ST 169 of the Criminal Code of the Russian Federation.

1. Unlawful refusal of state registration of an individual entrepreneur or legal entity or evasion of their registration, unlawful refusal to issue a special permit (license) to carry out certain activities or evasion of its issuance, restriction of the rights and legitimate interests of an individual entrepreneur or legal entity, depending on organizational and legal form, as well as illegal restriction of independence or other illegal interference in the activities of an individual entrepreneur or legal entity, if these acts were committed by an official using his official position, -

shall be punishable by a fine in the amount of two hundred thousand to five hundred thousand rubles, or in the amount of the wages or other income of the convicted person for a period of up to eighteen months, or by deprivation of the right to hold certain positions or engage in certain activities for a term of up to three years with a fine in the amount of up to eighty thousand rubles, or in the amount of wages or other income of the convicted person for a period of up to six months, or by compulsory work for a period of up to three hundred and sixty hours.

2. The same acts committed in violation of a judicial act that has entered into legal force, as well as causing large-scale damage, -

shall be punishable by deprivation of the right to hold certain positions or engage in certain activities for a period of three to five years with a fine in the amount of up to two hundred and fifty thousand rubles or in the amount of the wages or other income of the convicted person for a period of up to one year, or by compulsory labor for a term of up to four hundred and eighty hours. , or forced labor for a term of up to three years, or arrest for a term of up to six months, or imprisonment for a term of up to three years.

Note. In this article, major damage is defined as damage the amount of which exceeds one million five hundred thousand rubles.

Judicial practice under Article 169 of the Criminal Code of the Russian Federation

Currently, according to the corpus delicti indicated in Art.

169 of the Criminal Code of the Russian Federation, very few cases are initiated. An analysis of judicial practice shows that at the stage of pre-trial verification, such attacks are reclassified as giving or receiving a bribe, without seeing the basis for giving a bribe - obstruction in the implementation of legal activities by entrepreneurs. Extreme measures that the heads of legal entities agree to lead to an increase in the corruption component.

An indicative court decision under Article 169 of the Criminal Code of the Russian Federation is the guilty verdict issued in 2014 in the Ulyanovsk region in case No. 22-1594/2014 against the head of the municipality R.Kh. Bimeev. During the verification of statements received from the heads of 2 legal entities, the actions of the accused were checked for the episode of “restriction of independence and illegal interference in the activities of a legal entity.” While in office, Bimeev R.Kh. entered into contracts for the provision of consulting services for a fee, but without fulfilling the obligations assumed. In fact, this relationship led to the legalization of payment for the actions of the Head when circumstances required it. The parties argued that Bimeev R.Kh. forced them to sign agreements.

Lawyers challenging the verdict cited the following:

- the agreements were concluded with Bimeev R.Kh., as with an individual;

- the requirement to register the accused as an individual entrepreneur to provide consultations is not provided for in the legislation.

- the amounts of payments were subject to income tax in accordance with the tax legislation as amended in force at the time the agreement was signed.

The accused under this offense did not serve his sentence, since the investigation lasted longer than the allotted time, that is, the statute of limitations had expired and it was not possible to hold him accountable. Moreover, the court recognized the right of Bimeev R.Kh. for rehabilitation.

Today, a reference to Article 169 of the Criminal Code in the verdict can only be found as a mention of the content of the concept of large damage for economic and tax crimes.

In June 2022, a guilty verdict was issued in the Penza region in the case of 10-4-2017 against the head of the administration of the rural settlement, Sh.R. Nazirov, who, while in office, withdrew from the right to own, use and dispose of a cowshed from a citizen, at the same time being the head of a legal entity. In their complaint, the defendant’s lawyers asked the court to take into account that the property was not on the company’s balance sheet and there was no confirmation of its affiliation with a legal entity. However, the constitutional right to use one's own property to carry out legal business activities was not challenged.

The verdict in this case included deprivation of the right to hold leadership positions in municipal and state authorities, as well as payment of a fine to the state.

When is a document written with dashes?

A dash in the appropriate place on the invoice is used if there is no data to indicate the indicator (Resolution No. 1137). For example, the presence of dashes is justified when drawing up documents:

- For advances, services, sale of rights, for which the consignor and consignee are not indicated and there may be no information about the unit of measurement and the associated quantity and price (letter of the Federal Tax Service of Russia for Moscow dated March 15, 2012 No. 16-15/22629).

