The legislative framework

Let's consider the legislative documents that regulate various forms of responsibility of the chief accountant:

- Criminal Code of the Russian Federation.

- Code of Administrative Offenses of the Russian Federation (in particular, Article 15.11.).

- Tax Code of the Russian Federation.

- Federal Law No. 129 of November 21, 1996.

Let's consider the regulatory grounds for criminal prosecution of the chief accountant:

- Federal Law No. 309.

- Article 144 of the Code of Criminal Procedure.

Depending on the severity of the offense, the chief accountant can be brought to disciplinary, material, administrative, or criminal liability. Disciplinary action applies to all employees. They are not specific to chief accountants.

How to hold an employee to full financial responsibility ?

Material liability

The financial responsibility of the chief accountant can be of two forms:

- On a universal basis . Assumes MO on a general basis. If the chief accountant causes any damage to the organization, compensation equal to his average salary is recovered from him. For example, the damage to the company amounted to 100,000 rubles. The chief accountant's salary is 20,000 rubles. It will not be possible to collect more than 20 thousand from an employee.

- Full financial responsibility . Provides full compensation for damages. Let's consider a similar example: an organization suffered damage in the amount of 100,000 rubles. The chief accountant, if his guilt is proven, will have to pay compensation in the amount of 100,000 rubles, regardless of the size of his salary. The provision for full financial responsibility must be specified in the employment contract. It can only be delivered to employees with key positions (chief accountant, manager).

How to differentiate between the responsibilities of the manager and the chief accountant ?

IMPORTANT! If the employment contract does not contain a clause on full MO, the chief accountant will bear financial responsibility on a general basis.

You can oblige the chief accountant to pay compensation in the following cases:

- Lack of money or property.

- Damage to property (equipment, raw materials).

- Downtime due to the employee's fault.

- Fines assessed due to the fault of the chief accountant.

This is real damage. Compensation cannot be recovered for indirect damage (for example, lost company profits).

IMPORTANT! After discovering an offense, the manager must convene a special commission to identify the culprit. Only if the commission reveals that it is the chief accountant who is to blame can compensation be recovered from him. You also need to get an explanatory note from the employee.

Administrative responsibility

The chief accountant will bear administrative responsibility for the following violations of the law:

- Accounting rules are not followed.

- The employee does not submit documents required for tax control within the established time limits.

- Registration deadlines are not met.

- The rules for carrying out operations with cash registers are ignored.

- The chief accountant violated the laws of the Russian Federation concerning the financial industry.

In 2016, amendments to Articles 15.11 and 4.5 of the Code of Administrative Offenses of the Russian Federation came into force, concerning the procedure for bringing to justice. In particular, the following changes have been made:

- The amount of the fine has increased. Now it ranges from 5,000 to 10,000 rubles. The exact amount of penalties is determined by the court depending on the circumstances of the case.

- Responsibility for repeated violation of the law has been introduced. It will be valid if a new offense occurred during the previous administrative punishment. The fine in this case will range from 10 to 20 thousand rubles. An alternative option is disqualification of a specialist for up to 2 years.

- The statute of limitations for pending cases has been increased. Previously it was 3 months. That is, if the accountant’s offense was discovered after this time, it was impossible to hold the employee accountable. Now the period has been increased to 2 years.

- When establishing the guilt of the chief accountant, evidence of the misconduct must be presented. Since 2016, they can also be used as photo and video materials.

The illegal actions for which administrative liability is introduced were also specified:

- Registration of imaginary accounting items in registers.

- Introduction of accounts outside accounting registers.

- The reporting data does not correspond with the accounting registers.

All of these are quite serious violations.

Question: Is it possible in an agreement on full financial liability of the chief accountant to provide for liability for damage caused to the organization by dishonest performance of their duties? View answer

If bad loans lead to bankruptcy

The controlling persons are to blame for the bankruptcy (they issued loans without checking the borrowers).

This is the chief accountant. He signed documents for the release of funds. In addition, he served on the committee that approved the funding. Referring to this, they demand that the chief accountant be held vicariously liable. But there are no minutes of committee meetings or other documents showing: the chief accountant is the initiator of the transfers. His responsibilities are disclosed in the job description. They do not include screening of borrowers. Other departments are doing this. Proof - bank orders, staffing schedule, other documents on the distribution of responsibilities. It has not been proven that the chief accountant exceeded his authority. For example, he approved the issuance of loans without a borrower’s file. As for signatures on financial documents, this is a legal requirement. Its execution is not a reason for subsidiary liability. This is what the Supreme Court decided in its ruling dated February 1, 2019 No. 308-ES14-4271.

In this case, the following conditions must be met:

- It’s good if counterparties are checked not by the accounting department, but by another department. For example, the security service or the legal department. This will protect the business (transferring all functions to one department is dangerous). And it will reduce the likelihood of subsidiary liability of the chief accountant, as well as department heads. They may refer to limited powers.

