There are situations in life when it becomes difficult or even impossible to return money lent to other people or borrowed. Anyone can become a debtor in the context of the economic crisis that is currently raging all over the world. But paying off debts is much more difficult. Because “you take someone else’s for a while, but you give away yours forever.”

However, even the lack of money cannot be a valid reason for refusing to return borrowed funds. After all, to return their money, the creditor has the right to use any methods provided by law. And there are not so few legal ways to get out of debt.

How to force a person to pay back a debt

Debt collection should begin with a peaceful discussion of the problem. It may be more rational to draw up an agreement on installment repayment of the debt and formalize the obligations legally in it.

Note!

The document will be useful if the loan was not initially documented. He will simultaneously confirm the fact of transfer of money and establish the procedure for their return.

If the debtor does not negotiate or refuses to return the money, you can proceed to official methods - writing a claim, transferring the debt to specialized organizations, or going to court.

How not to offend a debtor

No one will give money to the first person they meet; they usually lend it to friends or relatives by verbal agreement. You can’t go to court with this, so you need to use every opportunity to reach an agreement with the debtor peacefully. What can be done?

Psychological techniques

You can start small - periodically remind yourself, speak firmly, confidently, and directly ask when the debtor will be able to return the money. If after some time it becomes clear that this is not producing results, psychological pressure can be organized.

This could be constant calls, SMS on all possible phones, you can arrange the arrival of an uninvited guest or a “random” meeting in a bakery.

An effective technique is to report new circumstances or documents regarding the debt at each subsequent contact. This way the debtor will be confused and will not be able to evade or repeat the same excuses. Sometimes complaining about problems or difficult events in life helps, the goal is to evoke pity in the debtor.

Compromises

If the debtor has real serious problems and you are ready to compromise, then you can agree to pay off the debt in installments (in installments), even in very small amounts.

You can also set off goods or services. For a loyal debtor who himself is suffering from an unpleasant situation, offer to write a receipt with specific amounts and payment terms. This will make life easier for both the lender and the borrower.

If it doesn't work out

Publicity

Sometimes word of mouth can help. Post information about the debtor on social networks, and mutual friends, relatives, and acquaintances will learn about the situation and be able to influence him.

Many people do not like such publicity; for them, it would simply be a blow, for example, for a person to come to work and loudly demand in front of everyone to repay the debt.

Settlement agreement or receipt

If attempts to repay the debt have failed and you have reached a dead end, use another method - enter into a settlement agreement with the debtor. How to do it?

Offer him new conditions, for example, a comfortable installment plan, but with the condition that all this will be written down in a settlement agreement or receipt certified by a notary. All the important points must be spelled out in the document - amounts, terms, consequences for violating the contract. Such a document will already allow you to go to court if necessary.

Important. Record all your actions to repay the debt, collect evidence. Record all contacts on a voice recorder or camera, and during the conversation, encourage the borrower to pronounce the necessary phrases about the debt, the amount of your debt and the terms.

Is it possible to return a debt if there is no receipt?

If the borrower does not repay the debt and peace negotiations do not help, you should begin collecting evidence of the debt in case you need to seek legal assistance.

Note!

Threats, blackmail, physical or moral violence are not allowed - all this can ultimately result in criminal legal consequences.

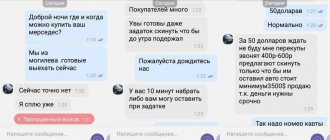

In order to have grounds for going to court, you should receive confirmation of the debt in the process of collecting the debt yourself: enter into correspondence with the debtor about the debt, including via SMS or messengers, and send an official claim. Any answers from the debtor, both official and in correspondence, must be preserved - this will have weight in court.

Note!

According to the rules established by the Civil Code of the Russian Federation, transactions between citizens whose amount exceeds 10,000 rubles must be formalized in writing. However, failure to comply with the written form does not invalidate the transaction, but only deprives the parties, in the event of a dispute, of the opportunity to refer to witness testimony.

