Crimes in the financial sector began to be committed as soon as the first banknotes appeared. Initially, these were elementary fraud schemes, theft and counterfeiting of banknotes. However, with the development of the financial and economic industry, the crimes committed have rapidly evolved, spreading to all types of activities where transactions are carried out in national or foreign currency.

Liability for offenses committed in the economic sphere is regulated by Chapter 22 of the Criminal Code of the Russian Federation . In particular, this section covers articles 169-200, which detail the types of currency fraud and other crimes related to the circulation of funds.

Download for viewing and printing:

Chapter 22. Crimes in the field of economic activity of the Criminal Code of the Russian Federation

Criminal Code of the Russian Federation of June 13, 1996 N 63-FZ

Offenses in the financial and economic sphere of activity

This category of crimes is rarely aimed at a specific person, and in general negatively affects state interests. Financial crimes contribute to inflation and drain funds from the state budget. This reduces the actual level of income of the population and hinders the development of the manufacturing industry and small and medium-sized businesses. However, what can be considered an economic crime?

General provisions

A characteristic feature of financial crimes is malicious intent. Crimes are not committed spontaneously; there is always a clear structure and plan of action. Much less often, atrocities are committed through negligence, when there may be an unauthorized intrusion into one of the areas of commercial activity. There is no premeditation here, however, there may be negative consequences for other market participants.

In both cases, the crimes committed harm the development of the business as a whole, disrupting the stability of the companies, making the market unstable.

How are economic crimes classified?

These offenses are conventionally divided into the following categories:

- encroachment on socio-economic relations - here we mean interference in the activities of stock markets and credit activities, a negative impact on the formation of the state budget;

- encroachment on financial capital, which is in private hands;

- illegal actions in the field of entrepreneurship;

- tax fraud and illegal bankruptcy;

These types of illegal activities are subject to criminal liability, according to articles that fall under Chapter 22 of the Criminal Code of the Russian Federation.

What is considered a crime

Offenses in the financial and economic sphere are characterized by the following features:

- failure to comply with regulatory requirements;

- erroneous completion of reporting documentation (if intentional actions are evident);

- financial reporting documents are submitted untimely;

- there are penalties and penalties, a revaluation of material assets and financial funds has been carried out;

- there are identified violations of the production process;

- employees do not comply with legislative acts, sometimes ignoring the orders of immediate management;

- the standard of living of the company's management or employees is noticeably higher than the actual level of income.

If there is malicious intent or criminal conspiracy here, criminal liability arises.

Objects and subjects

When understanding the circumstances of a crime, law enforcement officers take into account objective and subjective aspects. The objects of crimes are understood as factors that determine the type of commercial activity, the degree of severity and the resulting consequences. For example:

- conclusion of illegal transactions, violation of trade rules, fraud in the field of lending;

- inaction or tax evasion;

- theft and other material damage.

A subject is any individual who has reached the age of majority. Consequently, the goals and motives of the offense can be considered the subjective side.

Important! For some types of economic crimes, the concept of subject is used: precious metals, currencies, securities.

Law enforcement

There are law enforcement agencies whose primary enforcement activities focus on criminal violations of their country's tax code and related financial crimes such as money laundering, currency violations, identity theft fraud, and terrorist financing. Some of these law enforcement agencies:

- Australia - Australian Taxation Office

- Canada - Canada Revenue Agency

- Mexico - Unidad de Inteligencia Financiera

- Netherlands – Fiscale Inlichtingen- en Opsporingsdienst

- Nigeria - Economic and Financial Crimes Commission

- United Kingdom - HM Revenue and Customs

- United States of America - Internal Revenue Service, Criminal Investigation

Tax crimes

This is a rather problematic area that causes direct damage to the state.