- It’s good when the company has instructions for checking and selecting counterparties (and from it it is obvious that this is not the work of the accounting department). If there is no such document and you cannot insist on its acceptance, then at least orders, memos, email messages are desirable... In a word, everything that will show that the chief accountant did not make a decision on the choice of partners. And does not apply to controlling persons.

- It is dangerous to violate internal regulations (which happens in practice). By complying with them, it is easier to challenge the imposition of subsidiary liability.

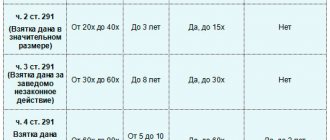

Criminal liability

The chief accountant bears criminal liability for offenses on the basis of Article 199.1 of the Criminal Code of the Russian Federation. According to the first part of this article, an official will be brought to the MA if the following factors are simultaneously present:

- The organization does not pay taxes in large quantities.

- The chief accountant commits illegal actions consciously.

- The violation of the law occurs for at least 3 years.

- The chief accountant, when committing illegal actions, is guided by his personal interests.

The second part of Article 199 of the Criminal Code of the Russian Federation is also of interest. It talks about exemption from the UO in the following circumstances:

- The offense was completely for the first time.

- The company has made all required payments to the country's budget.

The rules under consideration are relevant not only for chief accountants, but also for other officials who are responsible for paying taxes.

Is it possible to assign full financial responsibility to an employee to whom the powers of the chief accountant are transferred?

Don't agree with the director? Object

The court will not release the accountant from liability only on the grounds that he carried out criminal orders from management. It will be necessary to prove that the chief accountant objected to the director, but due to his official subordination he was forced to carry out the order.

Written evidence will help - an order from the director to record questionable documents. Only in this case will the manager be solely responsible for the accuracy of the reflection of the financial position, financial result, cash flow and other information. This conclusion follows from Part 8 of Article 7 of the Federal Law of December 6, 2011 No. 402-FZ.

However, in practice, it is unlikely that the chief accountant will be able to force the director to give a criminal order in writing. It is more realistic to draw up a memo of disagreement and submit it through the secretary to the director.

The memo must contain information about the receipt by the accountant of documents on a dubious transaction and their details. On the copy that remains at the disposal of the chief accountant, the secretary must put the incoming number and a note about receipt of the document.

A memo will not relieve the accountant from liability. But the court will definitely take this document into account as a mitigating circumstance.

Also, if, under pressure from management, the chief accountant has to reflect risky transactions, it is safer to refuse any kind of bonuses “for tax optimization.” Especially if their size is set as a percentage of the amount saved. After all, self-interest is proof of complicity.

Is it possible to hold the chief accountant accountable after his dismissal?

If wrongdoing is discovered after an employee has been fired, they can still be held accountable. To do this you will need to go to court. The statement of claim must be filed within 12 months from the date of discovery of the offense. The task of the manager in court is to collect evidence that the chief accountant caused real damage to the organization. Lost profits do not fall into the category of real damage.

IMPORTANT! 12 months must be counted from the date the offense was discovered, and not from the date it was committed. It is advisable to take care of evidence that a violation of the law was detected on a certain day.

Responsibility of the chief accountant for non-payment of salaries to employees

Non-payment of wages is a serious offense for which not only the manager, but also the chief accountant is responsible. An employee who has not received the required funds has grounds to contact the Labor Inspectorate. After this request, checks are initiated in the organization. If violations are identified during the inspection, fines are issued. A specific person, including the chief accountant, can be required to pay a fine. Let's look at who exactly will be responsible:

- If the salary was not paid due to the fact that there are no funds in the organization’s account, responsibility rests with the head of the enterprise.

- If there are funds in the account, this is considered evidence of delay of money due to the fault of the chief accountant. Accordingly, he will bear responsibility.

In this case, administrative liability is usually imposed in the form of a fine.

Do not you mind? Protect yourself personally

If the chief accountant not only does not object to the director regarding dubious transactions, but also actively participates in the development of tax schemes, secrecy will be required.

Do not write documents describing tax schemes or discuss them in email correspondence. Do not explain the essence of the schemes at a general meeting. Also, you should not report at the general meeting of shareholders, under the minutes of the secretary, how much taxes and how you saved. Thus, you help tax authorities prove the presence of intent to evade, and this is an obligatory part of the criminal case (clause 8 of the resolution of the Plenum of the Supreme Court of November 26, 2019 No. 48).

Do not give written instructions to optimize taxes to other company employees. If it is necessary to brief front-line employees, convince the CEO or CFO to do it themselves. Do not store the details of the proposed scheme either on paper or on a computer.

Choose saving methods that can be defended at least in court. Convince the manager to abandon gray payment schemes, do not register workers as individual entrepreneurs. Do not transfer money through your personal account that is intended to pay salaries to employees. Do not register either a legal entity or an individual entrepreneur in your name.

To protect yourself, review your job responsibilities. Remove from there the obligation to endorse contracts, since the chief accountant is not able to verify the integrity of all counterparties. This is the responsibility of the security and legal departments. Before recording a major transaction, obtain a lawyer's opinion on the risks this transaction poses. Keep such conclusions.