creation of new regulations designed to legitimize the situation in the field, the situation is far from civilized. The new regulators of 2017, although they work well, however, the population simply has not yet figured out how to use them to the fullest. Where to call, contact and who to complain about debt collectors for calling relatives, friends, making house calls, disclosing personal information, and so on. It turns out to be a funny situation, it seems that legal norms already exist, sanctions and prohibitions have been published, but tax collectors continue to commit outrages. This happens because the average person simply does not know how this mechanism is applied in principle. Who is involved in solving the problem, in which cases should you turn to bailiffs, in which to general law enforcement agencies, when to communicate personally with the district prosecutor. In this review, we will clarify this situation with all the associated details, and also figure out how to fill out the papers and draw up specific applications.

Normative base

The official term “collectors” does not exist in Russian legislation. But there is another concept - “legal entities that repay overdue debts.” In order to protect citizens and to control the activities of these offices, the law of July 3, 2016 No. 230-FZ was adopted. But even the introduction of this act sometimes does not stop debt collectors; some of them still act in violation of the law.

We list the regulations on the basis of which collectors must carry out their activities:

- Civil Code of the Russian Federation (the document determines the procedure for transferring existing debt from the creditor to the new claimant);

- Law on the Protection of Consumer Rights No. 2300-1 (the act regulates relations between the parties, so debtors can demand protection of their rights if they are violated);

- Law “On Enforcement Proceedings” No. 229-FZ (the document defines the procedure for debt collection, including measures and deadlines);

- GD dated December 19, 2016 No. 1402 (establishes the rules for maintaining a unified register of legal entities engaged in debt collection);

- Law “On the protection of the rights and legitimate interests of individuals when carrying out activities to repay overdue debts...” No. 230-FZ.

It is necessary to clearly understand whether the rights of a citizen have really been violated. After all, if employees of debt offices act in accordance with the law, then there are no reasons for appeal.

Law on the activities of debt collectors

The times when almost every citizen had the image of such an employee in his head with an invariable iron in one hand and a bat in the other are long gone. Legitimate regulators were now able to impose order on agency managers, forcing them to comply with regulations and treat people with respect. But there are still plenty of exceptions today. Many particularly persistent people who want to quickly get promoted ignore the requirements of the laws. And sometimes entire companies put this idea on stream, forcing workers to deal harshly with debtors.

But it is worth knowing that any organization in this area is now strictly limited in its capabilities. And there is a whole scattering of legal acts regulating the situation in the industry. Where to complain about the actions of debt collectors depends on how and what rights were violated. There are several basic documents that will become a reliable legal support:

- Civil Code of the Russian Federation. In principle, this law fully describes the actions of both the creditor and the debtor, and the collection departments, which can be recognized as legal. Regulates the entire procedure for relations in a lending transaction. This is a basic, fundamental aspect that applies to many cases. It is especially important when a bank or other organization allows itself to take actions that are not specified in the loan agreement. This may be an assignment of claims, transfer of collection privileges to an agency, and similar issues.

- Consumer protection. Few people know that this legal act also has a very direct relation to creditors. But in reality, the client remains a consumer at the time of the functioning of the credit relationship. And he can use the full amount of help. True, where to file a complaint against debt collectors for such violations (you can write it using a template via the Internet) is a more complicated question. Usually this means Rospotrebnadzor.

- This also includes the well-known law on “Enforcement Proceedings”. It partially connects the FSSP and the heroes of our today's review. Sometimes two authorities even work together, but these offices are still accountable. This means that if a problematic situation arises regarding debt collection, you can always contact the department with a question about company managers. And they will be obliged to restore order. Of course, bailiffs will need to file a complaint against the actions of debt collectors; a sample complaint can be obtained on the open virtual resource of the FSSP. Applications are not accepted by phone, but a completed application form can be sent remotely.