If we are talking about organizations and legal entities, those guilty of a crime are punishable by a fine of up to 300,000 rubles, forced labor for up to 24 months, and a ban on engaging in certain types of commercial activities for up to 3 years. In addition, it provides for arrest for six months or imprisonment for up to 2 years. In cases where the circumstances of the case provide for a particularly large scale or preliminary conspiracy of a group of persons, liability for illegal actions is increased. The maximum fine is increased to half a million rubles, the term of forced labor is up to 5 years, and detention is up to 6 years.

If this offense is committed by an individual, he may face a fine of 300,000-500,000 rubles, correctional labor for up to 3 years, or imprisonment for a similar period. The degree of responsibility is determined by the severity of the crime: especially large or not.

Article 199. Evasion of taxes and fees payable by an organization of the Criminal Code of the Russian Federation

Article 198. Evasion of an individual from paying taxes, fees and (or) an individual of the Criminal Code of the Russian Federation

Important! The perpetrators are released from liability if they are caught committing similar crimes for the first time and fully compensate for the damage caused, including arrears and penalties.

Financial crimes: how cyber forensics investigate them

False oil trader

The story began a year ago, when a company from Southeast Asia engaged in the purchase and sale of petroleum products was allegedly approached by representatives of a large oil trader in one of the CIS countries. They offered to supply natural resources at competitive prices. Communication with potential counterparties took place via email and instant messengers. Only scammers acted on behalf of a well-known organization from the CIS.

They “processed” the victim for three months and ensured that they were given three advance payments for the supply of petroleum products. To be convincing, the criminals even sent the Asian company fake letters of guarantee, allegedly on behalf of the general director of a real-life company. Her details were indicated in all invoices, with the exception of current accounts. Those actually belonged to individuals.

As Group-IB specialists explain, in practice, money from there goes to other banks in several transfers at once. Transactions are disguised as payments for fake services. Then the funds are sent to one of the offshore banks and cashed out. And all sales and purchase agreements and the transport agreement turn out to be fictitious.

But representatives of a foreign company in Russia managed to turn for help in time to Group-IB employees, who began the investigation.

How the crime was investigated

- In Moscow, with legal support from Group-IB, a criminal case was opened against unidentified persons under Art. 159 of the Criminal Code of the Russian Federation. The injured party is a partner of an Asian company in Russia.

- Together with the Investigation Department, during the next correspondence between the client and the scammers, they were left with a trap in the letter. We are talking about a link to a file, which, when opened, the attacker de-anonymizes himself. Thanks to this, it was possible to establish the location: the city of Kazan.

- Computer forensics experts flew to Asia to collect information from the victim's company email server and legally document all digital evidence.

- As part of the criminal case, investigators obtained bank statements for all accounts that participated in this scheme.

- Financial investigation specialists analyzed the movement of money and, thanks to this, identified the owners of the accounts. They had already managed to cash out some of the funds at Russian ATMs, but others were in the accounts of foreign banks. They managed to block them.

- Through the bank security service, videos were obtained from surveillance cameras at ATMs, which showed those who withdrew money.

- Operational search activities began, which Group-IB specialists helped to plan competently. At the same time, searches and arrests took place of the owners of fake accounts in Moscow, Kazan and Ufa and personally of the fraudster who conducted electronic correspondence with the victim.

- As a result of the searches, digital equipment (computers, laptops, smartphones, SIM cards, flash drives) and money in various currencies were seized.

- After interrogating the detainees, it was possible to identify those involved in the criminal group, including its organizers.

The entire investigation took about six months. The fraudsters were arrested and then prosecuted under Article 159 of the Criminal Code. A significant portion of the stolen money was returned to the victims. When gaining access to the scammers' technology, other victims were discovered.

According to experts from Group-IB, behind such schemes there is usually a group of fairly professional scammers. Some of them specialize in banking operations, which often presupposes the presence of “insiders” in credit institutions and cashers-executors. Others post advertisements for the purchase and sale of petroleum products or other goods. Still others are professional psychologists who scam clients by communicating via email or instant messengers. Fourth, they give it all a legal status by forging documents and non-existent contracts.

