In the modern world, transferring to one or another bank card or account is probably no longer difficult for anyone, being an established and familiar matter. However, even with all the care and responsible approach to such financial transactions, none of us is immune from mistakes: it is enough to enter just one character incorrectly and your transfer will go to someone else’s card. What can you do to ensure that the money returns, if not to you, then at least to the card owner to whom it was intended? And what should you do if the funds were transferred quite deliberately, but it later turned out that you were dealing with scammers? Together with FAN , lawyer Ekaterina Antonova (https://www.instagram.com/advokat_antonova_krd/), we’ll figure out how to behave in such situations.

Does it make sense to ask the cardholder to return funds accidentally transferred to him?

Trying to come to a humane agreement with someone who has the good fortune of suddenly receiving “material assistance” is, perhaps, the first thing that comes to mind for someone who has discovered a mistake and is wondering for the first time how to return money transferred to the wrong place . You can do the following: send, for example, 1 ruble to the same card (account or mobile phone number), and in the comments to the transfer briefly explain that you mixed up the account number, and also indicate your phone number so that the card holder I could call you back. Most often, this is exactly what people do, because a normal, adequate citizen, as they say, does not need someone else’s goods, therefore, having tried your situation on himself, he will most likely show up and return the transfer.

Memo to Avito users

Avito is not the best site for making purchases, but there you can find goods in the “second-hand” category that are famous.

First of all, when viewing ads, you need to pay attention to:

- seller profile;

- product photo;

- reviews;

- consumer ratings;

- how long a person has been registered on the portal.

Shell accounts

Most often, fake accounts become scammers. Experts advise sometimes visiting groups on social networks that warn other buyers about dishonest sellers.

There you can find not only information about scammers, but also see screenshots of accounts.

What should you look out for in a seller?

When making transactions on the Internet, you need to always be vigilant and buy products from trusted resources. It is better that it is a legal entity with a positive reputation and has been engaged in online trading for several years. If the seller does not have a real photo or is missing information, then this should alert you.

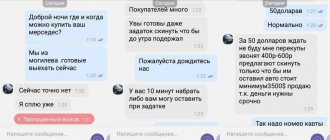

Communication method

If the seller does not respond to messages for a long time or avoids communicating in correspondence, it is worth offering to call by phone or talk via video conference. If you receive a categorical refusal, there is a possibility that the person is hiding something.

Product photos

Do not buy products without photos, and if you are not satisfied with the existing ones on the seller’s page, ask for new ones. A person who wants to sell a product does not refuse such a request.

Requirement to shoot a video of the product

Politely ask to shoot a video about the product so that you can look at the product from all sides. Conscientious sellers sometimes post a short video on their own to present the product face to face.

Calls to paid numbers

You should not pick up the phone if the call is coming from a short number. Sometimes the seller may ask for a cell phone call to discuss the details of the transaction - perhaps this is a ploy. Communicate via the Internet, which can protect you from calls to paid numbers.

What should you do if you have not received a response when you contact the cardholder?

How to return money transferred to a Sberbank or any other bank card if the recipient turned out to be dishonest - did not return the money transfer and did not even call back? In such a situation, you need to immediately personally contact the nearest branch of the bank of which you are a client and write a statement. This action, by the way, can be taken simultaneously with an attempt to negotiate with the subscriber directly.

“Even if a person transferred money to the wrong place, it will not be returned immediately. First, the bank will send an official notification to the citizen to whom the money transfer was made in error. It will contain a request to return the money to the rightful owner. The bank will not provide you with the personal data of this citizen, since this is a bank secret,” clarifies Ekaterina Antonova.

pixabay.com/

The application will have to be drawn up in two copies: the first of them with the bank’s mark will be given to you, and the second will remain in the bank. Be sure to make sure that the application reflects the date of its acceptance and also has the signature of a bank employee. The bank representative must then contact the owner of the account into which your funds were received and inform him that the transfer was made in error. Keep a copy of the application as the apple of your eye - in case the recipient of your money turns out to be fundamentally unscrupulous.

How can I return money to my card that I transferred as a loan?

There is an opinion that to demand repayment of a debt you need a receipt. The first good news is that when transferring money to a bank card, a receipt is not required. The transaction is a confirmation of the transfer of funds from a bank card to another. The second good news is that you have a chance to get your money back. Refunds will follow the same algorithm as in case of an erroneous transfer to someone else's card.

