Telephone scammers are a separate caste of swindlers. In most cases, they introduce themselves as employees of large Russian banks. Moreover, the swindler often has sufficiently detailed information about the victim, which allows him to quickly gain her trust. In an attempt to “cheat” another gullible citizen, a fraudster can show enviable persistence. And it is she who most often reveals the swindler, because a bank employee will never extort the client’s personal data, and is also openly nervous when such attempts turn out to be fruitless.

The main goal of a telephone scammer is to obtain the victim’s card number, CVC code and other information that allows them to withdraw money from the account. Knowing about the main fraudulent schemes, most citizens of the Russian Federation no longer fall for such tricks. However, if scammers continue to call bank clients, it means that sometimes gullible citizens still get caught.

Acting anonymously, such swindlers go unpunished every time. But is it possible to bring the attacker to justice? Below we will talk about where to complain about telephone scammers.

Features of telephone fraud

The first fraudulent schemes were developed in colonies and prisons, where prisoners came up with methods to steal money from the population. The advent of cellular communications has allowed fraudsters to expand their scope of crime.

Conversations with future victims of fraud are carefully thought out with the participation of professional psychologists. Criminals try to bring the subscriber to a state of panic.

Is there any point in contacting the police?

Most citizens who encounter scammers are in no hurry to contact the police, because they simply do not see the point in it. Indeed, the detection rate of such cases is extremely low, and therefore the swindler most often manages to get away with it. However, not all scammers manage to avoid liability. Some criminals received real sentences. And regular appeals from deceived citizens helped bring them to justice.

Some criminals begin to engage in telephone scams while already in prison. Despite the fact that mobile phones are officially banned in prisons, many prisoners have them. Accordingly, the most enterprising prisoners begin to master new types of fraud.

If it turns out that a person in prison is involved in telephone scams, his punishment will be increased, taking into account the new circumstances. However, it will be possible to bring the attacker to justice only if the deceived citizen contacts the police.

Common schemes

The following deception schemes are used:

- Unexpected trouble. You receive a call from a “police officer” informing you that your relative is in trouble (drugs, road accident), and you need money to let him go.

Attention! Remember that you must call this relative yourself using a phone number you know.

- Winning. The call comes from the radio station presenter, he reports a win, but in order to collect the prize, you must pay a certain amount and provide your card details.

- SMS with a request to call back on an unknown number. The call will result in the withdrawal of money.

- SMS with mailings, clicking on which will open the way for viruses.

New types of telephone fraud

Criminals also carry out scams using more modern means - through electronic wallets and bank cards. Calls can come from numbers belonging to well-known organizations.

For example, from number 900 (Sberbank), you receive an SMS about blocking an account or about a transfer. By dialing the phone number provided in the message, you allow scammers to debit money from your card.

The call from the bank is shown in the video:

Fraudsters can replace your number

Fraudsters, using special IP telephony services, can spoof a number that will look like your bank number. In order not to fall for the bait, there is only one recommendation: at the slightest suspicion, interrupt the conversation and call back yourself at the number indicated on the back of the card.

It is also not recommended to call back to unfamiliar numbers, especially short, landline ones, with a code other than +7 and starting with 8-809 (numbers for the provision of paid services). You may be charged for this, and if you end up being a victim of fraud, the fact that you called first will not be in your favor.

Fraudsters can encourage people to call back by immediately dropping the call after the call, so that the victim does not have time to answer.

How to recognize telephone scammers

Fraudsters are constantly coming up with new ways, so it’s difficult to consider all the fraudulent schemes for taking money from subscribers. In order not to fall into the traps of scammers, it is enough to remember the general signs:

- the number is hidden or unknown;

- persistence of the interlocutor, persuasion;

- the need for urgent decision-making;

- confusion or lack of answers when you ask specific questions;

- requesting passport details, cards, and other personal information.

A rule that you should always remember: no one should ever ask you for bank card codes, only scammers ask for them.

How to check a phone number for fraud in 2022

If you receive a call from an unfamiliar subscriber, you can check it via the Internet, on special websites, or simply by entering the number in the search bar.

Punishment for an unfinished crime

The criminal act is considered completed at the moment the victim transfers a certain amount of money to the fraudster’s account. However, few people know that even an attempt to seize someone else's funds is a crime. Accordingly, a person becomes a fraudster not at the moment of receiving money illegally, but already when entering into a dialogue with the victim. If the actions of the swindler did not lead to the desired result, then the crime was still committed. But in this case it is called unfinished, because the attacker tried to take possession of other people’s money, but was unable to receive it for reasons beyond his control.

A failed criminal may also face criminal charges. However, the punishment for him will be no more than ¾ of the maximum term provided for by the Criminal Code of the Russian Federation.

