The desire to save on the cost of purchase or the lack of suitable goods in stores located in the comfort zone leads people to online stores and to the pages of distributors of various brands on social networks.

Most online sellers are quite clean and fulfill their obligations , receiving advance payment for goods and delivering the promised goods, although not always of adequate quality.

Against the backdrop of successful intermediary and trading operations, situations often arise when a remote user transferred money to a fraudster’s card, but has no idea how to return it .

Ways to lose money from a card

There are two ways to lose money from your card:

- voluntarily transferring a certain amount as supposed payment for a fictitious product or service, or for other reasons;

- having lost confidential payment card data that allows you to make payments using it.

Why do they transfer money to other people's cards?

There is only one reason why people are deceived - excessive trust in completely unfamiliar subjects and insufficient vigilance , expressed in the reluctance to even superficially check the identity or details of a potential partner.

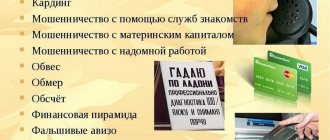

Unscrupulous individuals who do not lose restful sleep because of someone else’s grief come up with various schemes of deception, including :

- Fictitious sale of new or previously used goods that are in demand and have fairly high prices in stationary retail outlets.

- Imitation of charitable foundations and various collections of donations from compassionate citizens.

- Payment for various unique educational or behavioral courses that supposedly can change a person’s life for the better in a few days.

- Notifications about relatives in difficult life situations who need urgent help by transferring funds.

Regardless of the scheme being implemented, any fraudster takes advantage of the three main weaknesses of those around him - stupidity, greed and gullibility.

Unauthorized withdrawal of funds from the card

Every plastic payment card user has at least once wondered how scammers withdraw money from a bank card and what data they need for this.

Anyone who has heard the myth that scammers know how to withdraw money using a card number should calm down and not worry, since for this they will additionally need at least:

- first and last name embossed in large Latin letters on the front side of the card;

- a three-digit numeric code printed on the reverse side, which is usually not visible.

In addition to the listed levels of protection, banks, worrying about how to protect a bank card from fraudsters, everywhere introduce an additional barrier in the form of a password, which is sent to the linked phone number and used to confirm the transaction.

However, even such multi-level protection is not always sufficient for particularly sophisticated attackers who first obtain personal payment card data by installing a skimmer on an ATM, and then find out a mobile phone number by last name and first name.

By sending a short message to a well-known subscriber that he has become the winner of the drawing and in order to receive the prize, he needs to send a code to this number, which will arrive within a few seconds, the scammers force the victim to voluntarily give them the bank password.

Having thus obtained the key to the last protective barrier, the attackers make a large transaction, emptying the card .

Actions after transferring funds to scammers

The first thing is not to panic. The second is to understand what translation method was used.

Before it becomes clear that contacting the police is inevitable, you need to try to influence the villain yourself. The main thing here is not to focus on conscience or feelings of pity: this is always ignored. With such tactics of behavior, the citizen exposes himself as weak, and therefore gives the criminal a feeling of complete impunity.

Take a strong position in conversation/correspondence. This may have some impact, as a result of which the money, albeit with a small probability, will return to you.

Blood money went to a swindler on a Sberbank card

Often banking companies allow their client to cancel the transaction. But you need to hurry up with this: submit an application to the department immediately

, otherwise it will be too late. After a day or two or three, the bank may refuse to satisfy the request.

Important! The maximum time limit for submitting an application is one day.

The procedure is as follows:

- Visit the Sberbank office. Show your passport and ask for an application form to cancel the payment transaction. First, you can also try calling the hotline at 900 and +7 495 500 5550

and request assistance from the operator (however, he will most likely send you to the office). - Indicate the reason, either real (fraud) or neutral (translation error). It is recommended to use the second one:

complaints about fraudulent activities are often ignored due to the voluntary nature of the transaction. In case of an erroneous transfer, the financial institution legally has a weaker position for refusal. In the document, record your last name, first name and patronymic, contacts, as well as the card numbers between which the transfer was made. It is also necessary to indicate the time of payment and its number, which can be viewed in the transaction history statement. - Wait for the bank to return your funds (if the decision is positive). The money will be withdrawn from the fraudster’s account, and the balance of his card will become negative - if he has already managed to spend the amount stolen by fraud.

