When there is no objective possibility of fulfilling the obligations confirmed by the court, an application for deferment of execution of the decision . This appeal is submitted according to the rules established by Art. Art. 203 Code of Civil Procedure. And if it is satisfied, the initiated enforcement proceedings are subject to suspension.

Accordingly, this will be a big plus for the debtor. After all, bailiffs lift the seizure of property, including funds on an account or card. In addition, the alimony payer will not be temporarily limited in the right to drive a car.

In order for the court to delay the execution of the decision, the interested party needs to find compelling arguments. The main ones are presented in the proposed material. In addition, the given judicial precedents on the topic of the article.

Grounds for filing an application to defer the execution of a court decision

When the conversation turns to civil cases, the possibility of postponing a decision that has already entered into force is provided for in Art. 203 Code of Civil Procedure of the Russian Federation. It also involves installments. However, the two categories must be distinguished from each other.

If there is a deferment, the execution of the decision is postponed to the date specified in the court ruling. Installment plans imply the fulfillment of obligations in installments. The schedule and other essential conditions are established by the court.

You also need to pay attention to Art. 37 Federal Law on enforcement proceedings. It spells out the consequences of postponing the implementation of the decision. In particular, it is indicated that until the date determined by the court, enforcement actions are not carried out.

The right to submit an application is vested in:

- claimant;

- debtor;

- bailiff

As a rule, the application is addressed to the district court or the magistrates' station where the writ of execution or court order was issued. In addition, it is possible to file an appeal at the place of execution of the court decision. The Tax Code does not provide for the collection of state duty.

The decision based on the results of consideration of the application is always made by the first instance. This rule also applies in cases where the original decision was canceled or changed by higher courts.

An interested party has the right to request a deferment of payments at any stage of enforcement proceedings. There are no time frames outlined in the legislation.

General rules for changing the deadline for paying tax payments

A change in the deadline for payment of a tax, fee, insurance premiums, as well as penalties and fines is considered to be a postponement of the established payment deadline (including an unfulfilled deadline) to a later time.

This transfer is carried out in accordance with Ch. 9 of the Tax Code of the Russian Federation. In particular, the general conditions for changing the deadline for paying tax payments (penalties and fines) are established by Art. 61 Tax Code of the Russian Federation. Thus, clause 2 of the said article provides for a change in the payment deadline in relation to the entire amount or part thereof payable to the budget (debt amount) with the accrual of interest on the debt amount. Moreover, the designated transfer does not cancel the existing one and does not create a new obligation to pay tax (clause 4). In addition, this change can be secured by a pledge of property in accordance with Art. 73 of the Tax Code of the Russian Federation, by guarantee or bank guarantee (clause 5). The tax authorities change the deadline for paying taxes (as well as fees, insurance premiums, penalties and fines) in the manner determined by departmental orders (clause 8 of Article 61 of the Tax Code of the Russian Federation). Currently this is Order No. ММВ-7-8/ [email protected]

Arguments and evidence

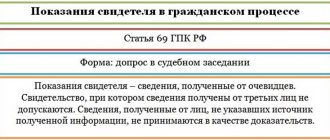

When considering petitions from participants in enforcement proceedings, courts rely not only on the provisions of the Code of Civil Procedure, but also on the instructions of the Supreme Court of the Russian Federation.

Thus, paragraph 25 of the Plenum Resolution No. 50 of November 17, 2015 states that the reason for granting a deferment is circumstances that cannot be eliminated at the time of filing the application.

These may include the difficult financial situation of the debtor and other objective factors.

When deciding on the merits of the application received, the court must examine not only the evidence presented by the interested party, but also the currently available materials of the enforcement proceedings.

In this case, an amendment is made to the fact that the deferment is an exceptional measure to ensure parity of interests of all parties - both the debtor and the rights of the claimant.

Payers of monetary obligations often request additional time to implement a court decision. The reasons put forward are loss of a job or being on maternity leave to care for a child.

When the decision concerns the foreclosure of a mortgaged apartment, debtors have the right to refer to the fact that the housing is the only one for them.

In many cases, federal and local authorities insist on transfer. As a rule, this happens when the treasury temporarily does not have the funds necessary to implement the decision, for example, providing an apartment to orphans. And the courts often comply with the requests of officials.

As for evidence, they provide any written materials indicating the intention to comply with the court decision in the future. A copy of the employment order and documents confirming the sale of other property will be suitable.

Who is eligible to defer loan payments due to coronavirus?

The following can fill out a certificate form for the bank regarding loan deferment:

- representatives of small and medium-sized businesses whose activities belong to the most affected industries;

- individuals.

Individual entrepreneurs have the right to request a deferment both as an individual and as a representative of an SME.

The list of the most affected industries was established by Government Decree No. 434 of 04/03/2020. For small and medium-sized businesses there is no limit on the loan amount.