Two conclusions follow from this rule:

- if the amount of debt is less than 10,000 rubles, you can go to court and prove the fact of the loan in any way, including testimony;

- if the amount exceeds 10,000, you can go to court, but you will have to prove the fact of the loan in any written way, except for testimony: correspondence, printouts of messages, transcripts of audio and video files.

How to lend money correctly

The fact of transfer of funds from the creditor to the debtor must be confirmed by documents - a personally written or signed receipt, a loan agreement. Subsequently, the creditor can use these documents as evidence in court proceedings for debt repayment:

- A loan or loan agreement is an official document designed to confirm the existence of a legal relationship between the parties of the creditor-borrower type.

The agreement can be drawn up in free form, by hand, but it must be written indicating the following points: full name, passport details, places of residence and telephone numbers of both parties, repayment period, amount of debt. It is also necessary to reflect the fact of accrual of interest and collection of penalties for late payments. - Receipt - this document is drawn up in simple written form to record the fact of transfer of money from the creditor to the debtor. Lawyers recommend transferring money against a receipt, regardless of whether we are talking about lending money, making a deposit, or an advance payment.

The requirement to draw up and sign a receipt or loan agreement must be observed if funds are issued at interest.

The receipt indicates:

- Full name, passport details, place of registration and actual residence, telephone numbers of the parties;

- the amount of funds transferred - in numbers and words;

- if there are witnesses - signatures and contact details of witnesses present during the transfer of borrowed funds.

The receipt can be handwritten or printed on a computer. The document is drawn up in two identical copies having equal legal force.

The task of the person who lends money is to carefully record the fact of issuing money, so that in case of problems with repayment, no questions arise in court or with supervisory authorities, where the creditor can turn to protect his rights and interests.

In addition to simplified documentation of the loan, the lender can also resort to the following methods to ensure the legality of the transfer of money:

- Certify the loan agreement and the receipt with a notary - a notary’s signature will allow you to avoid a situation where the debtor claims that physical or moral pressure was exerted on him, or words that, when signing the receipt or agreement to receive a loan, he was not aware of the consequences of his actions.

- Ensure the presence of witnesses at the meeting with the potential debtor, indicating their full name and contact information in the document. In the future, these people may be summoned to court to confirm the legality and legality of the creditor's demands for debt repayment.

- Organize recording of the transfer of money using video or audio recordings, which will then be used as evidence if the case goes to court.

A correctly executed document significantly simplifies debt collection under a loan agreement for the lender. So it’s worth playing it safe and spending money on a notary, rather than having to prove later that you actually lent it.

What evidence will be useful in court?

In the absence of a receipt, the following may be used to prove that the debtor has received money:

- testimony of witnesses - if third parties were present at the meeting with the creditor and debtor;

- statements from bank accounts and deposits - if funds were transferred in non-cash form;

- video camera recordings - in the case when the transfer of money took place in premises equipped with CCTV cameras;

- correspondence with the debtor by email, social networks, instant messengers or SMS;

- audio recordings - for their use as evidence, the court may order an additional voice examination.

Have you borrowed money from a person, but he is in no hurry to give it back? All means to legalize the fact of debt in this situation are good - and it is better when the debt can be confirmed from several sources at once: for example, from correspondence and video recordings from cameras.

How to return a debt on a receipt without court

The debt may be of interest to an organization specializing in debt collection - a collection agency.

The sale of debt to collectors is carried out through the conclusion of an assignment agreement, under which the agency acquires the rights of a creditor. Not every debt can be sold. Before concluding an assignment agreement, agency specialists will evaluate the debt for the possibility of repayment, and if it seems unprofitable to them, they may refuse the purchase.

Selling debt to collectors has advantages:

- The creditor receives the money immediately upon conclusion of the assignment agreement;

- the creditor gets rid of the need to collect the debt, go to court and suffer losses.

Note!

The collection agency will not buy the debt at full price. The percentage of the debt amount paid to the original creditor depends on the subsequent collection of the debt from the borrower. It is most profitable to sell debts secured by collateral or a guarantee - collectors can buy such debt for 90 percent.