Find out how to return an erroneous translation yourself:

Purchase documents for the promotion

Example from life

Top of page

Real life example. Any coincidence of events and names should be considered an accident. We care about the privacy of our clients.

A story recently happened to a friend of mine. Let's call her Anna. money in the amount of 15 thousand rubles to a bank card as Anna transferred the money from her bank card without any doubt, since Kirill was her long-time acquaintance and she trusted him.

After such an “unsuccessful affair,” the friendship of two wonderful people began to slowly crumble. Kirill began to “feed Anna breakfast.” He called and continued to make empty promises about the speedy return of his debt, as long as she did not write a statement to the police. So a month passes, then another, Kirill “feeds” with promises, but is not going to repay the debt. Anna begins to understand that Kirill will not return the money voluntarily.

The situation was complicated by the fact that Anna transferred money not to Kirill’s card, but to the card of his friend. Let's call her Veronica. Anna called her lawyer, i.e. to me. I explained to her that the transfer of funds was made to Veronica’s bank card, and accordingly, it was necessary to collect it from her.

Everything is simple , and most importantly, it’s real , you just need to want it and do it. Anna did not believe that the money could be returned. And also a legal way.

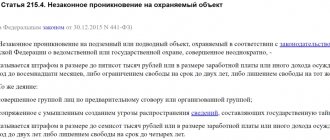

In what cases should you contact the police?

It should be remembered that even a bank employee does not have the right to force the recipient to return funds to you if you discover that you transferred them to fraudsters. He can only ask the recipient about it. How can you return the money transferred to the card if the bank informed you that the account owner was found, but the funds never arrived? According to the law, such situations are regulated by Article 1102 of the Civil Code of the Russian Federation “Obligation to return unjust enrichment.” Or in some cases - an article about fraud. Therefore, in order to defend your rights, feel free to contact the police, and this is where a copy of the statement written at the bank will come in handy.

Next, we again have two options for the development of events, the expert explains. In the first of them, the police refuse to initiate criminal proceedings. You will receive an official notification of refusal by mail at your place of actual residence (or the place where you contacted the police).

pixabay.com/

The second option is to initiate a criminal case. In practice, this happens very rarely and, as a rule, under special circumstances - for example, when there are several victims. Or if the person appearing in your application has been transferred money by mistake more than once and he never returned it. In this case, the recipient's actions may be regarded as fraudulent.

Where to complain about police inaction

The key link in the procedure for judicial collection of funds transferred to a fraudster from a payment card is the investigative activity of the police, who must make an official request to the bank and identify the recipient of the payment .

This must be done in order to determine the defendant in a civil suit, since conducting such cases against an entity whose identity has not been established is not permitted.

If the police do not fulfill their prescribed role , then further process will become impossible and then it will be necessary to contact the prosecutor's office with a statement in which all the circumstances of the incident will be outlined, including contacting law enforcement agencies.

The request to the prosecutor's office should be that police officers are required to carry out the necessary procedural steps and restore justice.

Is it possible to return the transferred money if the police did not help?

The initiation of a criminal case is the basis for going to court. However, even if a refusal is received, you also have the right to turn to Themis for help.

“If all of the above actions do not bring results and the citizen ignores the return of funds, then you can go to court with a claim for unjust enrichment. In such a situation, you will also need a copy of the application from the bank, as well as a copy of the police refusal to open a criminal case. In addition, you can obtain an official confirmation of the money transfer from the bank and attach it to the case materials,” says Ekaterina Antonova.

It may also be useful to file a claim. It should be sent to the defaulter's postal address in the form of a letter with acknowledgment of receipt. When both of you are invited for interrogation, there is a high probability that the unscrupulous recipient will return the money to you at this stage, because this procedure is not a pleasant one. If it was not possible to reach an agreement even now, then you will have to, as they say, “go to the end” - file a lawsuit and wait for the court hearing.

It is important to know that through the court it is also possible to recover from the defaulter interest for the use of funds that do not belong to him and the amount of the state fee for filing an application, and even receive compensation for legal costs and moral damages.

If you transferred more than 500,000 rubles

and you need help in collecting funds that you mistakenly transferred to someone else’s card - call me at :

Mobile:

Call from 9 - 18 Moscow time.

or write in a personal VKontakte, I’ll advise you - vk.me/proavant

PS The information is relevant today.

The world is changing, and so are the laws!

