September 19, 2019

Without a license

Counterfeit, theft

Staging an accident

Repeated payments

Many people are interested in making money from selling “vehicle licenses”. There are many reasons for this - a popular product, lack of mandatory training and licensing, and the opportunity to earn money online. However, along with the legitimate way to earn money, many fraudulent schemes have appeared.

In the first quarter of 2022 alone, fraudsters managed to obtain 4.6 billion rubles in insurance payments. Most of all, insurance companies suffer losses due to those who like to make illegal money in the Central District of Russia. Despite the constant fight against cases of violation of insurance laws, there is a risk that such situations will become more frequent.

How to work with MTPL legally?

To sell policies online without breaking the law, you can use our service. Everything is completely legal: we have entered into agreements with many insurance companies (and continue to integrate new organizations into the system). By working on our platform, you get the right to apply for compulsory motor liability insurance for any of these companies via the Internet, receiving a commission on each transaction.

The operating algorithm is very simple:

- You need to submit an application for registration in the service

, indicating your personal data (both individuals and legal entities can work using our website). - Then you will receive access to your personal account

and will be able to log in to the system. - Compare the conditions for compulsory motor liability insurance in different companies

, choose the most profitable option for a particular client and buy a policy absolutely legally.

As you can see, making money on compulsory motor insurance is officially not at all difficult. But, unfortunately, some are looking for ways to deceive the law and get money fraudulently.

Reasons for the increase in fraud cases

The reasons for the growth of fraud are simple - the desire to make a quick profit. Over time, swindlers learned to create fake accidents and make a profit in several companies at once. As for fraud with electronic MTPL policies, it is enough to make an offer to the client via the Internet and receive funds.

Important! Fraudsters offer compulsory motor insurance at a reduced cost and ask to send documents by mail and payment by card. Real insurers ask you to enter your data yourself and pay for the contract through a free payment service.

Unfortunately, as practice shows, it is law enforcement officers who work in collusion with insurers and make fake documents regarding road accidents. Some make a report, while others make an inspection report and set the amount of the loss.

Selling e-OSAGO offline

With this scheme, you open a separate office in which you register email. insurance and take payment for it from the client. In other words, a person comes to your office who has not contacted a professional broker and cannot figure out how to purchase e-MTPL on their own. You register it on the insurance company’s website, purchase a policy for it and for this you take a “commission” in the amount of 500-1000 rubles.

What is the violation and what is the threat?

Only official partners of an insurance company who have entered into an agency agreement with it can sell MTPL policies. (If you apply for a motor vehicle license on our website, we conclude an agency agreement for you). In this case, the agent receives a commission not from the client, but from the company itself - it is included in the cost of the policy.

Of course, an “entrepreneur” using such a scheme can always say that he was not selling a policy, but a service for registering on the company’s website, consulting services, etc. However, such activities always entail additional violations. For example, in offices they do not install cash registers (CCMs) and do not connect online cash registers, because this is quite expensive and complicated. And for this there is already a fine of 10 thousand rubles for the head of the company and 30 thousand for the organization itself.

Schemes used by company employees

In the domestic market for MTPL insurance services, a significant proportion of scams are committed by the employees of insurance companies themselves. Entire criminal structures are often organized, the central link of which is unscrupulous insurance specialists who decide to make money thanks to their official position.

Employees of the anti-fraud department identified the following cases of such fraud:

- issuing an insurance policy retroactively, when compulsory motor liability insurance is registered for a car that has already been in an accident;

- adding damage that does not exist in reality to increase the payment amount. This scheme involves an employee colluding with the owner of the car, who, after receiving the money, transfers to him a certain percentage of the funds received;

- fraud with the cost of car parts and spare parts. By collusion, employees are trying to deceive their company together with employees of the service station where the car will be serviced. The repair order indicates an inflated price for spare parts that require replacement. The company pays a larger amount than the actual cost of the repair, and the difference goes to the scammers;

- concealment by an employee of the insurance company of important circumstances of the accident, for example the fact that the driver was intoxicated;

- sale of counterfeit policies, blank OSAGO forms and other fraud with documents in order to make money from one’s official position.

