August 21, 2020

Adviсe

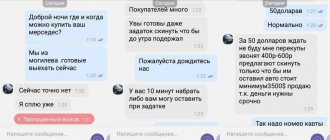

A novice investor approached the editors of AG with this question. “If you don’t understand anything about investing, go sweep the streets,” the fraudulent broker advised the man. He refused to return the money, but there is still a chance to get it back

- Give me back my money - 500 dollars.

“I told you, Nikolai: top up your account and I’ll pay you back.”

“I’ve already replenished it once, and you’re lost.” I didn't see you. There is no license or contract. You are committing fraud, extorting money from me.

– I don’t extort, but I help. I’m asking for the last time, and this is an offer, not an extortion: will you restore the account? Yes or no?

- I won’t restore anything. You transferred my money somewhere. Return it.

– You don’t understand anything about investing, Nikolai. What can I do here? You need to read books and develop yourself. All the best…

Types of fraud

Scammers have a huge assortment of different schemes at their disposal, with the help of which they lure money from gullible people. The list is updated almost daily. Try to treat any information with a certain degree of distrust, and your chances of not being deceived will increase significantly.

Currently the most commonly used are:

- bank fraud:

- in the credit sector. Transferring loan payments to your own accounts, processing a loan without the knowledge of its formal recipient, etc.;

- unauthorized debiting of money from current and deposit accounts, underestimation of the amount of deposits, etc.;

- Internet fraud:

- phishing - collection of personal data. Criminals send links to fake sites that are attractive to visitors. To open access to the portal, you are asked to provide information about yourself, including bank card numbers. Naturally, not everyone agrees to fulfill such requests. However, the mailing is massive, so criminals have plenty of deceived people. The obtained data is either resold to other scammers or used for other scams;

- via email. Mass mailing of so-called Nigerian letters. The letter sets out a story about a certain very large sum of money, which for a number of reasons its owner cannot receive. The recipient is offered to receive the amount at a high percentage. If you enter into further correspondence, you will be asked to pay, for example, for the services of a lawyer-intermediary. Actually, your funds are the target of scammers;

- when trading on the Internet. Fake online stores are being created with a wide selection of products and attractive prices. Prepayment is a prerequisite for purchase. After depositing it, you either do not receive the product at all, or you receive an item that is completely different from the quality you expected. After some time the site is closed;

- fundraising. Usually they ask for money for a child’s operation, but end up spending it on themselves;

- phone scam. Late in the evening or at night a call comes in asking for help, supposedly from a son or daughter. The victim is asked to urgently transfer money to a certain account to help their child. Oddly enough, this system brings good income to scammers. If your child is not nearby, call his mobile phone and ask for information;

- contractual fraud. Usually, scammers send the victim an extremely advantageous commercial offer on an advance payment basis. Company employees demonstrate a lot of evidence of loyalty to their company. After the funds are transferred, obligations are not fulfilled, managers do not answer calls, and the company itself simply disappears. However, for several days they may tell you stories that problems have arisen, but everything is about to get better. As a rule, scammers use one office rented for several days;

- other types. Thimbles, street lotteries, card games for money, car scams and other types of scams that have become classics of the genre have not gone away.

Do not be overly trusting, and when concluding contracts, always order legal support services from law firms.

What to do if you were deceived?

If you have become a victim of a fraudulent broker and your money is not being returned, we recommend that you immediately seek help from a lawyer or attorney.

For those who decide to act independently, we suggest using brief instructions. 1. File a fraud report at the nearest police station at your place of residence. Police officers are required to accept and register it. In your application, describe the situation in as much detail as possible, indicate the scammer’s contact information and attach screenshots of correspondence with him via instant messengers or email.

2. File a complaint about the actions of the scammers with the Prosecutor's Office of the Russian Federation. Its employees will be required to conduct an inspection.

3. File a complaint with the Central Bank of the Russian Federation through the online reception on the website. If a broker company has a license, the Central Bank of the Russian Federation, depending on the nature of the illegal actions, will send an order to it or revoke its license.

Fraud by an individual - write a statement to the police

In most cases, the perpetrators have yet to be found. Therefore, you need to contact the police. There you will have to write a statement in which you should talk about the incident and demand the initiation of a criminal case. You should be prepared for the fact that there will be no reaction to your appeal. Scammers cover their tracks well, it is extremely difficult to find them, and the police have more than enough more promising cases. You may need to hire a lawyer. His presence will guarantee that the case will be opened and work will begin on it.

How to solve problems if you have been cheated out of money?

There is a rule: lend exactly as much as you can simply give. I advise everyone to adhere to it always. But what to do if, for example, you wanted to help a person, and he suddenly decided to cheat you? Rules for “collecting debts”

- First, evaluate the amount, how significant is it?