- Contact the police if the bank refuses to assist. File a fraud complaint. Please attach all papers remaining from cooperation with a credit institution on a problematic issue to the application.

Note 2.

Keep in mind that criminals rarely ask to transfer money directly to their card. This threatens them with de-anonymization. This is usually the lot of inexperienced scoundrels.

Hard-earned money went to the swindler in Qiwi or Yandex.Money wallets

Here the issue can be resolved in only two ways: either the swindler returns the money himself, or the citizen sues him.

Technical support rarely helps to return funds for a simple reason: the fact of fraud must be proven, which victims are usually unable to do.

Important! A link to a scammer’s profile, screenshots of correspondence, and audio recordings are not evidence, since all this can be easily faked.

In this case, you need to write to support. Firstly, occasionally the request is still granted. Secondly, the fraudulent account is blocked after a positive review of the application.

Customer service phone numbers:

- Qiwi – 8 800 707 7759

; - Yandex money - 8 800 250-66-99

.

If you lose more than 4,000 rubles, it definitely makes sense to write a statement to the police. The document should also include correspondence with both the fraudster and the wallet support service employees, as well as all other available evidence.

What to do if money is transferred

Refunds transferred from a payment card are possible in two ways:

- voluntary transfer of funds by an attacker;

- return of the transferred amount by decision of the justice authority, in case of a positive decision in a civil claim for the recovery of unjust enrichment in accordance with Article 1102 of the Civil Code of the Russian Federation.

How to awaken the conscience of a scammer

The voluntary return of funds by a fraudster, although it seems like an incredible event, has its own precedents.

If the victim can develop vigorous activity on social networks and on thematic forums, then, as practice shows, the identity of the deceiver can be established, after which he becomes vulnerable, since a lawsuit can be filed against him.

A statement to the police in such a scenario will be a guaranteed success , since search activities have been carried out and the attacker has been found, all that remains is to bring them to justice.

Realizing the danger of criminal liability and a criminal record, the fraudster, whose identity has been established, is ready to cooperate and, without question, compensates for the damage and even compensates for moral damage.

If identity cannot be established

Regardless of whether the payment for any imaginary goods and services was made voluntarily or the transfer of funds was carried out by attackers who took possession of the information necessary for this, the algorithm for what to do in such a situation is comparable.

Anyone who has been scammed and has made a transfer from their payment card or discovered that someone else has done so must follow certain steps.

Interaction with the bank card holder

First of all, the victim should immediately contact the bank with a statement about the erroneous transaction with a request to stop the transfer of funds because he was deceived.

Unfortunately, the interval required for transferring money is quite short, so it will not be possible to make it in time before the scammers withdraw money from the card .

But this procedure is necessary , and a copy of the application must be stamped with receipt by the responsible bank employee, as it will be required later.

The period during which the bank has the right to consider a client’s request is up to 30 days, so it is not advisable to wait for a response; the following mandatory action must be performed.

If the transferred funds have not yet been cashed, then some banks may return the transferred funds , but in most cases this does not happen, as the charters of credit institutions provide only two possibilities for such an operation:

- the entity behind which the account is registered;

- bank, by court decision.

Having met the client halfway, bank employees can send an appeal to the payee with a request to return the funds, which is unlikely and only applies to law-abiding citizens.

Bank employees should not be asked to provide details of the recipient of the transfer or return the money; they are not involved in the transaction, which was carried out in good faith, and are not authorized to disclose confidential information about clients.