For individuals, the maximum amount of a consumer loan is established:

| Type of lending | Individual entrepreneurs | Individuals |

| Mortgage | RUB 4,500,000 - for housing in Moscow 3,000,000 rub. — for housing in St. Petersburg, Moscow region, Far Eastern Federal District 2,000,000 rub. — for housing in other regions of the Russian Federation | |

| Car loan | 600,000 rub. | |

| Credit card | 100,000 rub. | |

| Consumer | 300,000 rub. | 250,000 rub. |

Individuals are provided with credit holidays if their income decreases by 30% compared to the average monthly income for 2022. In addition to the requirement, a certificate is provided for the bank to defer the loan confirming the decrease in income:

- The Federal Tax Service confirms income for entrepreneurs. Average monthly income is calculated by dividing total income by 12.

- Individuals provide certificates of all income (salary, pensions, scholarships, other payments). Average monthly income is determined by dividing the amount of income by the number of months in which it is received. If income was received for more than five months, the two months with the highest and two months with the lowest income are excluded from the calculation.

Analysis of judicial practice

When considering applications whose purpose is to provide an installment plan, the courts pay attention to the extent to which the existing circumstances impede the execution of the decision. When it turns out that there are no objective reasons, a refusal follows.

In some cases, the court's ruling is overturned by the appellate board on the basis of a private complaint. As a rule, the claimant applies to it within the established procedural time frame. In this case, the appellate authority gives its own assessment of all available arguments.

Below, by way of illustration, are some definitions of the Moscow City Court. They were made on the basis of the applicants' complaints. Let us add that all the named initials of the citizens have been changed.

We recommend! Application to initiate enforcement proceedings: how to submit a writ of execution to the bailiff

Deferment of payment of loan debt

In the example under consideration, the Moscow City Court considered a private complaint of a bank against a ruling of the court of first instance. This judicial act granted the application to defer the execution of the decision to collect the debt and foreclose on the mortgaged apartment.

The borrowers, asking for time, insisted that housing was the only one for them. In addition, the defendants are a large family. In addition, the mother is on maternity leave.

By an appeal ruling dated October 8, 2018 in case No. 33-442/2018, the bank’s private complaint was denied. The court, citing legal norms, justified that granting a deferment meets the interests of all parties to the conflict.

In addition, the panel of judges noted that the family is taking measures to pay off the accumulated debt. This is how documents were submitted to receive financial assistance. In addition, an apartment belonging to the mother of one of the defendants is up for sale.

Postponement of eviction by court order

The Moscow City Court considered Ignatov’s private complaint against the court’s ruling to defer the decision to evict from the apartment. The first instance granted the defendants additional time to resolve the housing issue and respect the interests of minor children.

However, the higher court, by its ruling dated July 6, 2018 in case No. 33-27011/2018, abolished the deferment.

As justification, the judicial panel cited several arguments. Thus, it was found that when deciding on the merits of the petition, the defendants did not provide evidence that they were looking for alternative housing.

In addition, Ignatov insisted that citizens do not pay utility bills for themselves. In this regard, he is obliged to bear all expenses himself. Therefore, the continued presence of the defendants in the apartment will only lead to additional expenses.

Compliance with the rights of the claimant

Judicial practice shows that delaying the implementation of a decision is a last resort.

And if it turns out that the debtor has the capabilities and resources to fulfill his obligations, the adopted determination is subject to cancellation. As confirmation, one can cite the appeal ruling of the Moscow City Court dated August 30, 2018 in case No. 33-37869/18

The appellate instance considered a private appeal against a ruling to defer the execution of a court decision regarding the division of property, the establishment of shares in property and the eviction of a former spouse from a residential premises. As grounds for granting the application, the defendant referred to his low income and the presence of numerous dependents.

However, during the consideration of the case, it turned out that the debtor was the founder of two companies and owned several real estate properties. As a result, the court of appeal considered it necessary to cancel the ruling on granting installment plans.

Who has the right to apply for a deferment (installment plan)?

According to paragraph 2 of Art.

64 of the Tax Code of the Russian Federation, the right to deferment (installment plan) can be used by an interested person whose financial situation does not allow him to pay the said tax on time, but there are sufficient grounds to believe that the possibility of paying the tax will arise during the period for which the deferment is granted. The same norm provides a list of grounds when an interested person can apply for a deferment (installment plan) for the payment of tax payments:

- causing damage to it as a result of a natural disaster, technological disaster or other circumstances of force majeure;

- delay in funding from the budget or delay in payment for a completed government order;

- the threat of his bankruptcy in the event of a lump sum tax payment;

- production or sale of goods, works or services that are seasonal.

So, in accordance with the Tax Code, an organization has the right to apply for a deferment (installment plan) for making tax payments only in four cases.