Of course, intermediaries are often involved in such crimes. The scammers promise them 2-3% of the transaction. Newly-minted dealers call their business friends with the offer: “I have a reliable supplier of petroleum products at low prices.” The intermediary sometimes does not even suspect that he is “advertising.”

Why are such crimes committed?

The scheme that the victim encountered is quite common. The problem is that some banks, when transferring money to a company’s current account, do not check its TIN with that indicated in the payment order. Attackers register a shell company with the same name as a real company. And the customer is sent the details of the real counterparty for payment - with the exception of the current account, which belongs to the scammers.

Checking the counterparty's databases through the Taxpayer Identification Number (TIN) convinces the customer that the company is real: it has billions of dollars in turnover and has staff. The only thing that does not coincide with an “honest” company is a current account. But a large company may have several current accounts and it is impossible to check each of them for compliance with the TIN. If the bank does not verify this number, then the payment goes through to scammers.

About Group-IB

Group-IB is one of the world's leading developers of solutions for preventing cyber attacks, detecting fraud and protecting intellectual property online.

Since 2003, he has been working in the field of computer forensics, consulting and auditing of information security systems, providing protection for the largest Russian and foreign companies from financial and reputational losses.

The company's technological leadership is based on 17 years of practical experience in investigating cybercrimes around the world and more than 60,000 hours of responding to information security incidents, accumulated in one of the largest computer forensics laboratories and the 24-hour operational response center CERT-GIB.

The company is a resident of Skolkovo. Group-IB is a partner of INTERPOL and Europol, a provider of cybersecurity solutions recommended by the OSCE.

- Pravo.ru

Illegal currency transactions

Frauds in this area can destabilize the country’s foreign exchange market, therefore quite severe penalties are provided for offenses in this area.

If we talk about illegal currency transactions involving the transfer of money using fictitious documents, the perpetrators are fined half a million rubles and sentenced to forced labor or imprisonment for up to 3 years.

If we are talking about fraud on a large and especially large scale, a criminal conspiracy or a crime committed using a legal entity created for illegal actions, the fine increases to 1,000,000 rubles, and the prison term increases to 10 years.

Important! A large transfer is considered to be a transfer of funds in excess of 9,000,000, and an especially large transfer is over 45,000,000 rubles.

Refinitiv solutions to protect your business

Controlling risks and taking measures to minimize them is important for businesses of any size. You can do this by using Refinitiv tools and complying with anti-money laundering, bribery and corruption regulations.

Many regulatory guidance calls for the active use of technology for customer verification and Know Your Customer compliance, including Qual-ID and World-Check technologies.

Refinitiv Qual-ID

This is a tool built on the prevention of financial crime through personal identification, document verification and risk assessment using API technology. The technology will allow you:

- identify and assess risks associated with financial crimes;

- use the World-Check Risk Intelligence database;

- establish the identity of clients using reliable sources;

- check official documents;

- identify compliance risks.

Lending sector

It should be noted that the concept of “lender” refers not only to banking institutions; it also includes individuals, state-owned enterprises, and other organizations that issued a cash loan.

However, most often these crimes are committed in the banking sector. If an organization or private entrepreneur receives a loan on preferential terms by providing false documents, they can be fined up to 200,000 rubles. In addition, it provides for forced labor lasting up to 5 years or imprisonment for a similar period.

In cases where the case involves an illegally obtained government loan or its misuse, which caused major harm to state or civil interests, the fine increases to 300,000 rubles. In addition, those found guilty may face up to 5 years in prison.

Economic crime investigation

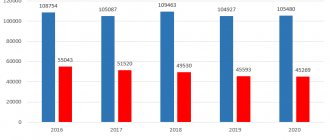

Recent studies in the field of economic offenses have shown that fraud is the most common case in Russia - the number of cases initiated under this article is almost 2 times higher than for other offenses (with the exception of theft and trafficking in drugs and illegal drugs).