Contacting the police

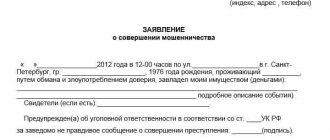

Having in hand a copy of the application to the bank about the transaction of funds into the fraudster’s account, you should go to the nearest police station and write a statement about the fraudulent seizure of funds.

The application should be accompanied by all available evidence of interaction with the attacker, including SMS correspondence, communication on social networks or on sites selling new or used goods.

Unlike citizens, to whom the bank does not have the right to disclose information about account holders, including the recipient of the transferred funds, law enforcement agencies can request it, but this takes up to two weeks.

Once the payment recipient has been identified, police officers interview him and determine whether he can be charged with fraud, which is often difficult to do due to the lack of evidence that a crime has occurred.

Regardless of the outcome of the investigation and whether the fraudster is punished under the article of the Criminal Code of the Russian Federation or not, his data becomes known and the possibility of filing a civil lawsuit arises.

Initiation of legal proceedings

Knowing the specific recipient of the transfer from a payment card, if he does not voluntarily plan to return the payment, a civil claim should be filed with the justice authority at the place of residence .

The statement of claim specifies the circumstances of the incident, including:

- interaction with the bank, attaching copies of payment documents and official correspondence;

- contacting law enforcement agencies and the results of the investigation into the fraud complaint;

- The payee's response to a request for a refund.

The subject of the claim should be the unjust enrichment of the payee , which, according to Article 1102 of the Civil Code of the Russian Federation, he must return to the sender if he did not provide any return services comparable in cost or did not sell the goods.

The trial of such claims is a lengthy process, but the practice of decisions knows precedents of positive outcomes for the plaintiff, when the money was returned in full.

Is it possible to return money after transfer?

Although it is difficult for scammers to get their funds back after an erroneous transfer, it is still possible. Moreover, it is not a fact that it will be necessary to resort to the help of courts or law enforcement agencies. The fact is that it also happens: the fraudster himself returns the money if he sees the need for it.

With the assistance of the law, everything is clear. It is not entirely clear how the second version of the scenario might develop.

The point is this: the attacker is absolutely aware of the damage he is causing to his victims. In the same way, he realizes that some insufficiently thought-out detail in the scheme can lead to problems and even prison. The key factor here is understanding the relationship between potential profit and risk

.

Usually, if something goes wrong, the scammer will neglect small amounts and return the funds to the rightful owner.

Note 1.

If out of five defrauded people one person threatens to go to the police, the money can be returned to him, since the thief would prefer to keep what was stolen from the other four people than to lose everything at once in case of problems with law enforcement officers.

Although this method is not at all a guarantee of a successful resolution of the situation, the first thing you need to do if you lose your honestly earned pennies is to bring to the attention of the scoundrel that he is at significant risk

. If some oversight was made during his machination that could reveal the identity of the villain, priorities may ultimately be set in favor of the deceived citizen.

Of course, if the fraudster is absolutely sure that he has not “exposed himself” anywhere, he will ignore the threats, as in most cases it happens. However, occasionally the maneuver can work.

However, you shouldn’t rely too much on psychology here. It is much more effective to take into account the technical specifics of the circumstances in each individual case.

Important! The ways to return the money depend on how the transfer was made. For example, when transferring to wallets of the Qiwi and Yandex.Money systems, technical support can assist in solving the problem, and in a number of other cases, the bank that serviced the online transaction helps.

Next, we will consider how best to act in the event of loss of funds, using the examples of the mentioned electronic wallets and Sberbank.

Where to complain about police inaction

The key link in the procedure for judicial collection of funds transferred to a fraudster from a payment card is the investigative activity of the police, who must make an official request to the bank and identify the recipient of the payment .

This must be done in order to determine the defendant in a civil suit, since conducting such cases against an entity whose identity has not been established is not permitted.

If the police do not fulfill their prescribed role , then further process will become impossible and then it will be necessary to contact the prosecutor's office with a statement in which all the circumstances of the incident will be outlined, including contacting law enforcement agencies.

