Lawyer under Art. 116 of the Criminal Code of the Russian Federation Battery

The specificity of beatings and other violent acts is that they are not types of harm to health, although they may cause minor damage to the body.

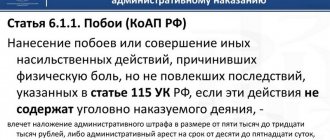

As a result of these actions, victims may not experience visible injuries. In such cases, during the examination, the expert records the presence of complaints from the victim without indicating the harm caused to health and the fact of beatings or other violent actions, which is established by the preliminary investigation body on the basis of other evidence. A lawyer, providing legal assistance in such cases, must have knowledge of the tactics and methods of investigating the crimes in question, take into account that a mandatory sign of the objective side of beatings or other violent actions is the infliction of physical pain on the victim, therefore, an experienced defense lawyer, asking questions aimed at clarifying this circumstance, may try to get the victim to deny it, which may allow the defendant to avoid criminal liability. In addition, the lawyer must take into account the motives for the crime given in Art. 116 of the Criminal Code of the Russian Federation, for which purpose by preparing your client for interrogation; during the interrogation, by asking the right questions to the client and the victim, it can help the law enforcement officer to come to the conclusion that the client was guided by motives other than those indicated in this article, which also may not entail criminal liability, however, there will be a possibility of being brought to administrative liability under Art. 6.1.1 of the Code of Administrative Offenses of the Russian Federation, or, if a person was previously punished under the specified article of the Code of Administrative Offenses of the Russian Federation and the statute of limitations has not expired, then it is possible to be held criminally liable under Art. 116.1 of the Criminal Code of the Russian Federation.

I have accumulated significant experience in providing legal assistance to persons brought to criminal liability for committing beatings and other violent acts, and victims of such acts. During my consultations, I explain in detail to clients about the specifics of the crimes of which they are suspected, accused, the qualifications of the acts they are charged with, the possibilities of reclassification to a less serious crime, an administrative offense, and I answer all the client’s questions.

Article 116. Annual additional paid leave

Ruling of the Supreme Court of the Russian Federation dated October 16, 2003 N KAS03-465 OJSC "Murmansk Sea Trade Port" appealed to the Supreme Court of the Russian Federation with the above requirement, citing the fact that the disputed paragraph of the Resolution of the Council of Ministers of the USSR dated June 17, 1981 N 558 contradicts the provisions of the new Labor Code on the issue of providing additional leave (Article 116 of the Labor Code of the Russian Federation) and violates the property rights of society protected by law. Believing at the same time that the issue of providing additional leave is fully regulated by the Labor Code of the Russian Federation, and therefore, in the event of a conflict between previously adopted legal acts and its provisions, the norms of the said Code (Part 1 of Article 423 of the Labor Code of the Russian Federation) apply.

Determination of the Supreme Arbitration Court of the Russian Federation dated January 17, 2013 No. VAS-17972/12 in case No. A75-365/2012

Recognizing the fund's decision as invalid, the courts, guided by the provisions of Articles 116, 166, 167 of the Labor Code of the Russian Federation, Articles 27, 28 of the Federal Law of December 17, 2001 N 173-FZ “On Labor Pensions in the Russian Federation”, Rules for calculating periods of work giving the right to early assignment of an old-age labor pension in accordance with Articles 27 and 28 of the Federal Law “On Labor Pensions in the Russian Federation”, approved by Decree of the Government of the Russian Federation of July 11, 2002 N 516, we concluded that the length of service giving the right to early appointment of an old-age labor pension, the mentioned periods are counted, since these periods are periods of work with the preservation of wages from which the employer made contributions to the fund.

Determination of the Supreme Arbitration Court of the Russian Federation dated October 2, 2013 No. VAS-13037/13 in case No. A63-13795/2012

Refusing to satisfy the fund's claim, the courts, guided by the provisions of Articles 116, 166, 167, 187 of the Labor Code of the Russian Federation, Federal Law of 01.06.1996 N 27-FZ “On individual (personalized) accounting in the pension insurance system”, Articles 27, 28 Federal Law of December 17, 2001 N 173-FZ “On Labor Pensions in the Russian Federation” indicated that the mentioned periods are counted in the length of service that gives the right to early assignment of an old-age labor pension, since these periods are periods of work with preservation of wages , with which the employer made contributions to the fund, therefore, there are no grounds for collecting financial sanctions from the institution.