Have a question for a lawyer? Ask now, call and get a free consultation from leading lawyers in your city. We will answer your questions quickly and try to help with your specific case.

Telephone in Moscow and the Moscow region: +7

Phone in St. Petersburg and Leningrad region: +7

Free hotline throughout Russia: 8 (800) 301-39-20

How to respond to calls

If an unknown person calls, you should:

- keep calm;

- when asking for a decision, ask for time to think (if you hear in response that the decision must be made right now, hang up);

- do not provide personal information;

- never tell anyone your bank card codes;

- if the caller introduces himself as a police officer, clinic or other government organization, ask for specific information about him and his superiors, the scammer will hesitate in this case;

- if you were named the winner of the drawing, find information about this promotion on the Internet;

- do not transfer money.

How is phone fraud carried out?

The basis of fraudulent schemes is personal information obtained on the illegal market of databases of online stores, financial institutions, and government agencies. In the same interview, Stanislav Kuznetsov said that today’s scammers have complicated their methods of work. They can process the next victim for a long time in order to convince her to transfer money, tempting her with financial benefits and even offering a certain position with a high salary. And for this purpose, they arrange video interviews with a potential “employer”. Every day new techniques appear, but the means of fighting criminals also do not stand still.

Where to report the phone number from which the scammers called, so that they can be identified later

Photo: © Sergey Nivens / Photobank Lori

Share

Tell

Share

Tweet

Share

Today, if not everyone, then most adults in Russia have bank cards. We transfer money from card to card to friends as part of a general purchase, ask them to put it into their account “before payday”, and pay cashlessly for purchases in stores and on the Internet.

This year the number of transactions involving cards is breaking all records. According to analysts from SberIndex and IT-, in the third quarter, non-cash trade turnover exceeded the 60% mark in as many as seven regions of the country, while Karelia topped the rating of the most cashless cities in Russia. The same analysts argue that this is an uncharacteristically high level for the season, and believe that the reason for the deviation lies in the reluctance of people to use banknotes again. The pandemic is a pandemic, but whatever you say, this method of payment is convenient, and often also allows you to save money thanks to various loyalty systems.

Against the backdrop of all the opportunities that open up for bank card holders, it is important not to lose your head and not forget simple safety rules, especially since there has been a lot of news about telephone fraud lately. Everyone hopes that this will not affect them, but the attackers have their own scheme for everyone. Let’s look at the most popular ones and create simple instructions that will keep you and your family as safe as possible.

Many people receive calls, including our editorial staff - you don’t have to look far. Recently, a colleague was convinced that suspicious transactions were taking place in his account, so the funds urgently needed to be transferred to a “safe account”, the details of which would now be dictated to him. He, of course, realized that they were scammers and asked: “What if I just withdraw the money?” “No, you can’t do that,” they reported at the other end. - “The account has already been opened, you must deposit something there.” “Okay, I’ll put in a ruble,” the colleague laughed. “But we need at least a thousand,” they said in response.

This story ended well: the guy just hung up. But a 31-year-old resident of Medvezhyegorsk, wanting to save his money, recently transferred 90 thousand rubles to the scammers. A 53-year-old resident of a village in the Prionezhsky district lost 43 thousand. The Kostomuksha Department of Internal Affairs received an appeal from a 41-year-old man who, under pressure from scammers, transferred more than a million rubles to a “protected account”! The scammers didn’t stop there: they tried to convince the victim to also apply for a loan. After this proposal, the man came to his senses and contacted the police. But a 44-year-old resident of Belomorsk took out a loan for 400 thousand and transferred this money to the attackers. A similar loan story happened to a 50-year-old Petrozavodsk woman who transferred more than 200 thousand rubles to the scammers.

Account security threats are still the most popular scheme. Fraudsters insist on an immediate solution to the “problem”, rush and scare them with consequences, impressing their interlocutor so much that he loses his vigilance and does not think about double-checking the information. And now people are increasingly receiving robocalls that may ask: “Call the security service back.” True, this robot will dictate to you a number that belongs to you know who.

What to do to avoid falling for scammers?

Remember rule number one: immediately end the conversation in any unclear situation. You can “enter” the phone number of your bank into the phone book - for example, in Sberbank it is 900 and 8-800-555-555-0. If these numbers are in your address book, any others will appear as unknown, and only this will allow you to be wary of what is happening. Do not call back any numbers other than the official ones, no matter how convincingly you are asked to do so. If anything, you can also quickly contact the bank through the mobile application.

Another important rule: no operations on the instructions of the caller! A bank employee will never ask you to transfer money or give you secret data: PIN, CVV or CVC code (those treasured numbers from the back of the card), password from online banking or codes from SMS.