- Second, you should not resort to crime.

We live in a “ semi-civilized ”, bureaucratic society. Where issues can be resolved without blunt beatings, humiliation, cutting off fingers, or subsequent, after the autopsy, sale of the debtor’s liver. Almost every city has collection agencies. Roughly speaking, these are debt collection agencies. The work scheme of the pros... It is believed that their origins mainly go to gangster groups, which, due to the current society, decided to legalize part of their business, and in this way as well. Yes, there is some truth in this. But it is impossible to say that all agencies are “bandits”. It would be more accurate to say that these are no longer bandits at all, these are smart, legally savvy psychologists and lawyers. Entire teams. Working with them is as follows. You come and explain the situation. That Vasya owes you 100 thousand rubles of money under such and such circumstances. Next, you enter into an agreement. Lawyers get involved and begin to exert psychological and legal pressure within the framework of the law. There are cases that during “pressure” a person can accidentally, in front of witnesses, slip on the stairs (get a lot of bruises), they can sabotage the entrance of the “accused”, tell the grandmothers and all the neighbors that he, for example, is a drug dealer or even worse, unscrupulous tenant/payer, etc. Thus, even before the trial, a person is brought to the state “within the law”, when he is ready to give away what he did not want to give to you personally. If the case comes to court, then experienced lawyers join in and fight the case to a victorious end. Yes, it is not always possible to win such cases. But the main advantage is that you save yourself from the stupid possibility of “being counter-charged for violence against a person” if you overdo it to collect debts yourself. And most importantly, in any case, create a certain vinaigrette of inconvenience for the person “in retaliation.” Advantages of this approach Moreover, the most significant advantage, in my opinion, is that such agencies, as a rule, know what they are doing, they take money only after the work has been completed (that is, they are pre-set for success). These people have the ability to find and identify (“ get out of the ground ”) a person wherever he is. And the more they look for him, the greater, as a rule, will be the amount that needs to be collected from him. Some agencies can even “peel” a person through opsos. Or skillfully transfer “the debts of the missing person to his relatives.” Of course, the approach to all clients is individual. Payment for services Commissions are usually 25-40 percent. It turns out that returning more than half of the money without much effort on your part (the work is done by professionals) will not be difficult for you. The main thing is to clearly explain the situation and set the correct vector. So, if you are owed 30-100+ rubles, do not rush to run, pull them out, break bones and lead the person to craniotomy or compression fractures. First, try to get in touch with the person, find out why he is “letting you down” ? If the reasons are serious, ask for evidence, preferably documentary evidence. Think about whether it might be more rational to slightly increase the term of the debt for a small bonus or just understand the situation. The main thing is to try to assess the adequacy of what is happening. After all, we are all human. We are all alive. We all may have situations... If you can’t do it yourself and according to the law, then, of course, it’s better to turn to a professional. And under no circumstances engage in amateur activities, especially criminal ones. God with you. It hurt. I will say that issues of this kind can be resolved, as a rule, with unscrupulous clients, and even with “unscrupulous friends,” with partners, etc. What to do if not everyone in this world can be held accountable for their words?

In any case, no matter what... We must try to make the world a better place. And I love and always advocate solving problems without third parties, if the situation allows. I advise you to do the same! Good luck, be discerning. Your white-headed Burnis...

Fraud by a legal entity - go to court

If the terms of the contract are not fulfilled by an actual legal entity, you should go to court. True, you first need to carry out the claim work, otherwise your claim will not be accepted. Send your claim by registered mail with acknowledgment of receipt and a list of the contents. After the legal deadline for responding has expired, file a claim with the court.

The result may vary. Counterparties may refer to force majeure circumstances; often scammers go into hiding and do not participate in such matters. In any case, it is extremely difficult to protect your interests without involving a lawyer in the case. The lawyer's fees during the trial can be reimbursed by the defendant, including this amount in the list of legal expenses.

Fraud by payment systemsedit

Sometimes payment systems themselves experience difficulties.

Some get out with the help of outright scammers. Some simply close down. The loudest scam is the “fight against terrorism” of the StormPay system. Initially, this system was international, open to all countries. However, the payment system found itself in a difficult position in competition with its peers. Funds were required for further development. And the administration did not come up with anything better than an outright scam - closing the accounts of users from certain countries. In any civilized country in the world, no person can be found guilty except by a court decision. The leadership of this payment system took on the function of a judge and, without any proceedings, declared the peoples of more than two dozen countries terrorists! Well, you can argue with this - you can declare the American government a terrorist, the prerequisites are there. And there are much more reasons than StormPay’s explanations. Perhaps you can defend your right in an American court. However, who will go there for their hundred or two dollars. More valuable to yourself. However, if we take into account that there were many users in these countries, and the chicken pecks every grain, then StormPay has done a good job of straightening out its affairs. However, such a massive and practically groundless scam raised suspicions about the reliability of the system even among American users. And the system is heading into the abyss.