Determination of the Supreme Arbitration Court of the Russian Federation dated November 28, 2013 No. VAS-16609/13 in case No. A75-6614/2012

Guided by the provisions of Articles 116, 166, 167 of the Labor Code of the Russian Federation, Articles 27, 28 of the Federal Law of December 17, 2001 N 173-FZ “On Labor Pensions in the Russian Federation”, Rules for calculating periods of work giving the right to early assignment of an old-age labor pension in accordance with Articles 27, 28 of the Federal Law of December 17, 2001 N 173-FZ “On Labor Pensions in the Russian Federation”, approved by the Decree of the Government of the Russian Federation of July 11, 2002 N 516, the decision of the Duma of the city of Pokachi dated March 18, 2011 N 18 courts, also came to the correct conclusion that the length of service that gives the right to early assignment of an old-age pension includes periods when the employee is on additional paid leave and business trips outside the regions of the Far North and places equated to regions of the Far North, since these periods are periods of work with retention of wages, from which the employer made contributions to the Pension Fund of the Russian Federation.

Ruling of the Supreme Court of the Russian Federation dated April 4, 2012 N AKPI12-317

As the applicant points out, the contested provisions of the regulatory legal acts of the former USSR contradict Articles , , 116, 117, 209, 219 of the Labor Code of the Russian Federation, Resolution of the Government of the Russian Federation of November 20, 2008 N 870 “On the establishment of reduced working hours, annual additional paid leave, increased wages for employees engaged in heavy work, work with harmful and (or) dangerous and other working conditions” and violate the rights and legitimate interests of the Company as an employer and participant in business activities.

Ruling of the Supreme Court of the Russian Federation dated December 19, 2016 N 310-KG16-16885 in case N A48-5811/2015

Having assessed the evidence presented, guided by the provisions of paragraphs 1 and 2 of Article 11, paragraph 3 of Article 17 of Federal Law No. 27-FZ of 01.04.1996 “On individual (personalized) accounting in the compulsory pension insurance system”, paragraph 2 of paragraph 5 of the Rules for calculating periods of work, giving the right to early assignment of an old-age labor pension in accordance with Articles 27 and 28 of the Federal Law “On Labor Pensions in the Russian Federation (approved by Decree of the Government of the Russian Federation of July 11, 2002 N 516), the courts came to the conclusion that the periods of workers’ stay in additional paid leave granted in accordance with the provisions of Part 2 of Article 116 of the Labor Code of the Russian Federation are subject to inclusion in the length of service giving the right to early pension provision, since during these periods the employee retains the average salary, on which insurance contributions to the Pension Fund of the Russian Federation are calculated. Federation.

Determination of the Judicial Collegium for Civil Cases of the Supreme Court of the Russian Federation dated August 15, 2016 N 18-КГ16-85

Article 116 of the Labor Code of the Russian Federation establishes that annual additional paid leave is provided to employees engaged in work with harmful and (or) dangerous working conditions, employees with a special nature of work, employees with irregular working hours, employees working in the regional Far North and equivalent areas, as well as in other cases provided for by this Code and other federal laws.

Resolution of the Supreme Court of the Russian Federation dated March 1, 2017 N 84-AD17-1

5. in violation of Articles 115, 116, 123 of the Labor Code of the Russian Federation, paragraph 5.3 of the collective agreement, vacation schedules for 2014 and 2015 respectively provide for vacations for employees lasting less than 28 calendar days (for 2014 - for cooks, drivers, system administrators, administrators; 2015 - 14 days leave is provided for all employees); for cooks R. and R., neither the vacation schedules nor the employment contracts define the annual additional paid leave provided for by the workplace certification card for working conditions; employees K., M., K.R., A. were not notified, with signature, of the start time no later than two weeks in advance, and were not familiarized with the orders for granting leave;

Decision of the Supreme Court of the Russian Federation dated July 17, 2003 N GKPI03-595

OJSC "Murmansk Sea Trade Port" appealed to the Supreme Court of the Russian Federation with the above requirement, citing the fact that the disputed paragraph of the Resolution of the Council of Ministers of the USSR of June 17, 1981 N 558 contradicts the provisions of the new Labor Code on the issue of providing additional leave (Article 116 Labor Code of the Russian Federation) and violates the property rights of society protected by law.