Blog author

Mingaleev Ilyas

Lawyer for debt collection in Kazan and Tatarstan. Experience in the Ministry of Internal Affairs - 5 years. Experience in jurisprudence - 10 years. Read more about our services here

.

Last messages

- How to unblock an account if the bank has blocked it under Federal Law 115? 12/30/2019

- Collection of debts from LLC founders and directors05/04/2019

- How to open an individual entrepreneur yourself in 2022: instructions for beginners03/15/2019

What if money was transferred to you by mistake and they ask you to return it?

“If an unfamiliar person transferred funds to you by accident, immediately transfer them back,” says Ekaterina Antonova. “After all, the article on unjust enrichment can be applied to any citizen, which means that a lawsuit can also be filed against you with a requirement not only to pay the entire amount in full, but also to compensate the victim for moral damage and financial costs for legal support.”

pexels.com/

Sometimes cardholders receive messages asking them to return erroneously transferred money to such and such a card or mobile phone number, while no funds were received on their card.

“If you suspect fraudulent activity, do not make any money transfers under any circumstances,” warns Ekaterina Antonova. - And of course, do not tell anyone the three-digit code indicated on the back of the card. Even bank employees do not have the right to request such information over the phone. In any other case, you need to immediately call the bank’s hotline and block the card. This can be done over the phone."

Experts explain what unexpected money in your account can do

If you received money on your card from someone unknown, then with a 99% probability you are dealing with scammers or organizations to whom they gave your passport details to conclude a loan agreement, lawyers and representatives of financial organizations told Gazeta.Ru.

“Translated by mistake, return it!”

The most important advice that lawyers give in case of an unexpected increase in the account is not to spend this money, because it will have to be returned later in any case.

“Black month” for American stocks: is it worth buying before autumn?

According to analysts’ forecasts, in the near future the American stock exchange will decline due to the season...

08 August 13:54

If you're lucky, your account was replenished due to an honest mistake, for example, in the phone number used for the transaction. In this case, you will most likely receive a call from the sender shortly after the transfer. Advise the person who sent the allegedly erroneous transfer to contact their bank with a request for a refund, says Andrey Shugaev, deputy chairman of MCA Klishin and Partners.

“At the same time, the citizen who received the money, in turn, also needs to call his bank and report that he received an unknown transfer. And then write an application for a refund of the money that was credited erroneously,” says the lawyer. In this case, you will be clear before the law and minimize risks.

Under no circumstances should you make a return yourself.

This is how scammers often work: you “returned” the money to the account they indicated, and five minutes later the real sender calls you and states that he doesn’t know the first person at all, and you transferred the money to an unknown location. In this case, the sender’s demands may well be supported by the court, warns Vice-President of the Association of Russian Banks Alexey Voylukov. Therefore, if it is unclear where money appears in your account, you need to contact your bank.

“Banks do not have a legal obligation to return transfers to senders at the request of the recipient, but most banks do this at the request of the client,” Alexey Voylukov explained to Gazeta.Ru.

One of the difficulties that recipients of unexpected money face is that it is not always possible to trace the source. Sometimes an extended account statement or payment document helps; the bank will issue them upon request, although in some cases for an additional fee, says Voylukov.

However, as one of the largest banks in Russia explained to Gazeta.Ru, financial institutions will not always have the details of the person who made the transfer. This is possible if the transaction was transferred not through a payment order, but through some payment services, for example, the fast payment system (FPS). The operator of such a service or system (in the case of SBP this is NSPC) can provide this information to law enforcement agencies or at the request of a court, but certainly not to an ordinary citizen.

Sometimes a sender who appears on your horizon after some time may demand a percentage “for using the money” while it was in your account. Lawyers remind you that the loan interest can be determined by the lender only if you have signed an agreement with him.

“If there is no agreement between you, then you must return the money with a percentage determined by law. That is, if you returned the money within a matter of days, then the amount of interest under Article 395 of the Civil Code of the Russian Federation will be extremely insignificant (about 9 rubles per day from an amount of 50 thousand rubles),” says Igor Serkin, head of the dispute resolution practice at the law firm Cliff.

But as a rule, “gifts” in the form of cash do not fall into citizens’ accounts just like that. Small banks, microfinance organizations (MFIs) or illegal lenders may be behind the transfer. They may have loan agreements in their hands, which the recipient allegedly took, obliging to pay from 1 to 3% per day of the loan amount.

