Avito (avito.ru) is a large bulletin board in Russia with tens of millions of advertisements. Every day on Avito, thousands of sellers and buyers make purchases and sell goods, at the same time the Avito.ru website attracts scammers whose goal is to fraudulently take over the buyer’s funds or access to a bank account.

Before making a purchase or to reserve a product, the buyer can ask for the seller's bank card number to transfer money. Let's consider all the common schemes for deception and illegal use of bank card data and the security rules, compliance with which will protect against this type of fraud.

Internet banking fraud

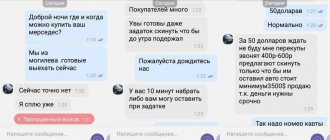

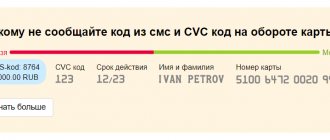

Having received the card details of the seller’s bank, the fraudster, under the pretext of confirming payment in the form of an SMS, which is sent to the seller, asks him to name this code: this is fraud; in order to receive payment on the card, the recipient is never required to enter or report SMS codes. The code is necessary for the fraudster to pay for his own purchase from the seller’s card account or to make a money transfer (also from the seller’s card). Some banks, providing Internet banking services, allow third parties to access the funds on the card if the person has information about the full card number and correctly enters the SMS code that is sent to the phone of the fraud victim.

Provide a toll number for feedback

Ads or personal messages sent via instant messengers may contain a paid phone number. The cost of a minute of conversation on it amounts to hundreds of rubles .

Another option is for the buyer to dial you several times and hang up. Then an SMS comes with a request to call back , the money in the account has run out.

The “treatment” is simple: Google the phone number. Usually, information about such divorces quickly spreads across the Internet.

You can also try contacting via Viber or WhatsApp. For real buyers, messengers are often connected to their main number.

Call from the bank - they ask you to log in using your card number

Under the pretext of checking an incoming transaction, blocking a card, receiving a payment from a buyer via Avito, or debiting funds, fraudsters call the phone and introduce themselves as employees of the client’s bank. Setting the name of the bank by card number is not a problem. The divorce victim does not pay attention to the phone number from which “bank employees” call; it happened that the calls came from official bank numbers.

The caller asks to confirm the card details or, for complete authorization in the system, asks to name all the data one by one (full name, card number, expiration date, CVV/CVC code), after which, to complete the authorization, he asks to name the received code. If the victim of a scam completes all these actions, the fraudster will pay for some purchase or make a money transfer from the card account.

They create a fake hype and ask you to book for ₽

Probably the most popular scheme. You find a product that costs less than its analogues . For example, an iPhone X for 30 thousand rubles, or a one-room apartment within the ring for 25 thousand per month. Naturally, call and chat with the owner.

But the seller/landlord says that there are more than enough people interested, so he will prefer the most interested one. Want to get a good deal? Leave a deposit of a thousand or two, and you will be first in line.

It is clear that after this they will neither send you an iPhone nor show you an apartment. Particularly inventive scammers go further - for example, they can call back and say that someone is ready to give a larger deposit.

Linking to a payment system in a trusted store/service

Fraudsters from Avito practice a method of stealing funds from a client’s card and without a code in the confirmation SMS, they only ask for the amount of the last replenishment in order to make sure that the card number is correct when performing a replenishment operation for a small amount. If sellers are careful and know that they cannot tell anyone the codes from an SMS from the bank, then giving the amount with kopecks for the last transaction, which the scammer asks for, does not cause suspicion or fear. But in vain!

Why does a fraudster need to top up his card? There are services and stores that use a bank card to pay for services and purchases without confirming debit transactions via SMS. To enable payment by card, its account is linked to the internal payment system. To do this, the card data is entered, after which the service tops up the client’s card with a small amount and immediately performs a cancellation operation. By entering exactly the transaction amount that the fraudster asks from the seller, ownership of the card is confirmed, after which purchases are possible at the expense of the defrauded seller.

Why does Avito attract scammers?

Thanks to the ease of creating an account, every day “fake” advertisements appear on the site offering to purchase goods at low prices . Thus, such an ad attracts a large audience of potential buyers. The site also does not have a seller rating system, which opens up opportunities for scammers. Accounts of unscrupulous sellers are blocked by the management of the site only when the victim files a complaint. However, creating a new account is not the point - a minute of registration and the scammers are again ready to look for easy prey.

Fraudsters modify and develop new schemes and operations. The most common are:

- fraud on Avito with prepayment , when the purchase of goods occurs with an advance payment and its further dispatch using a delivery service;

- fraud using payment cards - when money is withdrawn from the credit cards of buyers who provide information about secret codes;

- scams involving the purchase of cars and real estate , as well as the rental of space;

- fraud with vacancies (paid phone calls, participation in paid competitions, advertisements from network companies, provision of nanny services).

It’s better to get to know individual schemes better so as not to fall prey to scammers in the future.

They asked for a card number and transferred the wrong amount

There are also intricate schemes of deception through Avito. For example, a fraudster agrees to a purchase and asks the seller for a card number for payment. Let's assume the product costs 30 thousand rubles. Unexpectedly, the seller receives an SMS with a message that funds have been received on the card, but the replenishment amount is greater than the price agreed upon by the seller and the buyer. For example, 50 thousand rubles.