Ruling of the Supreme Court of the Russian Federation dated December 25, 2018 N 310-KG18-21715 in case N A35-2444/2017

at the request of the federal government health care institution, the medical and sanitary unit N 46 of the Federal Penitentiary Service to recognize as illegal the requirements of the inspection report of the state institution - the Office of the Pension Fund of the Russian Federation in the city of Kursk, Kursk region dated December 28, 2016 N 61 on the obligation of the insurer within two weeks from the date of receipt act to submit corrective forms of individual information with the excluded code 27-OS from information on accrued and paid insurance contributions for compulsory pension insurance and the insurance experience of insured persons for the periods: 2014, 1st quarter of 2015, in relation to employees of MCh-2 FKUZ MSCh-46 FSIN of Russia, employees of FKUZ MSCh-46 of the FSIN of Russia who have additional leaves in accordance with Part 2 of Article 116 of the Labor Code of the Russian Federation, Order of the FSIN of Russia dated December 26, 2005 N 928 “On additional leaves of workers and employees of institutions and bodies of the penal system” ,

Resolution of the Supreme Court of the Russian Federation dated February 28, 2006 N 59-ad06-1

Previously, the president of the ATPP L., by resolution of the State Labor Inspectorate in the Amur Region No. 63 dated June 11, 2004, was brought to administrative responsibility under Part 1 of Art. 5.27 of the Code of Administrative Offenses of the Russian Federation in the form of a fine in the amount of 2000 rubles for violation of Art. 116 of the Labor Code of the Russian Federation - failure to provide employees with annual additional leave of 8 calendar days - and for violation of Art. 183 of the said Code - non-payment of sick leave.

Type and amount of punishment for beatings and other violent acts under Art. 116 of the Criminal Code of the Russian Federation

Battery is an action characterized by repeated blows and beating of the victim. Other violent actions that cause physical pain can be expressed in hair pulling, pinching, tying, burning of individual parts of the body, impact on the body of plants, animals, insects, etc.

The victim's exposure to mental anguish, mental suffering, or methods that do not cause physical pain, for example, through strangulation, during the influence of the defendant, is not covered by Art. 116 of the Criminal Code of the Russian Federation.

Systematic infliction of beatings and other violent acts may result in criminal prosecution under Art. 117 of the Criminal Code of the Russian Federation, i.e. for torture.

Infliction of beatings and other violent actions of the Criminal Code of the Russian Federation is punishable by compulsory labor for up to 360 hours, or correctional labor for up to 1 year, or restriction of freedom for up to 2 years, or forced labor for up to 2 years, or arrest for up to 6 years. months, or imprisonment for up to 2 years.

In order for legal assistance to be most effective, it is advisable to contact a qualified lawyer as early as possible.

Commentary to Art. 116 Tax Code of the Russian Federation

To carry out tax control, the state establishes a rule according to which each taxpayer is subject to registration with the tax authorities (Article 83 of the Tax Code of the Russian Federation). Violation of this rule in the form of failure to comply with the registration deadline entails punishment under Article 116 of the Tax Code of the Russian Federation, and liability for evading registration is provided for in Article 117 of the Tax Code of the Russian Federation. Administrative liability of managers and other employees of organizations that are taxpayers for violating the deadline for registration with the tax authority is provided for in Part 1 of Article 15.3 of the Code of Administrative Offenses of the Russian Federation.

1. The commented article is devoted to this type of tax offense, such as violation of the deadline for registration with the tax authority.

The object of this tax offense is tax relations (Article 2 of the Tax Code of the Russian Federation) arising in the process of implementing one of the forms of tax control (Article 82 of the Tax Code of the Russian Federation). The immediate object of this tax offense is the established procedure for recording taxpayers. At the same time, the culprit violates not only the rules of Art. 83 of the Tax Code (to which the commented article directly refers us), but also the rules of Art. Art. 23, 84 Tax Code of the Russian Federation. The danger of this tax offense is that not only the taxpayer registration system is violated, but also the normal activities of tax authorities (which are forced to take additional measures to identify taxpayers who have not registered), other government agencies (for example, those controlling, licensing individual entrepreneurs and organizations , law enforcement, statistical, etc.). In addition, favorable conditions are created for the commission of more dangerous tax offenses (non-payment of tax, violation of the rules for drawing up a tax return, etc.) and even crimes provided for in Articles 198, 199 of the Criminal Code of the Russian Federation.