The request to the prosecutor's office should be that police officers are required to carry out the necessary procedural steps and restore justice.

What if the bank refused to refund the funds?

If the bank nevertheless refuses to return the funds, it is necessary that this refusal be formalized in writing: this is necessary for going to court.

“In addition, you can file complaints with the Bank of Russia and Rospotrebnadzor. As a rule, banking organizations, not wanting to quarrel with these structures, prefer to resolve the issue with dissatisfied clients peacefully.

But if it is impossible to return the money by going to the bank or going to court, then in such a situation the only hope remains is with law enforcement officers who can detain the scammers. And then the scammers, if they wish, can compensate for the damage caused. But you need to understand that in practice this also rarely happens,” explains Lisov.

How to avoid becoming a victim of scammers

To avoid having to go through the entire long path described to return funds transferred to scammers, you should be careful and follow a number of simple rules :

- try not to make purchases with full or partial prepayment;

- if it is impossible to avoid an advance payment, you should choose a counterparty that has a bank account and clear details, and not just an anonymous payment card number;

- when paying by bank card number, you should request the last name and first name indicated on the front side, as well as a photocopy of the corresponding page of the passport (with photo and full name);

- if the counterparty refuses to provide personal details from the card and a scan of the passport page, the interaction should be interrupted - this is a fraudster;

- you should enter the available data of the payment recipient (full name, card number, phone number, nickname, etc.) into the search engine line and analyze the search results - if there are 4 or more matches, then this entity is a fraudster;

- When analyzing matches returned by a search engine, special attention should be paid to thematic forums where those who, through negligence, have already become victims of scammers communicate.

Fraudulent schemes related to the transfer of funds to payment cards of criminals are becoming more diverse every year, and the current year 2022 is no exception.

As can be judged from the study, the return of funds transferred to the attackers is a possible procedure, but it is extremely labor-intensive and requires the full performance of their duties by all government agencies.

To avoid such a long-term return of your own money , you should be extremely careful and not blindly trust reviews about the seller, which can be left by visitors who received a small payment for 100 - 300 characters of positive text.

The simplest rules listed above will help you save your time and nerves without becoming a victim of entities offering profitable purchases and services, forgetting to mention that they are the only beneficiaries.

Video: How to return money written off from a card by unknown persons

It turns out that there is no chance of a refund?

However, according to Lisov, this does not mean that it is not worth fighting for your money: citizens still have the right to a trial. There are known cases when financial organizations themselves have leaked customer data into the hands of scammers who used this information to deceive citizens.

Moreover, as Svetlana Burtseva, Chairman of the Burtseva, Agasieva and Partners Law Firm of the Moscow Region Chamber of Lawyers, says, there are also cases where scammers voluntarily returned money to their victims. “True, these are rare cases and they required some effort on the part of the victim. For example, activity on social networks and forums can help identify the fraudster, who, fearing criminal prosecution and a criminal record, can pay damages,” she shares.

Also, according to Burtseva, the law obliges the bank to first return the stolen money, and only then conduct proceedings to return the erroneously transferred funds, taking into account all the existing circumstances of the fraudulent operation.

Of course, banks are reluctant to immediately return funds to victims. “Valuable bank clients and clients whose amount of stolen funds does not exceed possible legal costs have a better chance. Also, large banks, not wanting to spoil their reputation, try to return funds to the client, especially if he provides evidence of his non-involvement in the unlawful transaction,” explains Burtseva.

How to block a card if the bank does not respond? More details

How to prevent crypto scammers

Of course, it is always better to anticipate a threat than to deal with the consequences. Therefore, before investing in a particular project, carefully study all its documentation and, in case of the slightest doubt or inconsistency, seek advice from specialists. Many scams are camouflaged as quite competent concepts, but the devil is in the details. This is why it is so important to pay attention to the minor aspects of investment projects and other proposals that supposedly lead to high incomes.