As for customs VAT (payable in connection with the movement of goods across the customs border of the Russian Federation), an organization can receive a deferment (installment plan) in respect of this tax in cases and in the manner provided for by customs legislation (clause 6, clause 2, article 64 of the Tax Code of the Russian Federation ).

FAQ

Most citizens do not often defend their own rights in the courts. Therefore, some procedural aspects may cause difficulties for people. These include the opportunity to obtain additional time to execute a court decision or court order that has entered into force.

Civil lawyers are periodically asked many questions. First of all, they relate to the conditions for rescheduling. They also ask the specialist about the procedure for appealing an already adopted determination.

Here are the answers to just some of the requests. Perhaps someone will see their own situation in them.

Possibility to undefine

I am a mortgage debtor. Due to illness, he did not make payments for six months, and the bank was forced to sue. As a result, a decision was made to foreclose on the mortgaged property.

I applied for an installment plan, but the request was denied. Is it possible to challenge the determination, and within what time frame?

Nikolay, Kolomna.

Expert commentary

Roslyakov Oleg Vladimirovich

Lawyer, specialization civil law. More than 19 years of experience.

Yes, such a possibility exists on the basis of Art. 331 Code of Civil Procedure of the Russian Federation. For this purpose, a private complaint against the deferment ruling is filed. It must be filed through the trial court within 15 days from the date of the ruling. In this case, the period begins from the next calendar date. We recommend! How to find out debt from bailiffs on the website, online by last name

The complaint must duplicate all the reasons why time is needed to implement the decision. It is also required to reflect the arguments regarding disagreement with the determination to refuse the application.

Postponement of enforcement proceedings

A few months ago, the court, by its decision, recovered from me the amount of damage caused to the second car in an accident. However, due to an unfavorable combination of circumstances, he was temporarily left without work.

On the advice of a lawyer, he filed an application to postpone the execution of the decision. I wonder if the petition is granted, is it possible to postpone the enforcement proceedings?

Victor, Moscow.

Expert commentary

Roslyakov Oleg Vladimirovich

Lawyer, specialization civil law. More than 19 years of experience.

In the event that the court makes a positive determination for the debtor, this entails a temporary cessation of all actions performed by the bailiffs. The corresponding instructions are contained in Art. 37 Federal Law on enforcement proceedings. The deferment is valid until the date specified in the court ruling. It would also be useful to notify the FSSP department about filing an application with the court. Some bailiffs in this case formally suspend their actions in relation to the debtor.

Can a creditor appeal a determination?

I came across the following situation. I incurred debt on a consumer loan due to the fact that I was laid off due to layoffs, and for a long time I could not find a job. The writ of execution is already with the bailiffs.

At the moment, I have obtained from the court a deferment of the enforcement proceedings. Can the other party challenge it and appeal the determination? Thank you for your reply.

Svetlana, Balashikha.

Expert commentary

Roslyakov Oleg Vladimirovich

Lawyer, specialization civil law. More than 19 years of experience.

Yes, a creditor may file a private complaint against the deferment determination . Moreover, the time delay is not in his interests. However, the appellate authority has the right to dismiss the complaint. The creditor, for its part, has the opportunity to file objections to it.

Is it possible to defer debt obligations?

I borrowed a large sum from a friend, but could not pay it back on time. Now he has filed a lawsuit to collect the debt on the receipt, which will most likely be satisfied.

I intend to return the money, but I need more time. What is the best thing to do in such a situation?

Gennady, Moscow.

Expert commentary

Roslyakov Oleg Vladimirovich

Lawyer, specialization civil law. More than 19 years of experience.

The surest option would be to reach an amicable agreement with your friend. If this does not work out and the bailiffs start working, then it is necessary to obtain a deferment of the decision to collect the debt. To do this, you need to file a petition with the court that previously considered the case. It must justify why it is currently not possible to pay off the debt.

Consideration of the case

The application is submitted either by the bailiff, or by the debtor, or by the collector. Documents are accepted through the office; if the claim meets the formal requirements, proceedings are opened.

The judge issues summonses; if the participants in the process do not appear, the decision is made without their participation.

A private complaint is filed against the ruling made by a participant who is dissatisfied with the result no later than 15 days after the announcement of the decision or from the date of drawing up the full decision.

How to get a loan deferment

Requesting credit holidays is allowed for loans received before April 3, 2022. Application deadline: September 30, 2022. During this period, payments will be suspended, but interest will accrue. An individual has the right to request not a transfer of payments, but a reduction thereof. Submission of an application is allowed only once.

Credit holidays can be interrupted at any time. Early repayment of the loan is allowed during their validity period. Credit holidays are not interrupted until the amount of early payments reaches the amount of payments and interest during the deferment.

A request or application for a deferred payment on a credit card, consumer or mortgage loan is sent to the bank in the manner provided for in the bank agreement:

- personally;

- by post;

- via Internet banking or mobile banking.