- Criminal Code of the Russian Federation. An unexpected member of our list, but quite legitimate. After all, a serious number of various offenses in the field are connected precisely with this branch of legislation. Insulted - Criminal Code, threatened with violence or harm to health - here. We are already silent about the physical intervention that could have taken place. And in this case the sanctions will be much tougher. These are no longer various restrictions and financial sanctions, nor bans with the deprivation of a license to operate. Here, guilty citizens, employees and company executives can go to places not so remote. But in this option, the main link becomes another body, which acts as a prosecutor in court and initiates criminal cases. If you are interested, the answer to the question of where to write a complaint against debt collectors, and where to find a sample application to the prosecutor’s office or the police is available online, as well as on the official website of the structure. The form can also be obtained directly from the office. But this is not necessary, because the application is accepted in free form. A citizen is not required to have legal knowledge to protect his rights. The main thing is to indicate the date and essence of the complaint.

- 230 Federal Law. So we got to the main thing. This law consists entirely of articles regulating work in the collection of overdue debts. And all major offenses that arise during the performance of their duties by managers usually relate to him.

Read Collector: who is he and what does this person do?

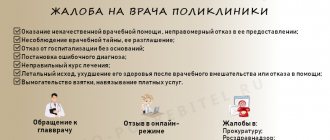

Grounds for filing a complaint against debt collectors

Employees of this agency have certain rights and prohibitions:

| Can | It is forbidden |

| Communicate directly with the debtor on weekdays from 8 a.m. to 10 p.m. | Appear to the debtor at 6 a.m. or 11 p.m. |

| Meet in person no more than once a week | Wait at the borrower's entrance every day |

| Make phone calls no more than 8 times a month | Disturb the debtor or his relatives with calls several times a day |

There are other reasons for filing complaints. For example, when office employees used physical force against a debtor, or come to the employer and express their complaints and demands. If it is difficult for citizens to independently understand all the intricacies and nuances of the legislation, then they should turn to lawyers for help.

Reference! If employees of collection companies threaten to kill a citizen or his loved ones, call several times a day, leave signs on the entrances with the debtor’s personal data, then all this is a reason to file a complaint with the relevant authorities.

Lawful actions of collectors

And there are such things. True, the list turns out to be quite narrow. And if you think about it, any employee of an organization specializing in financial collection remains an ordinary citizen. He has almost no special rights when performing his duties in his position. The only way it differs from millions of others is access to confidential data. Yes, he has information about the debt, but he is prohibited from disclosing it. Therefore, his list of acceptable actions is very small. And as soon as he takes a step aside, the borrower receives a legal opportunity to protect his interests. All that remains is to understand where to complain about the collection agency, because you can submit a complaint to many different authorities, including online. But in essence, the powers of managers include:

Bankruptcy of individuals

from 5000 rub/month

Read more

Services of a credit lawyer

from 3000 rubles

Read more

Legal assistance to debtors

from 3000 rubles

more

Write-off of loan debts

from 5000 rub/month

More details

- Informing about the presence of arrears and the specific amount due for payment. Moreover, with a detailed analysis of what part of the debt is relevant, what are sanctions and penalties, and what appeared due to the annual rate.

- Repayment requirements. Yes, the employee often says this - I demand. But this is where his powers come close to the border. He cannot force the borrower to pay. Visit or phone call. For polite, but only conversation.

Moreover, there are limitations to the described possibilities. Calls are allowed no more than once a day, no more than three times a week, with a total number of less than nine per month. Contacts after hours, after 22.00 or before 8.00, are excluded. On weekends and holidays this range becomes even smaller. As a result, employees have few opportunities left.

Where can I go?

In any case, first you should try to resolve the issue with the employees of the claimant’s company. Or write a statement addressed to the director so that he can understand the situation.

The pre-trial method of conflict resolution is considered priority. If a citizen was unable to reach an agreement with the management of the debt office, then there are several other authorities where he can turn to protect his rights.

| Police | A complaint is written if the debtor or his relatives were threatened or used physical force. |

| Roskomnadzor | The institution is contacted when telephone calls are received to the debtor, his relatives, friends and colleagues at prohibited times and days. |

| FSSP | The institution is empowered to control debt collectors and maintains a register of such persons. In case of discrepancies in the provided data, measures may be taken against violators. |

| Central Bank | A complaint is filed with this body if the collectors exceeded their powers or did not inform the debtor about the interests of which creditor they represent. |

| Prosecutor's office | It is worth contacting this authority if the supervisory authorities are inactive. |

| National Association of Professional Collection Agencies (NAPCA) | A higher organization may initiate an inspection of the company specified in the complaint. If the facts specified in the complaint are confirmed, members will be issued an order. There is a hotline: 8-800-737-77-66. |

A citizen can also contact the financial ombudsman - this is a representative of the public who is ready to resolve the issue peacefully between the parties to the conflict in the event of unlawful actions by debt collectors.