The work of uncovering economic crime is carried out by special units of the Ministry of Internal Affairs of the Russian Federation. Each division has its own departments for uncovering atrocities in various fields of human activity - mechanical engineering, metallurgy, agriculture, etc. If we are talking about a threat to the state, then the FSB of the Russian Federation gets involved in the work.

Watch a video about the peculiarities of the methodology for investigating bribery and other official crimes:

Degree of punishment

Recently, financial fraud in the economic sphere is rapidly gaining momentum. This is caused by the development of commercial activity, which implies a constant turnover of large sums of money, creating a favorable environment for the commission of such crimes. Responsibility for illegal actions in the field of economics and finance provides for monetary fines, corrective labor, and real prison terms. The proportionality of punishment depends on the nature and severity of the crime committed.

How investigations are carried out

The Department for Combating Economic Crimes is engaged in uncovering financial fraud. Special requirements are imposed on employees of this structural unit. In particular, in addition to legal education, an economic education is required. Only a comprehensive methodology helps to increase the detection of such offenses.

Methods of offenses

The object of the criminal’s activity, in the case of economic offenses, is always finance or any other material objects that have value, but the acquisition of the object occurs under the guise of business, banking activity or under the guise of financial transactions that are not prohibited by law.

If we talk about the practical application of fraud, we can distinguish simple and complex ones:

- Simple: include the activities of individuals who are engaged in business, but do not officially register their activities and do not pay taxes.

- Complex: legally operating banks (and other financial institutions) open branches without registration, withdraw funds offshore or open a new company in order to ensure the ability to carry out certain activities illegally, without affecting the main business.

Some crimes are aimed at concealing economic activity, which includes falsifying documents, opening deposit accounts by persons who do not have the right to do so, opening new enterprises on the basis of liquidated ones, concealing income, falsifying documents on the accounting activities of enterprises, etc.

All methods of committing crimes in the economic sphere are interconnected. Law enforcement agencies are able to detect traces of atrocities only when conducting a thorough check of documentation on a number of transactions.

Yasuo Hamanaka...$2.6 billion. ... "Mr. Copper."

Organization: Sumitomo Corporation.

When: 1996.

How: The head of Sumitomo's metal trading division earned the nickname "Mr. Copper" and controlled up to 5 percent of the world's copper. Hamanaka used his position to monopolize copper buying and pressure the market through the London Metal Exchange, reaping handsome profits for his company and bonuses for himself for nearly a decade. Eventually, the price of copper fell and Sumitomo faced huge losses. The company refused to admit that it knew anything about his dealings and called Hamanaka a “fraudster,” accusing him of forging his boss’s signature.

Sentence: 8-year prison term.

Bruno Michel Iksil... about $9 billion.

Organization: JPMorgan Chase. When: from 2011 to 2012. How: Iksil took a job in the London office of JPMorgan Chase in 2005, where he came from Paris. He was known for his aggressive trading and earned the nickname "Caveman" after a $1 billion bet (on certain companies defaulting) netted his employer $450 billion. After a series of credit default swap frauds (valued at $9 billion after the complex labyrinth of their sale was unraveled), Iksil became known as the “London Whale.” Verdict: The investigation is currently being conducted by the Federal Reserve, SEC and FBI (see: Wikipedia).

Nick Leeson... $1.4 billion.

Organization: Barings Bank.

When: 1995.

How: Leeson worked at the Singapore branch of Barings Bank, London's oldest merchant bank (founded in 1762). He carried out unauthorized trades on the Nikkei Index Futures index, primarily providing large profits for the bank, and additionally bonuses for himself. The Kobe earthquake on January 17, 1995 caused the index Leeson was trading to collapse. Leeson fled Singapore, leaving a note saying "I'm sorry." Barings Bank was declared insolvent after 5 weeks.

Sentence: 6-year prison term.