How to return an undocumented debt, without a receipt or witnesses

Providing money without a receipt is a rather risky undertaking, even if you know the person well and are confident in his honesty and responsibility. We can never know what the future holds for us. If the repayment deadline has come and the money has not been repaid, you should first try to resolve the issue amicably by contacting the borrower to find out the reason for the delay.

Of course, if the creditor has evidence in hand, he can always go to court or the police to protect his rights and interests.

If there are no receipts or witnesses, then the algorithm for guaranteed debt repayment may include the following steps.

Peaceful settlement of the issue

Usually the creditor does not take the receipt due to an oversight or due to excessive gullibility. On parole, the money is given to close and distant relatives, friends and good acquaintances. Therefore, the “working button” during negotiations becomes an appeal to conscience. That is why there is a saying in Rus' that if you want to lose a friend, lend him money.

If the debtor finds himself in difficult life circumstances, during peaceful negotiations the following agreements can always be reached:

- postpone debt repayment for a reasonable period of time;

- offer to repay the debt in installments;

- agree to barter or repay the debt in kind - in the form of services or goods.

For example. Vasily is an individual entrepreneur, he has his own store in which he sells building materials. To develop the business, he borrowed 200 thousand rubles from his cousin.

However, due to the coronavirus pandemic and the economic crisis, Vasily was unable to repay the debt on time, as the turnover of his business decreased. He suggested that his brother pay off the debt in goods, since he was still making repairs and would buy building materials.

Contacting the police to report fraud.

When it is not possible to extract money from the debtor peacefully, and negotiations with him do not yield results, you can try contacting the police. The Criminal Code of the Russian Federation provides for criminal liability for citizens who have taken possession of other people's money through deception.

The actions of the debtor can be classified by the police under Article 159 when he borrows money and does not repay it. In this case, the debtor takes advantage of the fact that the creditor actually does not have evidence of the provision of borrowed funds.

It is also possible to initiate a criminal case for fraud if it is proven that the debtor abused the trust of the creditor or misled him. But, let’s be honest, the police are reluctant to initiate cases for reasons such as non-repayment of debts, and even without documents. Be prepared for the fact that the police will do their best to avoid accepting your statement.

Trial

The procedure for collecting debt through the court can drag on for several months or years, so it is resorted to when other options have failed. The court's decision will depend entirely on the circumstances of the case and the available evidence.

Collection of debts issued without a receipt, not accompanied by any documents at all (for example, a telephone recording) is a complex process and requires careful preparation. In such situations, it is better to enlist the support of an experienced lawyer who will help you protect your rights as a creditor.

How to repay a debt by turning to debt collectors

When involving collectors, a mandatory condition for transferring debt collection to third parties is the recognition of the fact of transfer of money by the court. Therefore, the procedure for returning money with the help of collectors, roughly speaking, the sale of debt from an individual creditor to collectors, is possible only after the end of the trial.

Deceived creditors decide to turn to debt collectors when they need money immediately, while the chances that the debtor will return it voluntarily are minimal. Collection agencies charge a considerable amount for their services, so you should only contact them if you have a large amount of debt.

Attention! Today, collection services operate legally, guided by current federal legislation. Therefore, in controversial situations and conflicts with collectors, citizens can always turn to the FSSP, the prosecutor's office or the Ministry of Internal Affairs for help.

How to collect a debt when the only evidence is correspondence on social networks

For a long time, the question of the possibility of using SMS and correspondence on social networks to confirm the fact of a debt remained open. However, courts are now increasingly accepting such evidence as evidence for making a reasoned decision.

In the end, the courts began to accept the “tick” that the borrower puts on the MFO website in the column “I have read the terms of the loan” as an analogue of a digital signature. Why can't a promise to repay a debt sent through a Facebook chat serve as the same proof?

Materials obtained using the latest information and telecommunication networks and means, the reliability of which can be proven in the manner prescribed by law, can be used to prove guilt, protect the rights and legitimate interests of the plaintiff or defendant.