The person himself chooses which of the listed institutions to contact. This mainly depends on the violation committed.

The total period for sending a response to a complaint should not exceed 30 days. In special cases, the review may be extended, but not more than 30 days. In this case, the applicant must be notified of the change in deadlines.

The most important thing: what you need to know about collectors

If you want to get rid of sewers, the first thing you need to do is learn how they work. There are only two options:

- Agency contract . When a bank enters into such an agreement with a collection agency, the original creditor does not change: you still owe money only to the bank, and the collectors serve as intermediaries (for example, if the creditor does not have full-time specialists in collecting overdue debts). If you find out that collectors work under an agency agreement and only represent the interests of the bank, remember: you cannot give money to them directly.

- Assignment agreement . Its presence means that the bank has ceded the right to claim the debt. Now the lender has changed, and instead of a financial institution it has become a collection agency. Accordingly, you will have to carry out all calculations, request documents and interact with collectors. In this case, you should immediately complain to government agencies or associations.

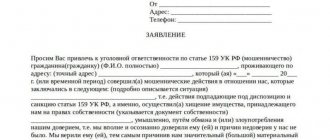

How to write a complaint?

If a fact of unlawful action by debt collectors is revealed, none of the listed institutions can leave the appeal without consideration. The complaint is drawn up in free form, since there is no approved form.

The claim must be made in writing and contain the following:

- the name of the institution where the injured party applies;

- information about the applicant (full name, address, contact telephone number);

- the name of the document, in our case – Complaint;

- information about the collection organization;

- a detailed description of the current situation;

- demands put forward by the applicant, for example, to inspect the institution and hold it accountable;

- the listed documentary evidence (they must be attached to the application);

- date of completion and personal signature of the applicant.

The complaint is drawn up taking into account the violations identified, as well as the body to which the debtor applies. You can even complain about calling relatives if personal information was obtained illegally.

How to communicate with collectors?

Remember that debt collectors are people too. Try not to be rude or swear, they are doing their job. But if you break the law, report it to the appropriate authorities. To do this, prepare:

- Turn on the recorder. Install the program on your phone and practice so that you can record a conversation at the right time. The recording will be required to file a complaint against the actions of the collection service.

- Ask for full name and position. Ask the caller to introduce himself. He is obliged to provide the position, name of the collection agency and the bank he represents.

- Explain that you do not know the debtor and will not pay his debt. If you know the borrower, tell them that the debt has nothing to do with you.

- Ask them not to call again. State your position clearly, arguing that you did not consent to the calls and are not a contact person or co-borrower on the loan.

- Don't be rude or use profanity. Such a recording is inconvenient to present as evidence. Your threats and screams will not affect the collector. He will continue to call as if nothing happened.

You are not obliged to listen to your interlocutor and enter into discussions with him. Feel free to hang up if the conversation is irritating.

Read the article “Collectors: rules of the game and how to protect yourself?”

Complaint against collectors in five instances

On our website you can download ready-made forms taking into account the nuances and possible situations:

Download a sample complaint against collectors to the FSPP Download a sample complaint against collectors to Roskomnadzor Download a sample complaint against collectors to the Central Bank Download a sample complaint against collectors to the prosecutor's office Download a sample complaint against collectors to the police Download a sample complaint against collectors to Rospotrebnadzor

Life hack: how to get rid of debt collectors?

The advice is suitable for people who are not related to the debtor. If collectors are constantly calling you, act in their own way - ask questions after turning on the audio recording.