There are more competent scammers. These are not even scams, officially these are very correct actions. For example, introducing a PIN code when logging into your e-gold account. Security is good, but it may be better to ask the user if he wants to accept such help. It would be much smarter not to enter the sending of a PIN code by default, but only to inform about such a service, which has become a disservice for many. The email address may have been closed during this time. In this case, the code is sent by mail. Okay, the postal service between Russia and the USA can safely take a turtle or a snail as a logo. But it's tolerable. What if the address of residence has also changed? Proving that you are the right person only makes sense if you have at least several tens of thousands of dollars in your account. In addition, many registered as John Smith from Michigan, and logged in under a Ryazan IP. Some registered an account in the name of Vasya Pupkin. But here you only have yourself to blame.

WebMoney also sometimes does dirty tricks in the form of sending a code to an email address, but here the Russians have come up with the idea of receiving certificates. And it won’t be difficult to restore your account if they are available.

In general, payment systems have been struggling with anonymity lately. On the one hand, this is correct, on the other hand, they are deprived of their obvious dignity. Indeed, name at least one terrorist or other criminal who stores funds in an electronic payment system!

However, such actions are beneficial for systems. If in the case of StormPay it is still theoretically possible to sue for money, then when registering under someone else’s name this is simply impossible!

DECEPTION, credit card fraud

Fraud is the theft of someone else's property or the acquisition of rights to someone else's property through deception or breach of trust.

The Bank of Russia on its official website reported about fraud and an increase in the number of cases of transactions using payment cards without the consent of their owners. It's like watching the movie “Now You See Me” online, when a team of the world's best illusionists pull off daring heists during their shows, playing cat and mouse with FBI agents. “Unknown persons place advertisements for the purchase of payment cards or contact cardholders directly with an offer to buy these cards from them. Then such cards are used to carry out unauthorized transactions,” the Central Bank said in a statement.

We are talking about online deception and scammers who use other people's cards to cash out criminal proceeds or withdraw money stolen on the Internet. “One way is for the scammer to use a drop. This is a person who, for a small fee, approximately 1 thousand rubles, issues a regular debit card for himself, then gives it to the fraudster. This is pure blatant deception. As a rule, “drops” are degraded individuals, either pensioners or students, who are in the illusion of deception and do not understand that they are being misled. Fraudsters also buy existing cards by posting advertisements on the Internet. Typically, a card obtained by fraud is used to withdraw funds stolen in online banking from electronic wallets, p2p card transfers. The detection rate of such crimes is low, and “droppers”, as a rule, manage to avoid responsibility. Although the Criminal Code of the Russian Federation contains Article 159.3. Fraud using payment cards. But as you can see, there is deception online.

Deception of consumers through online portals of free advertisements

In this case, scammers place advertisements for the sale of goods (which do not actually exist) at an attractive price, and then convince potential buyers to make an advance payment on bank cards (which, of course, are issued in advance to dummies).

Surprisingly, the victims of such primitive fraud are not only buyers of small household goods, but also expensive vehicles - scooters, snowmobiles, cars, and even tractors.

What is the usual mechanism of fraud? Owners of twin sites of well-known brand resources accept orders, for example, for cars, ask for an advance payment by bank transfer, and then stop communicating.

Or, for example, some companies offer services for the construction of wooden houses. They collect from citizens from 200 thousand to 1.5 million rubles in the form of advance payments under construction contracts, then they freeze all work, and the collected advance payment is not returned

Or, for example, companies involved in installing windows, doors, and furniture. Consumers are increasingly at risk of running into scammers who take the necessary measurements in the apartment, take a 50 percent advance payment from clients, and then disappear in an unknown direction.

There are many scammers in the microcredit market. Companies, through social networks and advertisements, promise citizens any amounts at meager interest rates and for a long period of time, but subject to making an insurance deposit of 5-10 thousand rubles. :19: Trusting borrowers deposit funds into the specified accounts and phone numbers, but never receive the desired loans. Such scams account for approximately 30% of court cases.

Carefully study the contracts offered by service providers, definitely refusing to sign contracts without details, signatures and seals.

You should not make an advance payment for the goods before receiving them directly (by post or through a courier). According to the Law “On the Protection of Consumer Rights”, the buyer has the right to refuse the goods at any time before its transfer, and after the transfer of the goods - within 7 days. There is a ten-day period for returning money to the buyer from the date of filing the claim (minus the seller’s costs for delivery of the returned goods from the consumer).