To collect a debt based on correspondence from social networks, the following standards must be observed:

- Correspondence used in court proceedings must be properly formatted. To certify it and give the evidence legal force, you need to contact a notary.

- Judicial practice indicates quite clearly that correspondence in instant messengers and social networks can be used as evidence in civil cases.

- The correspondence itself will not be enough; you will also need to prove that the messages were actually sent by the debtor; for this, you can ask the operator to confirm the fact of telephone connections and Internet access.

The content of the correspondence should be analyzed in advance for the possibility of using it as evidence in court. If there are any gaps or unclear points, they are clarified by providing additional documents and witness testimony.

How to repay a debt on a receipt through court

Before going to court, it is necessary to follow the pre-trial procedure for resolving the dispute - sending an official claim to the debtor.

The claim must state the essence of the demands, their grounds, the full amount of the claim, taking into account possible penalties and penalties, and invite the debtor to voluntarily repay the debt within a certain period. You can also indicate a procedure for repaying the debt that is convenient for the creditor - the details to which the debtor should transfer the money.

Note!

If the requirements are not met within the time limit established by the claim or the debtor has sent an official refusal, you can go to court.

You should contact the district court at the debtor’s place of residence. The statement of claim must state the essence of the problem, the requirements, and the procedure for calculating the debt if it consists not only of the amount of the debt, but also a penalty.

The appendices to the claim must include:

- supporting documents: a copy of the receipt and printout of negotiations between the parties, a copy of the previously submitted claim and the debtor’s response to it;

- receipt of payment of state duty;

- copies of the claim in an amount corresponding to the number of defendants;

- calculation of the full amount of claims.

Having accepted the statement of claim, the court will consider it and make a decision to collect the debt from the defendant if it considers the plaintiff’s arguments to be exhaustive. Based on the outcome of the consideration of the case and after the decision is made, the plaintiff will be able to obtain a writ of execution and apply to the bailiff service for forced collection of the amount of the debt.

Pre-trial ways to get money

Whether it is necessary to send a written claim to the borrower demanding repayment of the debt or not depends on the previously drawn up loan agreement. It often happens that when people write a receipt, they do not attach importance to some important aspects, for example, they do not indicate the date and time of transfer of funds. In their absence, by law it is considered that in this way the lender has agreed with its borrower to return the money on demand. If the receipt is printed and not handwritten, the borrower often denies the very fact of its authenticity. In this case, it is very difficult to verify this.

Example of a written request:

If the receipt indicates the deadline for repayment of the loan amount, then there is no need to send a letter demanding repayment of the debt. Therefore, if there is such an agreement, you can go to court without warning the debtor about it.

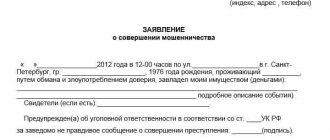

In special situations, you can try to bring a person who has not paid the debt on time under Article 159 of the Criminal Code of the Russian Federation (fraud). But in 90% of cases, after filing an application from a creditor, they refuse to initiate a criminal case, since it is quite difficult to prove fraud in non-payment of debts. But still, if the victim decides to contact the police department, it is important that he writes a statement that includes the following information:

- Full initials of the debtor, his passport details, residential address and place of birth.

- The amount the debtor borrowed.

- Date and approximate time of transfer of funds.

- Additional information (borrower’s place of work, mobile phone).

An example of filling out a police report can be downloaded from this link.

Statement

If you borrow money and don’t pay it back, is it fraud?

The legislator has provided that the receipt scam and falsification of court documents are committed intentionally. That is, the criminal thinks through subsequent actions in advance down to the smallest detail.

Accordingly, it is necessary to stock up on evidence to confirm that the money was planned to be appropriated initially. These include telephone conversations and electronic messaging. A fraudulent receipt clearly indicates malicious intent.

The situation will be different when the non-repayment of the debt is due to objective life circumstances. Here the borrower cannot be called a fraudster.

What should the receipt look like?

A properly executed receipt will help you quickly collect your debt.