- For objects of sale created (processed) in the Russian Federation, or those for which it is impossible to indicate the country of their origin (letters of the Ministry of Finance of Russia dated August 15, 2013 No. 03-07-08/33247, dated December 26, 2014 No. 03-07-08/67893 ).

- For goods from the Customs Union, when imported from which a customs declaration is not issued and therefore information about the place of origin is not required (letters of the Ministry of Finance of Russia dated September 12, 2012 No. 03-07-14/88, dated July 25, 2012 No. 03-07- 13/01-43).

- For goods from the European Union, for which there is no special code, and then if there is a name of the union as a country, a dash will be present in the column of its code (letter of the Ministry of Finance of Russia dated July 19, 2012 No. 03-07-09/68, Federal Tax Service of Russia dated September 4 .2012 No. ED-4-3/ [email protected] ).

Article 169 of the Criminal Code of the Russian Federation: obstruction of lawful business or other activities

Officials of state control structures are subject to prosecution for obstructing legitimate business or other activities.

The legislator clearly distinguishes between acts that are usually recognized as criminal attacks on the rights and freedoms of entrepreneurs:

- They refuse to register a legal entity when such a refusal is not supported by normative legal justification.

- Delaying the above procedure.

- Failure to issue permits to carry out licensed activities, as well as obstruction in paperwork.

- Any restrictive actions in relation to commercial enterprises of one of the organizational and legal forms (IP, LLC, PJSC, CJSC).

- Oppression of the independence of such a subject of civil circulation or interference with its work.

To qualify an encroachment under Article 169 of the Criminal Code of the Russian Federation, a special type of offender is provided - an official. The subjective side is the official position, within which manipulations to limit the rights of entrepreneurs are manifested.

When a commercial enterprise goes to court to restore its rights and wins the case, but officials continue to “harass”, then we can talk about qualified personnel under Part 2 of the article in question. It also provides that the actions of an official can cause major damage to the entrepreneur.

In 2003, the gap in criminal legislation in terms of determining the amount of material damage was filled, and a note was added to the article of the Criminal Code of the Russian Federation regarding the content of obstruction of business activity. It is indicated that material losses expressed in one and a half million rubles are recognized as large.

The punishment facing the violator under Part 1 of Art. 169 provides:

- penalties in the range of 250,000 - 500,000 rubles with the possibility of replacement by the amount of the criminal’s salary for one and a half years;

- preventing the violator from engaging in certain types of activities or holding positions for 3 years after the court verdict with simultaneous payment of penalties in the amount of no more than 80,000 rubles or replacement by the amount of income for six months;

- sentence to compulsory labor for a period of 15 days (360 hours).

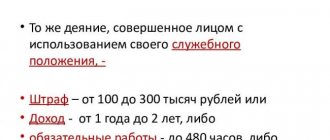

When a violation of the criminal law is classified under Part 2 of Art. 169, are charged with one of the following penalties:

It is not allowed to hold positions for at least 3, but not more than 5 years from the date of entry into force of the sentence with the simultaneous payment of a fine not exceeding 250,000 rubles or with the replacement of the financial punishment by the amount of income for the last 12 months:

- Compulsory or forced labor may be imposed for 480 hours and 2 years, respectively.

- The violator may be restricted (arrested) for 6 months.

- Imprisonment for no more than 3 years is also imposed (there is no minimum threshold for conviction).

Thus, a qualified staff that suffers significant material deprivations for entrepreneurship is expressed as a serious responsibility for the clerk.

How long does it take to issue an invoice?

The invoice is drawn up (issued) no later than the 5th calendar day (clause 3 of Article 168 of the Tax Code of the Russian Federation in accordance with clause 2 of Article 6.1 of the Tax Code of the Russian Federation) following the event with which it is associated:

- for shipment;

- receiving an advance;

- agreement on the fact of a change in the price or quantity of goods already sold.

If the last day of this period falls on a weekend, its end is postponed to the next working day (Clause 7, Article 6.1 of the Tax Code of the Russian Federation).

Typically, an invoice is issued for each event separately, but it is possible to draw up one document for all shipments made to 1 buyer in 1 day (letter of the Ministry of Finance of Russia dated May 2, 2012 No. 03-07-09/44).