Selling stolen or counterfeit policies

Stolen policies can be divided into two categories: those whose forms were literally stolen, and those that were issued legally, but their payment was not paid by the agent to the insurance office.

Fake policies are produced by printing outside Russia. They are even assigned real numbers that are registered with some insurance company, which makes them very similar to real forms.

What is the violation and what is the threat?

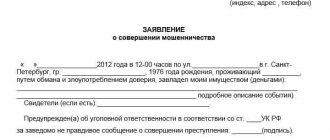

It is unlikely that anyone will doubt that selling counterfeit or stolen MTPL policies is illegal. Those who falsify official documents face criminal liability (Article 327 of the Criminal Code of the Russian Federation) and a sentence of up to 2 years in prison .

In addition, the owner of a fake OSAGO may also be punished. If it can be proven that he knew about the fake document, this corresponds to paragraph 3 of Article 327 of the Criminal Code of the Russian Federation (“Use of a knowingly forged document”). This will entail a fine of up to 80 thousand rubles, or compulsory labor, or arrest for up to six months.

The only exception, when the car owner not only will not be punished, but will also be able to receive insurance payments under a fake policy, is if he purchased compulsory motor liability insurance in the office, and the insurance agent did not deposit the money into the company's cash desk. The Supreme Court of the Russian Federation took a clear position: in this case, the form is valid, the company itself is responsible for the actions of its employee and is obliged to compensate for damage in the event of an accident.

My MTPL policy is fake. What to do?

Unfortunately, the insurance company will not help you - it is not responsible for such situations. The RSA recommends contacting law enforcement agencies to report fraud. In addition, you will have to buy new insurance. The holder of a fake policy cannot count on receiving insurance compensation, recalls Law & Com Offer partner Victoria Solovyova. And if he is found guilty of an accident, he will be forced to compensate the victim at his own expense. If the fact of falsification of the policy is discovered by a traffic police inspector, the car owner faces an administrative fine in the amount of 800 rubles.

Repeated receipt of insurance payments

Some scammers manage to obtain insurance payments for the same accident from several companies at once. There is a known case when a fraudster from Tula issued compulsory motor liability insurance with 11 (!) insurance companies. Can you imagine how much you can earn with such a scheme? True, in that story everything ended quite quickly: after the fifth campaign, the adventurer was exposed.

What is the violation and what is the threat?

As in the previous case, such actions can be classified as “Insurance Fraud”. This means that you again risk either paying a fine of up to 300 thousand (at best), or being imprisoned for up to 5 years .

Insurance fraud will increase by 17% in 2022

The number of cases of fraud in the insurance industry in 2022 will return to the level of 2019, Izvestia reports citing Sergei Efremov, vice-president of the All-Russian Union of Insurers (VSU). He estimates the figure will rise by 17% to about 12,000 cases. According to insurers, the most popular fraud schemes are retroactive registration of compulsory motor liability insurance, sale of invalid policies and imitation of the theft of expensive cars.

- The Central Bank will fight the purchase of e-OSAGO in offices

April 29, 11:14 - The Central Bank will oblige insurers to disclose information about intermediaries

May 13, 9:18 - The Supreme Court defended the owner of the car in a dispute with the insurance company

April 19, 16:28

According to estimates from the largest insurance companies, very often compulsory motor liability insurance is issued retroactively, after an accident, since up to 15% of drivers do without policies at all or drive with fake ones. But such schemes are usually uncovered, because cameras make it possible to record the exact time of the accident. With the growing popularity of CASCO, fraud has become widespread, in which supposedly stolen expensive cars are actually transported to Central Asian countries. In addition, criminals often sell invalid policies electronically or try to obtain unreasonably inflated insurance payments.