What is included in its composition and what rules it must comply with:

- full data about the borrower (full name, registration address, actual residence address, passport details, telephone numbers);

- complete similar information about the lender;

- The purpose of drawing up the receipt must be clearly and clearly stated. If we are talking about money, then the amount of debt is indicated in numbers and duplicated in words. Without this information, the paper is invalid;

- dates are clearly marked. The document must contain the dates when the lender transferred the money to the person, and when the borrower is obliged to return it;

- there must be signatures of the parties, primarily the debtor. If you do not have the document certified by a notary, ask for a signature with a transcript by hand.

If the loan is for a serious amount, it is better to enter into a loan agreement. If money is transferred in cash, this must be confirmed with a receipt. If to a card, the contract must indicate the bank details of the parties - from which account the transfer will be made. The agreement can be drawn up by hand, setting out the terms and period for repayment of the debt.

Assignment of the right of claim

One of the ways to return money if you have a receipt is to assign the right to collect debt obligations to a collection company. Depending on the terms of the agreement, the collection agency returns to the lender the amount of debt due. In this case, the lender, on the one hand, loses a significant amount, but on the other hand, is freed from the need to communicate with the debtor and litigation.

Collectors collect all debts from the debtor in accordance with the procedure established by law.

What evidence will be useful?

The Russian Civil Code provides for mandatory written form for transactions between citizens in an amount exceeding 1000 rubles. The law also indicates the possibility of proving a transaction without a written contract using any evidence, with the exception of witness testimony. This means that you can provide the following evidence to support the loan:

- video recording Of course, it is unlikely that you will find a video recording of the circumstances under which the money was lent (although in some cases this happens). But you can provide a video that you shoot after problems with recoil arise. Thus, in one of the cases, an individual creditor provided a video recording to the court in which he asks for his money to be returned to him, and the debtor, agreeing with the amount of debt, expresses his intention to never return the amount. So he says: “Yes, I took money from you, but you won’t get anything, I don’t have money.” This video recording became very strong evidence in court, which persuaded the court to consider the transaction completed.

- SMS correspondence or audio calls .

And in these cases, we are mainly talking about recording the actions of the debtor already during the period of active claims of the borrower. However, the very content of such conversations indirectly indicates the presence of an obligation that they do not want to fulfill. Example No. 2 . I.A. Zheleznov filed a claim in court to recover an amount of 70,000 rubles from E.P. Ryazanov, to whom he lent this money without a receipt. As evidence Zheleznov I.A. provided the court with a printout of long-term (more than 6 months) correspondence, where in SMS messages he almost daily reminds the debtor of the unfulfilled obligation. Ryazanov E.P., in turn, in the text of his response messages, writes that he is not currently able to return the entire amount, and asks that payments of 7,000 rubles per month be divided into 10 months. At the trial Ryazanov E.P. stated that he had no debt obligations to I.A. Zheleznov. not available, but the court sided with the plaintiff, whose evidence not only refuted the defendant’s position, but also confirmed the amount of the amount (7000x10=70000). The claim was granted. - any documents that can somehow confirm the existence of an obligation . Thus, in one of the cases, the written evidence was a pledge agreement: the debtor did not return the money for a long time, but the lender was so decisive and persistent that he was able to force an agreement to pledge the property - it turned out to be a motorcycle. The parties drew up a collateral agreement, where one of the clauses stated: “the motorcycle is considered collateral to secure the debt that occurred on the date of conclusion of this agreement in the amount of such and such.” Subsequently, in court, this document became the basis for collecting the debt given to the defendant without a receipt.

Let us remind you once again that it is unacceptable to refer to witnesses and use their explanations as evidence in debt cases without complying with a written form.

Example No. 3 . Konev A.I. lent it to his friend M.Yu. Prezanev. a large sum of money in the amount of 500,000 rubles. The money was transferred without written documents, but in the presence of two mutual friends. In the future, due to the lack of intention to return the amount back, Konev A.I. filed a lawsuit, attaching a petition to call two eyewitnesses, as well as their written explanations. The court, on the basis of civil law rules that exclude the possibility of accepting such evidence, rejected the claim.