If, during a dispute, collectors or microfinance organizations claim that an agreement was concluded between you, then you need to become more active - at least contact a qualified lawyer.

“It is not enough to simply say that the agreement was not signed. If there is an agreement that was not signed by you, then this is the basis for a statement about falsification of evidence if the case is in court, and for a statement to the police in any other case,” Serkin emphasizes.

There is also no need to succumb to panic and pressure from such creditors, just as there is no need to pay them interest.

It is necessary to record all communications and write official appeals - to the bank, to the police and to the company that allegedly issued the loan. You can also contact the Central Bank, as the supervisory authority for financial organizations, with a complaint about calls about obtaining a microloan without your knowledge and ask the regulator to conduct an inspection.

If the guilt of microfinance organizations, and not third parties, is proven, such companies will face sanctions from self-regulatory organizations and the Bank of Russia - from fines to exclusion from registers (meaning the further impossibility of conducting microfinance activities), says Elena, director of SRO "MiR". Stratieva.

If you receive calls from collectors, you may need to contact the Federal Bailiff Service, which supervises them, advises Voylukov. In case of threats, you can also complain to law enforcement agencies with a corresponding statement about attempts at extortion, recalls Andrey Shugaev.

“I emphasize once again that you should not “repay” debt and interest for using other people’s money yourself. This will only benefit the scammers,” says Shugaev.

MFOs are not always guilty by definition

As Stratieva reminds, microfinance organizations can also become victims of fraudsters - for example, they can receive fake documents using a leaked database. Just two weeks ago, documents with personal data of bank clients were found

at a landfill in Pyatigorsk.

“Without knowledge of passport data in detail, such agreements are not required in terms of refunds, which means that theft or sale of personal data of consumers of financial services can also take place here. Also, without knowing the full details of the borrowers, transferring to the account is technologically impossible. Yes, it is possible to transfer to a card using a phone number, but only a few microfinance organizations make transfers to individuals using phone numbers, not card numbers,” says Stratieva. That is, in fact, the situation may be much broader and more complex.

Unfortunately, it is impossible to completely insure against any type of unfair practices. Especially when dealing with those that may be based on the theft and sale of personal data. Here there can only be one piece of advice - carefully monitor where and when you leave them, whether you are asked to sign consent to the processing of personal data, if they require it from you, under what conditions, she summarizes.

How to protect yourself from making erroneous money transfers?

And finally, some advice for those who are tired of double-checking the numbers of bank accounts or cards during financial transactions. Firstly, to optimize money transfers, you can create special templates in mobile banking. In addition, you can use a text editor, saving the numbers of frequently used accounts in it, and then copying and pasting them in the desired column during the translation. And of course, you can easily and securely transfer funds using the contact list in your mobile phone.

How to avoid becoming a victim of scammers

To avoid having to go through the entire long path described to return funds transferred to scammers, you should be careful and follow a number of simple rules :

- try not to make purchases with full or partial prepayment;

- if it is impossible to avoid an advance payment, you should choose a counterparty that has a bank account and clear details, and not just an anonymous payment card number;

- when paying by bank card number, you should request the last name and first name indicated on the front side, as well as a photocopy of the corresponding page of the passport (with photo and full name);

- if the counterparty refuses to provide personal details from the card and a scan of the passport page, the interaction should be interrupted - this is a fraudster;

- you should enter the available data of the payment recipient (full name, card number, phone number, nickname, etc.) into the search engine line and analyze the search results - if there are 4 or more matches, then this entity is a fraudster;

- When analyzing matches returned by a search engine, special attention should be paid to thematic forums where those who, through negligence, have already become victims of scammers communicate.

Fraudulent schemes related to the transfer of funds to payment cards of criminals are becoming more diverse every year, and the current year 2022 is no exception.

As can be judged from the study, the return of funds transferred to the attackers is a possible procedure, but it is extremely labor-intensive and requires the full performance of their duties by all government agencies.

To avoid such a long-term return of your own money , you should be extremely careful and not blindly trust reviews about the seller, which can be left by visitors who received a small payment for 100 - 300 characters of positive text.

The simplest rules listed above will help you save your time and nerves without becoming a victim of entities offering profitable purchases and services, forgetting to mention that they are the only beneficiaries.

Video: How to return money written off from a card by unknown persons

Sending goods by cash on delivery

Fraudsters resort to this method of deception when selling electronics, gadgets, computers and other IT equipment. You may not suspect deception until the last moment. The seller does not require prepayment and does not ask for card information. The parcel is sent by mail cash on delivery. When you receive the goods at the post office, you pay for it, and then you realize that what they sent you is not what you paid for.