If the shipment occurs in a continuous mode (energy resources or rent), then the document can be issued once for the entire month or quarter (letters of the Ministry of Finance of Russia dated 04/22/2015 No. 03-07-09/22983, 06/25/2008 No. 07-05-06/ 142, dated 02/17/2009 No. 03-07-11/41).

Issuing an invoice with a date exceeding 5 days should not lead to problems with deductions for the buyer (letter of the Ministry of Finance of Russia dated January 25, 2016 No. 03-07-11/2722, resolution of the Federal Antimonopoly Service of the Volga District dated April 15, 2014 in case No. A65- 11811/2013).

Another comment to Art. 169 of the Criminal Code of the Russian Federation

Giving another explanation to the article, it is necessary to highlight a special object of criminal encroachment - business activity, which must be conducted in accordance with the established legal order.

The Constitution, as well as civil legislation, enshrines the right to “use an individual’s abilities, as well as his property, to conduct business or other legal economic activity.” At the same time, the Civil Code of the Russian Federation states that an entrepreneur is the middle link between a citizen and a company, since he has to rely only on his own strengths, skills and abilities to build an economically profitable business model. To achieve this, the state seeks to create conditions for minimal intrusion into the affairs of such an entity. If an audit is carried out, then the goal is the same - to monitor compliance with legal requirements for specific actions and not violate the rights of consumers and other market participants (restriction of competition).

Within the meaning of Article 169 of the Criminal Code of the Russian Federation, they can be held accountable on the grounds discussed above only for infringements of persons who derive profit from their activities. This crime does not apply to non-profit organizations.

During the investigation of a crime, it is noted that the motives and purpose of the crime may be different from obtaining material gain (bribery), but this is not significant for conclusions about guilt. It is noted that even personal hostility will provoke the use of official position to commit an illegal act.

Regarding the subject, it is necessary to mention one important nuance. The age at which liability may arise for the composition in question is 16 years.

But it is known that in order to be included in the personnel service reserve for municipal or state positions, full legal capacity due to age must occur, and for some positions there is an age limit for concluding a contract.

Separately, a few words should be said about how the amount of major damage provided for in the note to the article of the Criminal Code of the Russian Federation is calculated. In accordance with the norms of civil legislation, material losses can be expressed directly - loss of profit, payment of rent for premises without conducting business, and also indirectly - through lost profits from the lack of capital movements, increased prices for consumables or production costs.

What is the highlight of the unit document?

Documents prepared by departments have the following features:

- Their number contains an indication (through a fraction) of the department number (clause 1 of the Rules for filling out invoices, clause 1 of the Rules for filling out an adjustment invoice).

- The main company is indicated as the seller, but with a subdivision checkpoint (see letter of the Ministry of Finance of Russia dated May 18, 2017 No. 03-07-09/30038). At the same time, when selling to the countries of the Customs Union, it is permissible to indicate the checkpoint of the main company (letter of the Ministry of Finance of Russia dated 06/03/2014 No. 03-07-15/26524, Federal Tax Service of Russia dated 07/08/2014 No. GD-4-3 / [email protected] ).

- The shipper is indicated as the one who actually shipped the goods, including this may be a division (letter of the Ministry of Finance of Russia dated 06/03/2014 No. 03-07-15/26524, Federal Tax Service of Russia dated 07/08/2014 No. GD-4-3/ [email protected] ).

If the division acts as a buyer, then the specifics of document preparation for it are as follows (letters of the Ministry of Finance of Russia dated 05/04/2016 No. 03-07-09/25719, dated 02/26/2016 No. 03-07-09/11029, dated 06/03/2014 No. 03- 07-15/26524, dated 04/13/2012 No. 03-07-09/35):

- The main company is indicated as the buyer, but with a subdivision checkpoint.

- The consignee is the one who actually receives the goods - the main company or division.

What makes an individual entrepreneur’s invoice stand out?

In the document drawn up by the individual entrepreneur, the following data will be special:

- The full name of the individual entrepreneur is given as the name of the seller, and, if necessary, the shipper.

- The address of the seller for an individual entrepreneur is his place of residence indicated in the Unified State Register of Individual Entrepreneurs.

- A checkpoint not assigned to an individual entrepreneur is never reflected in the invoice.

- Additionally, data from the state registration certificate of individual entrepreneurs is provided. You can indicate the OGRNIP in an additional line after the individual entrepreneur’s signature.

For a sample invoice for individual entrepreneurs, see this article.