2. The objective side of the analyzed act is that the perpetrator:

a) does not submit an application to the tax authority for registration at the location of its separate division. It should be taken into account that the application is not considered submitted even in cases where it does not correspond to the established form or certified copies of the relevant documents are not attached to it (clause 1 of Article 84 of the Tax Code of the Russian Federation);

b) fails to submit the said application within the prescribed period, which is provided for in Article 83 of the Tax Code of the Russian Federation.

Unfortunately, the commented article does not take into account that the new version of Article 83 of the Tax Code of the Russian Federation does not contain deadlines for filing an application for registration. The fact is that both registration and registration (after the adoption of the Law on Registration of Legal Entities) are carried out by the tax authorities themselves (Article 83 of the Tax Code of the Russian Federation).

It is the objective aspect that distinguishes this tax offense not only from the offense specified in Article 117 of the Tax Code of the Russian Federation, but also from the tax offenses provided for in a number of other norms of Chapter 16 of this Code, in which the offender also violates various deadlines established by the Code (for example, Art. 118 of the Tax Code of the Russian Federation provides for liability for late transfer of information about a bank account, Article 119 of the Tax Code of the Russian Federation establishes liability for violation of the deadline for filing a tax return, etc.);

c) commits a violation of the deadline for filing an application for tax registration at the location of the separate division:

- up to 90 days inclusive. In this case, the perpetrator is held accountable under paragraph 1 of Article 116 of the Russian Federation;

- more than 90 days, in this case liability arises under paragraph 2 of Article 116 of the Tax Code of the Russian Federation.

This act is committed in the form of inaction.

3. The subjects of the offense provided for in the commented article are not all categories of taxpayers, but only organizations (including branches and representative offices), individual entrepreneurs, as well as persons engaged in private practice (private notaries, security guards and detectives). For other categories of taxpayers (i.e., for individuals who are not individual entrepreneurs, private notaries, private security guards or private detectives) there is no obligation to independently submit applications for registration to the tax authorities. The tax authority carries out their registration as taxpayers independently on the basis of information provided by the bodies that carry out registration of individuals, acts of birth and death, accounting and registration of property, etc.

Bringing a tax agent (not registered as a taxpayer) to account under Article 116 of the Tax Code of the Russian Federation would be unlawful.

Branches and representative offices and other separate divisions of Russian organizations cannot be considered independent subjects of this tax offense. Bringing the organization itself to justice under Article 116 of the Tax Code of the Russian Federation does not exempt its head (other persons performing management functions in the organization), if there are appropriate grounds, from administrative, criminal and other liability (including for violation of tax legislation) provided for by federal laws (clause 4 of article 108 of the Tax Code of the Russian Federation).

It should be taken into account that in accordance with Article 15.3 of the Code of the Russian Federation on Administrative Offenses:

a) violation of the deadline established in the commented article for filing an application for registration with the tax authority or the general public fund shall entail the imposition of an administrative fine on the heads of legal entities in the amount of up to 10 minimum wages;

b) the same act involving the conduct of activities without registration with the tax authority or the public tax office shall entail the imposition of an administrative fine in the amount of 20 to 30 minimum wages.

According to Article 15.3 of the Code of the Russian Federation on Administrative Offenses, only officials of legal entities, but not individual entrepreneurs, are held administratively liable.

4. The subjective side of the tax offense in question is characterized by the presence of both an intentional form of guilt and a careless form of guilt (Article 110 of the Tax Code of the Russian Federation).

In any case (i.e., regardless of guilt), the person is subject to a tax sanction in the form of a fine in the amount of 5 thousand rubles. (10 thousand rubles - according to clause 2 of article 116 of the Tax Code of the Russian Federation).

If there are mitigating circumstances specified in Article 112 of the Tax Code of the Russian Federation, and taking into account the rules of paragraph 3 of Article 114 of the Tax Code of the Russian Federation, the amount of the fine must be reduced by no less than two times; in the presence of an aggravating circumstance specified in paragraph 2 of Article 112 of the Tax Code of the Russian Federation, it increases by 100% (clause 4 of Article 114 of the Tax Code of the Russian Federation).