The seller doesn’t even disappear. He gets in touch with you and explains that it is not stipulated anywhere that they were required to send you branded equipment. At the same time, the technical parameters of the device coincide with those declared, which means there can be no complaints.

To protect yourself from such scams, buy an item that you can inspect initially. It’s better to pay a little more, but get a high-quality gadget that meets all the stated characteristics.

Advance payment scam

The prepayment fraud scheme is as follows: after finding the desired product on Avito, you contact the seller, but he informs you that he is currently out of town, but the item you are interested in can be booked. You will be asked to pay a fee for the reservation. Or, when selling any devices, the seller offers to install a special application for an additional amount. The amount of the advance payment may be small so as not to scare away potential clients.

Until you send an advance payment, the scammer goes to any lengths to prove his “honesty”. He can even send you a scan of your passport. In fact, it turns out that the sent data is invalid or belongs to an unauthorized person from whom it was stolen.

After the seller on Avito receives an advance payment, he will disappear. You will not receive phone calls or messages. Before sending money to an unknown person, make sure that the risk of contacting a scammer is minimal. Typically, with this scheme, financial losses are small. The seller receives a little from everyone who “bought” the scam, and the sum ends up being quite large.

Can money be stolen from a contactless card?

If a contactless card ends up in the hands of fraudsters, then yes, they can. More precisely, not to steal, but to pay for several purchases with it up to 1 thousand rubles each in retail stores. Also, all the fraud schemes described above work with contactless cards, except for data theft through ATMs, if you do not insert a card reader.

There is a rumor on the Internet that money can be stolen from cards with NFC technology by touching the terminal to a bag or pocket, for example, in public transport. Technically, this is very difficult to do, since the distance between the card and the terminal should be no more than 4 cm, and the attacker will only have a few seconds to complete the write-off procedure while the device is active.

How to avoid such troubles in the future?

We recommend choosing reliable banks that are interested in clients and try to provide all possible assistance in any situation.

It would be a good idea to insure your account. This service costs an average of 2 thousand rubles per year. If they try to rob your account or transfer money somewhere without your knowledge, you will be paid insurance. According to statistics, 70% of the reasons why people lose money from their account are due to the actions of scammers. We remind you once again that in case of an erroneous translation, insurance will not save you!

It is also a good idea to study popular fraudulent schemes so as not to fall for the tricks. Forewarned is forearmed. If you know how to cheat, the higher the chance that nothing like this will happen to you.

ATTENTION! Today, one of the methods of deception that many people continue to fall for has again become relevant.

Your friends post on social networks about the grief that happened to them. They ask to transfer funds to a specific account, supporting the sad story with photographs, as well as a card number with their own name and surname.

Double-check the information! Remember that all the data can be drawn in Photoshop in half an hour. But everything looks quite convincing and compassionate people believe and want help in rubles. People see photographs, documents and transfer money. Then, in a panic, they look for ways to return it when they realize that they have stumbled upon scammers.

We sincerely wish you never to find yourself in such a situation. However, if you need to cancel the transfer, now you know what actions to take.

Comments from alexD: In fact, there are a huge number of ways to force or deceive a bank client in order to get his funds. Often, attackers have no way to gain access to your funds, and all they can do is, on the contrary, force you to do something.

In our country, Sberbank cards are very popular and it is with them that cases of fraud are most associated. Honestly, I have met and seen more than once how people themselves send money to just anyone, naively believing that they are returning an erroneous transfer to someone or even helping their loved ones. In reality, it is just ordinary deception and fraud. But you can fight this.

Selling low-quality goods

Scammers on Avito often offer goods at a fairly low price with a guarantee of quality. For example, instead of a good car, they will slip in a used, beat-up car, or instead of a purebred husky puppy, they will give you a mongrel with a false pedigree.

Buyers are often attracted to advertisements with goods that are cheaper than other sellers. In this case, the seller demands to pay for the goods as soon as possible under the pretext of an urgent departure, so that you do not have time to notice the catch.

Check the offered product carefully and without haste. If the seller is in a hurry, most likely he wants to deceive you and get money for a low-quality product. Do not trust those sellers who offer expensive equipment or purebred animals at too low prices. It's better to pay a little more and get a quality item than to try to save money and get a counterfeit.