As soon as the debt collector calls you, tell him that you are not the debtor and do not know this person. Notify the other person that the conversation is being recorded. This is necessary so that the recording will be accepted as evidence if it comes to that. Next, ask the caller to introduce himself, company name and position. Don't stop there! Request your INN and OGRN numbers. When the collector provides the information, ask to send a scanned copy of the state registration certificate. This will take him by surprise and he will most likely end the conversation.

By these actions you will show the collection agency that you are knowledgeable about the issue.

Going to court

This is the fifth - extreme measure of influence. In this case, the document acquires the status of a statement of claim. The injured party may refer to Art. 151 Civil Code of the Russian Federation. Used in cases of insults and humiliation. You can obtain compensation for moral damages. The court will consider the application received and a decision will be made taking into account the evidence presented.

Ways to file a complaint in court

The claim is sent to the inspection authorities in one of the available ways:

| Personally | If there is an appropriate authority in the city, then you can go to the office yourself and submit a complete set of documents. It is necessary to require that an employee of the institution put an acceptance mark on the copy of the person who applied. |

| By mail | If it is not possible to personally contact the government agency, then the letter is sent by registered mail, with acknowledgment of delivery. Then it will be known that the letter has been delivered to the addressee. |

| Electronically | Citizens can submit a claim online through the official website of a government agency or through State Services. This method of treatment is possible only if this option is provided by the institution. |

What actions contradict the Civil Code of the Russian Federation?

On January 1, 2022, Federal Law No. 230 came into force, which regulates the activities of collection agencies. This is due to the fact that collectors used illegal methods of debt recovery - they resorted to threats, damaged property, and caused bodily harm. Now administrative and criminal liability is provided for each violation.

What is prohibited for debt collectors?

List of prohibited actions:

- inform third parties about the existence of debt, disclose the borrower’s data;

- call colleagues, acquaintances and relatives without the written consent of the debtor;

- intimidate, use force, damage property, etc.;

- put pressure on the borrower;

- mislead, threaten with prison and non-existent fines;

- call from a hidden number.

Complaint about calls from debt collectors regarding someone else's loan

Sometimes such unpleasant situations arise.

Collectors do not respond to the phrase: “I didn’t apply for any loans,” different people can call from different numbers, each time you have to talk to a new employee and explain the current situation. In this case, several options are possible. For example, if you did not take out a loan, but acted as a guarantor for the loan, you will have to pay the accumulated debt. Here the law is on the side of the bank, since if the borrower violates the terms of the loan, the guarantor is jointly and severally liable for the remaining payments. You need to try to negotiate with the defaulter so that he pays off the debt, otherwise you will have to pay for it. Later, you can legally recover the paid amount from the borrower.

A person who has entered into inheritance rights will have to pay off debts for a deceased relative if he did not manage to close the loan. In accordance with Art. 1175 of the Civil Code of the Russian Federation, citizens are obliged to bear responsibility for the debts of the testator, but within the limits of the property left behind. The exception is situations if the citizen did not accept the inheritance. In this case, he is exempt from payments.

Attention! You will not have to pay for other people's debts and no one has the right to demand them if the citizen is not a guarantor or heir. In such a situation, money cannot be obtained even through court.

What should you do if debt office employees regularly visit you or your relatives and bother you with calls, but you haven’t taken out a loan? The main thing is not to panic, talk to them calmly. Warn that you are recording conversations and record the conversations on a voice recorder.

If the collector’s visits and calls continue, it is necessary to go through the procedure of recording the conversation each time. This evidence is the basis for filing a complaint to law enforcement agencies. This can be done after each arrival of the collector. Next, a complaint is filed against the debt collectors to the prosecutor's office. Demanding debts from a person who is not a debtor is called extortion; violators in this case face criminal liability.

Comments: 128

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article Irina Rusanova

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya

- Konstantin

02/25/2022 at 15:13 Good afternoon! In 2015, the FSSP closed the problem loan proceedings. In 2022, collectors bought the debt and did not bother me all the time. During this time, I created a good credit history, but suddenly banks began to refuse loans. It turns out that collectors began submitting information to the BKI about late payments, thereby lowering my credit rating. The last payment is indicated in 2040. Now they don’t even go to court, and they spoil the history of the BKI. Credit history is important to me. What to do?