If you have changed your phone number, you should inform your bank. Otherwise, there is a risk that your bank data will fall to the new owner. Or when transferring funds using a phone number, the money will not come to you, but to a third party.

In addition to the “security call,” scammers can send a message (allegedly from the bank) about an erroneous money transfer. When an SMS is then received from another number asking for these funds to be returned, many naively transfer them without specifying the information. Remember: if you have made a transfer to someone yourself, you will not be able to return the money. Therefore, in any such situation, first check the phone number from which the enrollment message came. And at the same time, the balance of your card: if it has not changed, feel free to erase all SMS related to this story, and tell your friends and family how great you are. Where do scammers get real people's phone numbers? Yes, anywhere! On social networks or on free classifieds sites, for example. By the way, in correspondence on these sites you should under no circumstances disclose your card details. Recently, a 38-year-old resident of Petrozavodsk lost 4 thousand rubles in this way: he trusted a “potential buyer” of sneakers.

And the 23-year-old Petrozavodsk resident was informed that his bank was joining another well-known bank and all clients needed to independently re-register their accounts. The most convenient and fastest way to do this is, of course, by phone. The young man was switched between “employees” for a long time, then he was asked to dictate a code from an SMS message to the “voice assistant”. As a result, 83 thousand rubles were written off from the account.

What to do if you have already dictated the data or suspected fraudsters in time?

If you realize that scammers are calling you, the wisest decision is to end the conversation. Nowadays there are a lot of videos on the Internet about how people troll telephone scammers, but this is definitely not the most useful practice.

If you nevertheless succumbed to persuasion and dictated personal data or a code from an SMS, then the money can still be saved. Immediately call the bank and block the card. It is important not to waste precious time here.

You can check any suspicious phone number (and Internet address, by the way) on the official website of Sberbank. The result of the audit will be a risk assessment and recommendations. There you can also provide the addresses of fraudulent sites and telephone numbers if, alas, the fact has already been confirmed and you have lost your money. This will help in collecting data and preventing similar incidents from happening to other people. The resource is free and available to everyone, including clients of other banks.

To more effectively fight telephone scammers, you should definitely keep this instruction for yourself and share it with your loved ones. Be vigilant - take care of the reliable safety of your personal data and do not give attackers a single chance!

Where to contact

When committing telephone fraud, the subscriber should contact:

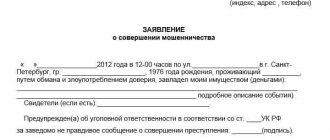

to the service center immediately after the subscriber makes a money transfer within the network of one operator. To return a sum of money, you must write a corresponding application. If money is transferred to the phone number of a criminal using the services of another operator, then it is impossible to return it by transfer to the police department. If you commit fraud, you should quickly contact the department and write a statement about the unlawful act. Such a statement shall indicate in detail the following information:

— the time the message was received (the call was received) and the number from which it was sent,

- information about the person who called (last name, first name, position), if the caller wished to introduce himself and provide such information,

— the content of the message or conversation, requirements regarding information provided over the phone.

After acceptance and registration of the application, within a period of 10 to 30 days, a decision is made to open criminal proceedings. This will most likely be refused, citing some reason. But it’s still worth filing an application, since this fact will be taken into account by the court or investigator when fraudsters commit illegal acts again.

Phone Fraud Protection Hardware

You may get the impression that there is no escape from telephone scammers. But bank security services are actively opposing them. Sberbank, for example, has developed and implemented a cybersecurity system using artificial intelligence. All calls regarding transfers or withdrawals of funds from accounts are monitored to detect signs of criminal activity. The bank's database contains many fraudulent call centers and 130 criminal schemes. A red banner appears on the online banking screen if a fraudulent transaction is suspected. By the end of 2022, the Ministry of Internal Affairs of the Russian Federation plans to launch a special service “Anti-Fraud” to combat such criminal activities.

How to check the number from which calls are coming

There are quite a lot of services on the Internet to determine, if not the owner of a specific phone number, then at least the city or country from which the call came. Up to 40% of such reports are made from abroad, another 40% from places of detention. In any case, a call to a trusted security service or bank call center will help, and not to the number specified by the robber.

Department of the Ministry of Internal Affairs of Russia for the Meshchansky district

Institution data

| Name | Department of the Ministry of Internal Affairs of Russia for the Meshchansky district |

| In what area | Meshchansky |

| In which region of Russia | Moscow |

| Website | https://mvd.ru |

| Address where it is located | Moscow, Sretenka street, 11 |

| Working hours | no information |

| Institution phone number | +7 show phone |