From time immemorial, there have been people who dream of taking possession of other people's property in an easy way, by gaining the trust of the victim or by deceiving him. In legal language, such actions are called fraud.

And in order for affected citizens and legal entities to protect their rights, in many cases it is necessary to write a statement to the prosecutor’s office about fraud.

To ensure the legal literacy of the common man, in this article we will talk about how to correctly write a statement to the prosecutor's office regarding fraud (it can be downloaded here), bring the swindler to criminal liability and get your money back. So.

Online fraud: types

There are many ways to deceive people over the Internet.

The ingenuity of scammers knows no bounds; new techniques are constantly appearing aimed at luring money out of Internet users. It is impossible to describe all types of fraud, so below is general information about methods of deception, grouped according to similar characteristics. Existing types of fraud on the Internet can be divided into 2 large groups:

- Software. Money is written off from the user using special means: viruses, fake sites, etc.

- Psychological. The basis for fraud is the human factor: users independently transfer money to the accounts of criminals, believing in the story they set out.

Fraud using software tools

Examples of online fraud carried out using various software include:

- Phishing. A message is sent to your email/phone asking you to confirm your password to use a bank card or log into your account on a website. Fraudsters report that if you refuse to provide such information, access to the card or resource will be limited. The user submits the required data, after which the fraudsters have the opportunity to unlimitedly use the card or account in their own interests.

- Debiting funds via SMS. To complete registration on the site or gain access to download a file, the user is asked to go through an identification procedure confirming that he is not a bot (a program that automatically generates new accounts or continuously downloads files from the server). To do this, the site owners suggest using a mobile phone. An SMS message with an access code to the system is sent to the number specified by the user. It must be entered into the appropriate field on the page that opens. The following are several possible scenarios:

- All funds on it are debited from the user's account;

- funds are debited not only from the account, but also from bank cards linked to the phone number;

- a subscription to paid services is automatically formed, as a result of which the user’s phone balance is regularly reduced by a certain amount.

- Fake sites. Instead of the official website of a bank or online store, the virus program transfers the user to a fake website that has a similar design and differs by one or more letters/numbers in the domain name. The user, unaware of the substitution, places an order on it, pays for it, and the money goes to the fraudster’s account. The payer, of course, will not wait for his purchase.

Psychological Fraud

The following methods of online fraud fall into this category:

- Imaginary charity. Treatment of seriously ill children, assistance to fire victims, restoration of churches and shelters, etc. - social networks are full of requests for help in such situations. Despite all the moral nuances of holding such collections, scammers often create fake pages using other people’s photographs and documents confirming the fact of their need for money. To protect yourself from this type of deception, you should transfer money only through large charitable foundations or, if the details of a private person are used for collection, require the presentation of original documents (or scanned copies with the id of the group or page through which the collection is made).

- Selling a non-existent product or a product that does not have the stated characteristics. The buyer, seeing an attractive price, seeks to take advantage of the offer and transfers money to the online store or private seller. At best, he will receive products that do not correspond to the order, and at worst, he will be left without money and without a package.

- Selling online courses. With the development of digital technologies, it has become easier to obtain the necessary knowledge: you don’t need to go to the library for a specific book, just download an electronic textbook or video lesson. There are decent video courses, the creators of which really understand the subject and share their knowledge with other people. However, there is a lot of various garbage on the Internet, purchasing which users waste their money. “How to make a million without any effort”, “How to build muscles in 2 days” are vivid examples of what courses you don’t need to buy.

Applications

In cases where clients contact the bank and can support their arguments with any documents, it is worth attaching them to the claim. There is no need to send original documents to the bank; copies are better. In this matter, when filing a claim with the bank, a sample is also not provided.

So, if we are talking about excess write-offs, you can attach a copy of the loan agreement, which indicates the exact amount of write-offs per month. Or if the bank did not count the funds paid, then it is worth sending along with the claim a copy of the check or payment receipt.

Entrepreneurs can attach to their claim, as an example, a copy of a payment order when the transaction they need was not carried out on time or was not carried out at all. And when an organization applies, the issue is definitely not resolved without additional documentation.

Legal provisions

It is preferable to correctly describe in the complaint the legal norms that, in the client’s opinion, were violated.

A clear indication of the law will save the bank from unnecessary thoughts, and the client from further illegal actions of the organization.

Basically you need to refer to:

- to the norms of the Law “On Protection of Consumer Rights”;

- to the norms of chapters 21 to 27 of the Civil Code of the Russian Federation.

If the client is not sufficiently aware of these legislative acts, then he needs to contact a qualified lawyer who will tell you how to correctly write a claim to the bank. Since the claim to the bank does not have a sample, this will be the best solution for any consumer.

Checking an online store for fraud

To avoid falling for scammers, you should choose only trusted online stores and not pay in advance for orders made through social networks or classifieds sites.

If the product is extremely necessary or the price is very attractive, you should check the online store for fraud before placing an order. To do this you can:

- Find out the domain registration date. If the site was created recently (a week or even a month ago), the likelihood that it is being used by scammers is extremely high.

- Read reviews on forums or specialized review sites. If there are no such reviews or they are negative, you should refuse the purchase. The abundance of the same type of enthusiastic responses should also alert you - most likely, they are custom-made and do not correspond to reality.