Receipt fraud, what article?

Swindlers steal money and property from law-abiding citizens, deceiving them or gaining the trust of their future victim in various ways. Attackers stop at nothing; it is useless to call them to conscience.

Only a court has the right to punish for a crime in Russia in accordance with the Criminal Code (Criminal Code of the Russian Federation). It also provides for such a type of theft of property as fraud.

At the same time, crimes such as forging a receipt for receiving money, Article 159 (fraud), or Art. 303 (falsification of evidence and results of operational investigative activities).

Let us examine the provisions of Art. 159 of the Criminal Code of the Russian Federation. Parts of the article related to business fraud are not mentioned.

| Article sanctions | part 1 | part 2 | Part 3 | part 4 |

| Fine | up to 120,000 rubles or 1 year’s salary | up to 300,000 rubles or the amount of salary for 2 years | from 100-500 thousand rubles or the amount of salary for 3 years | — |

| Mandatory work | up to 360 hours | up to 480 hours | — | — |

| Correctional work | up to 1 year | up to 2 years | — | — |

| Restriction of freedom | up to 2 years | — | — | — |

| Forced labor | up to 2 years | up to 5 years with or without restriction of freedom up to 1 year | up to 5 years with or without restriction of freedom up to 2 years | — |

| Arrest | up to 14 months (2 years) | — | — | — |

| Deprivation of liberty | up to 2 years | up to 5 years with or without restriction of freedom up to 1 year | up to 6 years with a fine of up to 80,000 rubles or in the amount of 6 months’ salary or without and with or without restriction of freedom up to 1.5 years | up to 10 years with a fine of up to 1 million rubles or in the amount of salary for 3 years or without and with restriction of freedom up to 2 years or without |

Punishment is directly dependent on the damage caused to citizens and businesses. How much does this amount to in terms of money? Let's refer to the note for Art. 158 of the Criminal Code of the Russian Federation.

Types of damage and amount:

- significant (category applies only to citizens) – at least 5,000 rubles;

- large - from 250,000 rubles;

- especially large – from 1 million rubles.

Now it’s worth stopping at Art. 303 of the Criminal Code of the Russian Federation. It is used in the case of providing false evidence to the court in any category of cases.

The main penalty is a fine of 100,000 to 300,000 rubles. or in the amount of salary for a period of 1 to 2 years. In this case, mandatory or corrective labor is provided. Their duration is limited to 480 hours and 2 years, respectively. The court also has the right to arrest the accused for up to 14 months.

All of the above sanctions apply when the crime is completed and property is seized. If for some reason the plan could not be completed, the punishment is applied in the amount of ¾ of the maximum sanction of the corresponding part of Art. 159, art. 304 CC.

The crime provided for in Art. 303 of the Criminal Code of the Russian Federation, refers to non-serious ones. According to it, the statute of limitations for bringing to justice is 2 years from the date of commission of the act.

If the debt is issued against receipt

In Russia, everything is built on trust - people lend money to friends and colleagues without even asking for confirmation of the loan. But it is difficult to return money without confirmation.

- 11.7 KB

How to properly draw up a receipt, in what cases does it have legal force, what can you get if you have the document in hand?

A receipt is a document confirming the transfer of money from one citizen to another with return under the conditions specified in the text.

The receipt is made in simple written form; it is not necessary to have it certified by a notary. This document, even if not certified by a notary or witnesses, has legal force and can be used to recover a debt through a court order or lawsuit.

When registration is required:

- if the amount is above 10 thousand rubles;

- if the receipt provides for the transfer of money as security;

- rent a house. A receipt is a great option for tenants. To protect yourself from dishonest landlords, you need to record in writing the rent paid, as well as the transfer of the security deposit.

A receipt is required to confirm the transfer of funds. The legislation also provides for an oral agreement if the loan amount is less than 10 thousand rubles.

If the receipt or loan agreement is drawn up in front of a notary, it will be easier to collect the debt in court.