Insurers expect that by the end of the first quarter of 2022, the number of frauds with MTPL, CASCO and civil liability insurance contracts will increase by 10–20% compared to the same period last year.

Sergey Efremov, on the contrary, believes that the indicators for the first quarter will be close to those in 2020, but will significantly exceed the amount of fraud in subsequent quarters of the same year. According to an ARIA representative, amid the coronavirus pandemic and restrictions, the activity of insurance fraudsters has decreased significantly.

If in 2022 about 12,000 applications about such schemes were filed with the police for a total amount of 8 billion rubles, then in 2020 the same figures amounted to 10,000 complaints and 5.5 billion rubles. damage. In 2021, their level will likely return to pre-pandemic levels, Efremov believes.

Fraud in the auto insurance market has increased due to the pandemic

Along with insurance abuses, the BCC expects an increase in fraud in property and liability hedging agreements, where people often try to backdate agreements to get paid for damages that have already been caused. Efremov noted that with compulsory motor liability insurance it is becoming increasingly difficult to use new abuse schemes, so fraud in hedging health and property will grow faster.

Moreover, if three years ago only 10% of claims from insurers involved professional fraudsters, now their share is about half of the total number of claims. Experts note that against the backdrop of declining incomes due to the pandemic, rising exchange rates and other negative factors, many people are increasingly willing to inflate the amount of damage, not realizing that they are breaking the law.

- Pravo.ru

- criminal process

conclusions

We hope that none of you will want to risk your money and even your freedom by participating in such MTPL frauds. Firstly, all methods of fraud have long been known to the police and insurance companies, and those who make money from compulsory motor insurance illegally are identified quite quickly.

You can earn a completely legal and high income from policies. It is enough to become an agent for the sale of insurance through the Rosstrakh service. This way you can legally sell policies from many insurance companies.

If you still have questions, send a request and we will advise you

Existing anti-fraud options

In fact, today it is possible to detect the deception of fraudsters in MTPL insurance using several methods and apply appropriate measures.

Options for dealing with scammers:

- Creation of a unified PCA database that reflects information on sold contracts and insurance payments.

- Checking online sites for MTPL sales and blocking those that operate illegally.

- Notifying people via television or radio. Often on the news or in specialized programs they talk about fraud with electronic compulsory motor liability insurance. This allows you to increase the financial literacy of motorists.

How to prove you're right

If you find yourself in such a situation, it is very important to remain calm and not give in to the persuasion of scammers. Calling the traffic police to the scene of the incident is mandatory, and this must be done from your phone. Recently, scammers have been actively using fake IDs and uniforms, so it is also necessary to write down the numbers of the arriving patrol car and the names of the employees. You should not be afraid of physical harm; as a last resort, you should lock yourself in your car and call the police by phone.

Important!

Under no circumstances should you leave the scene of the accident or pull over to the side of the road. Leaving the scene of an accident implies liability under Part 2 of Article 12.27 of the Code of Administrative Offenses of the Russian Federation, so you must wait for the police to arrive without moving the car. You can spend your waiting time usefully - try to find witnesses to the accident. These could be passers-by, drivers of neighboring cars, passengers

The main goal of the bandits is to convince the driver of the need for expensive repairs to their car. Under no circumstances should you succumb to persuasion and give cash or leave the scene of the accident before the arrival of traffic police officers. It is helpful to have the contact information of a trusted legal professional with you. Calling such a person will help you stay calm and formulate the right course of action.

Who is the participant?

As research data from the Russian Union of Auto Insurers shows, an insurance fraudster may be:

- Policyholder (driver who has taken out an MTPL insurance policy);

- Insurer (an insurance company employee who issues insurance policies);

- A law enforcement officer (a traffic police officer who arrives at the scene of a traffic accident, records it in the protocol and sends a report to the State Traffic Inspectorate);

Read about what fraudulent schemes each of the listed categories of scammers uses in the next section.