Reply ↓ Anna Popovich

02/28/2022 at 00:49Dear Konstantin, contact BKI directly by submitting a claim to your credit history bureau (BKI). The bureau will review the information contained in your credit history within 30 days.

Reply ↓

02/21/2022 at 14:26

Good afternoon, tell me, do you definitely need a lawyer to refuse to cooperate with collectors or microfinance organizations? Or I can write it myself simply according to the application.

Reply ↓

- Anna Popovich

02/22/2022 at 00:59

Dear Nadezhda, you can do this yourself using a template that you will find in the public domain.

Reply ↓

02/18/2022 at 02:12

Good evening! The collectors call me names, insult me, humiliate me, it got to the point that they signed photos of my daughters that the daughters provide paid services to pay off my mother’s debt, because my mother owes money to the IFC. They sent such obscenity to their daughters at school and technical school and to teachers. I'm just SHOCKED. What to do, how to live with this?

Reply ↓

- Anna Popovich

02/18/2022 at 15:10

Dear Elizabeth, you need to contact the police and attach to your application the necessary evidence indicating that illegal actions have been committed against you.

Reply ↓

02/12/2022 at 21:11

How to stop calls from collectors (they start calling a week before the payment day), if you are lying at home on sick leave due to Covid, with a high temperature, and the collectors pester you, ordering you to pay immediately, and besides, all departments have been temporarily closed for the last three days. They are already increasing interest rates right over the phone. And I am not able to get to the nearest office, even if it were open. Moreover, you have to talk on the phone mainly with a robot. Is there really no control over collectors even in the case of Covid?

Reply ↓

- Anna Popovich

02/14/2022 at 18:42

Dear Mila, you can use one of the methods given in the article.

Reply ↓

02/10/2022 at 18:40

Good afternoon, out of stupidity, I took out loans and with her very good situation I can’t pay, the collectors started calling after 2 weeks and not long ago they made an appointment not in the office but in the hotel, what kind of collectors are these, as I understand it, they are returning 90 goals, while they are calling every single day half an hour, etc. I don’t understand what’s going on, I’m already flinching from the calls

Reply ↓

- Anna Popovich

02/11/2022 at 10:29

Dear Irina, you can file a complaint with law enforcement agencies regarding this behavior of debt collectors.

Reply ↓

02/07/2022 at 23:19

In 2014, OTP Bank sent a credit card by mail, I didn’t sign the agreement, I activated it by phone. In 2016, I stopped paying. In 2022, OTP Bank sent a court order, I canceled it. The debt was sold to collectors. In 2022, in January, the collectors brought me a court order , I filed an objection. I wanted to know from what time the Sid begins, from the last payment, or from the cancellation of the court order.

Reply ↓

- Anna Popovich

02/09/2022 at 01:21

Dear Anna, as a general rule - from the moment the bank learned about the delay. But it is also necessary to take into account the deadline for paying off the debt on the card and additional nuances.

Reply ↓

02/04/2022 at 00:34

The neighbor died in April 2022. We knew that she was in arrears on the loan and sent the death certificate to the credit institution. After this, calls and threats began from NATIONAL COLLECTION SERVICE LLC. this happened for a month until I blocked their numbers and warned them of liability. the calls stopped, but not for long. At the end of January 2022, calls resumed and ROBOT was connected. I had to talk with these individuals (I call them parrots), but my objections were not accepted by them. I wrote a complaint to Roskomnadzor. The complaint has been registered. What do you recommend to do next? (I warned the organization about subsequent complaints in accordance with the list published on sites on the Internet)

Reply ↓

- Anna Popovich

02/04/2022 at 23:34

Dear Valery, if you are actively receiving calls, contact the prosecutor’s office.

Reply ↓

Anonymous

02.25.2022 at 21:24

Tell me how the prosecutor's office will help, I wrote a statement to the police and nothing, I wrote to the prosecutor's office and nothing

Reply ↓

2

What to do if you didn't take out a loan?