The seller contacts the buyer, who reports that he sent such an amount by accident, asks to return the excess (20 thousand rubles) and gives the card number. Decent people, not suspecting any trick, will send the buyer a surplus of 20 thousand on the card and the goods for which payment was received... And after a while the seller gives an explanation to the police, the bank account is blocked while the involvement in fraud is verified. How is this possible? This scheme involves a third party - the victim of fraud!

The money transferred to the seller’s card was not the same buyer who agreed to the transaction. The fraudster was simultaneously negotiating with another person, placing an ad on Avito for the sale of something at a remarkable price in search of a fraud victim.

Having agreed on a sale with the found buyer, the fraudster provided the card details that he asked from the seller, which is why the seller received a transfer of the wrong amount. Next, the fraudster gives his card details and receives the difference in the amount. Why does this combination happen, why doesn’t the fraudster immediately give his card details? First: the fraudster’s card number has already appeared on the Internet, so the buyer participating in the deception can check this number before making a purchase, and the seller, when making a return, is unlikely to check the card number for fraud, since the money for the goods has already been received. Second: until the deceived buyer realizes that he will not receive the goods, it takes a lot of time to contact the police while the investigation is taking place. During this time, you can commit a fraudulent scheme with the card several times, after which you can withdraw all the money from the account and throw away the card.

And who is this person, in what place in the world was he at the time of committing fraudulent actions with the seller and buyer on Avito, in what country is the bank that issued the card located, and in whose name the card was issued (and does such a person really exist or the data is false) - this is already a long trial that may end in nothing. And the scammer’s phone number can be registered to a dummy person, because a SIM card without a passport can be obtained for free from the metro or at the train station.

How to avoid falling for tricks

Listed above are only the most common online tricks. Many people ask themselves: “how can you avoid getting scammed?”

To do this, it is enough to act in accordance with simple rules:

- Check your cash account using mobile banking. This will help you always know how much money is on your balance.

In addition, you can always track any transfer of funds when buying or selling goods. If this service is not activated, just go to an ATM and check everything you need through it.

- Read reviews about the seller. People always write about their experiences with this or that person. Also on Avito. You can come up with a list of potential scammers after receiving several opinions from other consumers.

- Keep your payment receipts. After any purchase, feel free to ask for any guarantees by mail that the goods will be delivered (remember, no courier will deliver the goods to you). If you don’t receive your order, then you can present them as evidence in court or simply demand your money back.

If on Avito they ask for a card number for payment...

Safety rules for sellers on Avito:

- The seller must not disclose any SMS codes to anyone to receive payment. An SMS code is needed to pay or gain access to an account; a bank employee will never ask you for the SMS code!

- To receive payment on a bank card, it is enough to provide only the card number (16 or twenty digits on the front side). You cannot transfer all the card data (last and first name on the card, expiration date and three-digit CVV code on the back - confidential data!).

- To make a payment, the buyer does not need a copy of the seller’s passport; a photo of the card and a photo of the passport may only be asked for fraudulent purposes.

- Under no circumstances should the seller make payments to any account, card, or electronic wallet, so as not to become an accomplice in a fraudulent money laundering scheme.

They offer to conclude an agreement before showing the apartment

You call about an advertisement for renting an apartment, and bad luck! It has already been delivered.

But don’t worry, this is a big agency, they will offer you even better options. It is enough to conclude a selection agreement - read, pay several thousand for access to the database.

The contract doesn't actually guarantee anything. It may indicate a limited number of options that the realtor will show you, or a fixed validity period.

And then they will simply throw up their hands in front of you - it’s their own fault that you don’t like anything. And the fact that everything was offered at twice the price of what was needed, or in the wrong area at all, is your problem .

Cloning other people's ads and scamming others

In the ad you see a suspiciously cheap product (this is how almost all stories about fraud begin). Contact the seller, ask for additional photos, videos, and so on. You receive them and make sure that everything is OK.

Transfer money in exchange for scans of your passport/licence/wedding photo of your grandparents. And this is where the scam begins: they don’t send you anything.

The fact is that you communicated with a scammer who was an intermediary between you and the real seller. It was the real seller who took all the photos (including a scan of the passport).

It’s just that somewhere between you paying for your purchase and sending the goods, the scammer suddenly refused the purchase . And he made the seller feel sorry for himself - he ended up in the hospital, he needed medicine, not a new smartphone, let's cancel the deal.

The seller accepted the situation and returned the money. But not for you, but for the scammer . A curtain.

UPD: 10.18.2020. Attention! Avito. Delivery: scam with substitution of goods

A new type of scam: substitution of goods when returned to the seller. The scheme is like this

- The buyer writes to you, you discuss the details of the transaction. He is ready to buy your laptop (for example). Important: the buyer is not from your city

- You agree that you will send the goods via Avito.Delivery

- The laptop arrives to the buyer at the Russian Post office

- The buyer is allegedly not satisfied with the product and sends it back

- Money blocked by Avito is returned to the buyer, because he “did not accept the goods”

- You receive a package back that should contain a laptop, but instead you receive three packs of salt

- Result: the money was returned to the buyer, he has your laptop. You have neither a laptop nor money.

What to do? There is no defense strategy against such schemes yet. Avito does not block the buyer's funds until the seller verifies his return. Therefore, you need to select a buyer extremely carefully (preferably from your own city and check the registration - if the buyer registered a couple of days before the purchase, then this should raise suspicions).

Alice Maddison 05/20/2020