- Really evaluate the store's offer. Liquidation of a branded collection at a 90% discount from the initial cost, sale of confiscated goods, or sale of flagship models of electronic equipment at half price is most likely just a bait from scammers.

Time limit for reviewing a claim to the bank

The period within which a banking organization must provide a response to a claim can range from 3 to 45 days. In exceptional cases, this period may be extended. This is in practice, as for the legal deadline, the bank must respond within 10 days.

The specific period for consideration of consumer requirements depends on many aspects and on the individual characteristics of the application.

As a rule, simple issues that do not require detailed investigation and clarification of all the circumstances of the case are resolved quite quickly, within 3-5 days from the moment the bank receives the claim.

More complex problems, for which it is necessary to study the event in detail, take more time and may drag on indefinitely.

To avoid the bank delaying the process, the claim can indicate a time limit for consideration of the claim. It is advisable to indicate it in the range from 10 to 30 days. If the question is urgent, this should also be indicated in the text of the document.

Pre-trial settlement of disputes with a banking organization is one of the most effective and fastest ways to resolve disagreements. Therefore, competent preparation of the text of the claim and correct submission of documents to the bank are guaranteed to increase the chances of a favorable solution to the problem in the shortest possible time.

If you have any doubts about writing a claim, it is better to contact our claims lawyer so as not to waste time or incur additional financial losses.

Internet fraud - how to get your money back

Unfortunately, it is almost impossible to recover money lost as a result of fraudulent activities on the Internet. Most often, scammers have minimal computer and legal literacy skills and accept money not to a bank card, but to an account that does not require identification confirmation (for example, to a wallet opened in the Payeer system), which complicates the procedure for finding them.

It will also not be possible to contact the scammer on your own and appeal to his conscience. Usually the telephone numbers indicated in the advertisements do not answer, and the copies of documents and information about the registration address provided are fake.

Contacting law enforcement agencies may give you a slim chance of getting your money back. How to do this is described below.

What to do if the prosecutor's office refuses to consider the application

As with other government departments, an application to the prosecutor's office about fraud may be rejected. It is usually caused by the inability to determine the identity of a potential criminal, lack of evidence of illegal actions. Such facts will be indicated in the refusal letter, and the prosecutor’s office will receive them from the materials of the pre-investigation check of the Ministry of Internal Affairs. All conclusions indicated in the response must be reasoned and supported by references to the results of inspections.

Cases involving fraud are initially difficult to solve. Therefore, in a refusal of an application, it may be proposed to file a claim in court, demand the recovery of money or the return of property under civil law. If you disagree with the prosecutor's conclusions, you can file a complaint in the order of subordination. If such an appeal does not bring results, you can file an administrative complaint in court.

☎️ Still have questions after reading the article? Get a free consultation from a qualified lawyer. Call now! +7 800 302-76-57

Where to report online fraud

Despite the fact that the media and popular electronic resources constantly publish information about existing methods of deceiving the population, law enforcement agencies daily record hundreds of cases of dishonest actions against consumers of information. Where to turn in case of Internet fraud if you have encountered deception on the Internet?

First of all, the victim must submit a statement to the police department located at his place of residence. A separate division, the “K” department, has the authority to handle complaints regarding Internet fraud.

The application must indicate:

- Full name, passport details, registration address, contact phone number of the applicant;

- description of the situation that occurred: date, time, place where the fraudulent actions were committed, as well as the essence of the actions that led to the deception of the victim;

- date of application and signature of the applicant.

You can submit your application either in person or online. To do this, you need to follow the link https://mvd.ru/request_main and send the document (you can attach additional evidence of fraud to it: screenshots of pages, Internet banking receipts, etc.).

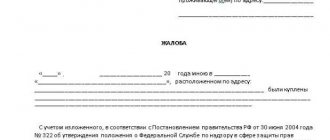

statements

There is no standard form for filing a complaint against fraudsters. Below you can download an application template in Word format. When writing it, it is necessary to take into account the signs of a criminal act. You can familiarize yourself in advance with the rules for drawing up statements on the official website of the prosecutor's office. Or, at a meeting with an employee, clarify unclear points and take them into account when drawing up.

This is an example that you can use to fill it out yourself. The form has been compiled taking into account the norms of current legislation. Please note that all information is fictitious.

Punishment for online fraud

Responsibility for fraud (including fraud on the Internet) is provided for in Art. 159 of the Criminal Code of the Russian Federation. The sanction of this article establishes the following types of punishment:

- a fine of up to 120 thousand rubles;

- a fine in the amount of the salary or other income of the convicted person received by him for a period not exceeding one year;

- compulsory work lasting up to 360 hours;

- correctional labor for up to 1 year;

- restriction of freedom/forced labor for up to 2 years;

- arrest for up to 4 months;

- imprisonment for up to 2 years.

Thus, the punishment for fraud on the Internet is not severe enough, even taking into account the legislator’s differentiated approach to its possible types.

Results

So, fraud on the Internet can be based on the use of special software tools that can withdraw funds from user accounts, or it can consist of a set of psychological techniques aimed at misleading the user, as a result of which he independently transfers funds to the fraudster. It is very difficult to recover money lost as a result of fraudulent activities. This can only be done if the criminals are found by law enforcement agencies and brought to justice.

See also: “Fraud using payment bank cards.”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.