You may face claims from collectors, even if you have already repaid the debt or have never been late at all. This may be due to the following reasons:

- if errors were made when drawing up the assignment agreement or executive documents (for example, if information about the namesake was incorrectly indicated in the writ of execution);

- if the bank sold the repaid debt to collectors;

- if the collection organization initially collects a non-existent debt.

If you are not a debtor, any actions taken by debt collectors against you are a violation of the law. Immediately contact the police or the FSSP and describe in detail all illegal actions. If a mistake was made at the bank, you should submit a request to eliminate it. Our lawyers will provide you with the necessary assistance in these matters.

Call us or contact us via the online chat form.

FAQ

- Does it make sense to go to lawyers to protect yourself from debt collectors?

And how will they help? There's a meaning. For example, if they call, write, try to contact you and generally take up your time, a lawyer will help make sure that the debtor is no longer bothered. But, on the other hand, this does not eliminate the debt problem. And the lawyer will also advise you on how to resolve the situation and get rid of debts. - Can debt collectors seize a debtor's car? They've already tried.

No, collectors do not have such a right. Only bailiffs can make an arrest in case of overdue debt. If collectors begin to stage demonstrative scenes with an arrest, contact law enforcement agencies when trying to break into your home or touch your property. Most likely, representatives of the collection agency will immediately leave the “battlefield” without waiting for the police.

- Both bailiffs and debt collectors collect from the debtor. Is it possible to get rid of any of them?

Unfortunately, it is not possible to “get rid of” bailiffs; they have exclusive rights and opportunities. But you can refuse collectors - you need to write a refusal to interact with them. This is a document that will allow you to get rid of calls, messages and attempts to meet with the debtor.

- How can you refuse to communicate with debt collectors?

Refusal to communicate with debt collectors is possible after 4 months of continuous delay. To do this, you need to draw up an official appeal to the collection agency and send it by registered mail with notification to the address of the collector. You can find out more details from our lawyers.

We will write off your debts through bankruptcy with a guarantee

Our lawyer will call you in a few minutes and answer all your questions

our team

Vladislav Kvitchenko

CEO

Tatiana Smirnova

Senior bankruptcy lawyer persons

- Grigory Nechaev

Bankruptcy lawyer persons

- Oleg Martin

Financial analyst

- Yaroslav Mitkov

Junior bankruptcy lawyer persons

Video on the topic

Collectors

Author:

Vladislav Kvitchenko

CEO . Practicing lawyer in the field of bankruptcy of individuals. persons Since 2015, she has been successfully handling insolvency cases. Vladislav is brilliantly versed in bankruptcy law, gives expert comments on legal situations and actively publishes in specialized publications.

How to make an application

Resolving a dispute with debt collectors through court is a labor-intensive and lengthy process. However, a correctly drawn up application with all attached confirmations and evidence significantly reduces the time for its consideration. This document must contain:

- information about the judicial authority (full name and address of the judicial branch) where the claim is filed;

- information about the applicant (full name, home address and other information - home and mobile phone numbers, email);

- data of the defendant (full name of the agency, information about the employee who is directly involved in developing the plaintiff’s debt);

- a detailed statement of the circumstances of the situation (specific facts about actions that violate the rights of the borrower);

- list of requirements for the claim (clear justification for termination of the contract, compensation for damage, compensation for moral damage);

- justification for the claim (this includes the legal norms on which the plaintiff relies);

- conclusion (list of all attached documents for filing a statement of claim, date and signature of the applicant).

How can the police help?

Filing a complaint with the police usually occurs in criminal cases, for example:

- Overt threats (in person, by phone, through social networks, through relatives, etc.).

- Damage to property.

- Physical violence.

- Extortion.

- Fraud, deception.

When you come to the law enforcement agencies to write a complaint, be prepared by taking with you various evidence of the debt collector’s guilt. These could be SMS messages, call printouts, video recordings in violation of the debtor’s rights. Representatives of the law will carefully check everything, open a case, and bring the violator to justice. You can see a sample complaint against debt collectors for filing with the police here.

Often, collectors themselves threaten to contact law enforcement agencies in order to punish an undisciplined borrower, but in this case the debtor has nothing to fear, except, of course, if he commits some crime. As a rule, the claimant’s threat to go to the police remains only a threat.

When to contact

Before filing a claim against debt collectors and going to court with it, you should carefully analyze whether there is a proper basis for this and whether such a measure will be correct and advantageous. Going to court to force the collection service to stop its actions against the debtor can lead to the opposite effect - the pressure will only increase and you will have to agree to all their terms.

To determine whether there is a direct need to sue debt collectors, it is necessary to take into account the essence of their work, which also takes place. However, in order to repay a loan debt, a debt collector may also use unlawful methods of influence , which include the following:

- psychological pressure on the borrower and his family members;

- all sorts of tricks and tricks;

- resolving the issue of debt payment by filing a lawsuit against the borrower.

Of these, the first two are usually the most productive methods of debt repayment. For example, psychological pressure includes:

- multiple calls at any time of the day;

- threats to the debtor and his relatives;

- placing leaflets insulting the human dignity of the debtor in the entrance of his house for all neighbors to see;

- calls to the place of work with information about the existing debt;

- direct “live” meetings of collectors with the debtor and members of his family, accompanied by threats and demands addressed to them.

It is difficult to be prepared for such contacts. Calls from collectors come suddenly and begin with a notification that the debt has been transferred to the collection service, as well as that all its actions are justified by the interests of the lender. The purpose of such presentation of information is to form in the borrower a complete understanding of the legality of all current and subsequent actions in relation to his person on the part of the agency.

Then the borrower is notified of the lender’s requirements (the amount of debt repayment and the deadline for its fulfillment). The borrower’s refusal to repay the debt within the specified time frame is a kind of “trigger” when a request to voluntarily repay the debt turns into methods of psychological pressure and various tricks that may look like

- participation in promotions,

- a proposal to fulfill at least part of the obligations to the creditor, followed by a relaxation of the remaining conditions,

- requirement to send funds to a bank card and others.

For example, a borrower from city N did not repay a loan debt of 20 thousand rubles. The employee invites the debtor to take part in the current promotion, where he is invited to transfer 5 thousand rubles. If you win, you promise that the remaining amount of the debt will be automatically written off, while if you lose, the debtor loses nothing, and the funds are credited to repay the debt.

The purpose of such an offer is simply to extract money from the borrower - nothing will be written off, and the amount of debt will remain the same. The bank can confirm that such a promotion really exists, but the debtor did not meet the deadline when it was relevant.

Such situations of deception and tricks of debtors by collection agencies are widespread. A general recommendation for all borrowers who have an overdue credit debt, when receiving the first calls from collectors, is to transfer any interaction with them into the legal field by exchanging official letters by direct mail or email. In this case, a legal entity is involved.

You can also bring a dispute to court. However, if collectors easily meet halfway in response to a request to resolve the issue of debt payment through the court, it means that they have serious legal support, and therefore are confident in their abilities.

Help from the Financial Ombudsman

The financial ombudsman is a conciliator between the bank and the client; it is a body that considers their disputes out of court. This position was created by the Association of Russian Banks. If the dispute has not yet reached court, then it is quite possible to achieve justice. Reception of complaints is free of charge.

The procedure is possible only if an agency agreement is concluded between the bank and the collection company, and not a direct sale of the borrower’s debt under an assignment agreement. Those. the collector acts on behalf of the banking organization, while violating the law and exceeding his authority.

You can file a complaint in the following ways

- By email or registered letter.

- On the official website of the Financial Ombudsman.

- When visiting an organization located in Moscow in person.

The period for consideration of a complaint can range from 1 to 3 months.

When can you complain to the Central Bank?

The central bank can help the debtor solve the problem with debt collectors, but not in all cases. Protection is provided if unlawful actions were committed by bank employees, for example, the rules for disclosing confidential information regarding the existence of a debt were violated (calling the boss, neighbors, relatives at work), the agreement for the sale of debt to collectors was incorrectly drawn up, etc. Threats, reprisals, and damage to property are not within the competence of the regulator.