The Russian Federation, as a rule of law state and implementing its social policy, provides its citizens with certain social guarantees, which, among other things, include the provision of maternity capital.

Please note that this measure is provided strictly for specific purposes. Thus, such goals include: improving living conditions, educating children or other goals defined by law. However, there are cases of cashing out maternity capital. This action can be characterized by the criminal receipt of these funds without their intended use; read how to cash out maternity capital legally at the link.

ATTENTION : our criminal lawyer is ready to defend the accused (suspect) under these elements of fraud or act as a representative of the injured party.

Responsibility for cashing out maternity capital

Let's look at a specific example: in a criminal case considered by the district court of the Saratov region in relation to gr. R.O.V., convicted under Part 3 of Art. 159.2 of the Criminal Code of the Russian Federation. A woman, wanting to cash out maternity capital, which she was entitled to in connection with the birth of her second child, submitted a fictitious purchase and sale agreement for a residential building and a loan agreement for the purchase of housing to the Russian Pension Fund. Based on the documents presented to the convicted person, the Pension Fund of the Russian Federation transferred funds in the amount of 374,920 rubles, which R.O.V. disposed of at her own discretion.

In this case, thanks to the work of her defense attorney and the collected characterizing material, the latter was sentenced to a minimum sentence of one year probation. As you can see, it is quite possible to receive a suspended sentence with a probationary period for these offenses.

However, we should not forget about the organizations that provide these criminal services; we should not forget that there are frequent cases of deception of mothers, in which maternal capital is cashed out, but becomes the property of the criminals. So: in 2013, a group of people offering services for cashing out maternity capital was convicted, while the money did not reach the mothers, but ended up in criminal hands, as a result, each person involved in this criminal case received from 3 to 7 years of actual imprisonment.

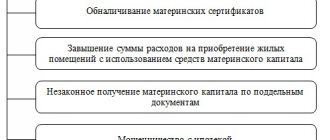

Criminal schemes for cashing out state aid

Over the past decade, judicial practice has accumulated materials on several common methods of deceiving the state. Information about them is given in the table:

| Name | Method of implementation |

| Mortgage loan fraud | The actions of the criminal group are as follows:

The scheme is revealed very simply. The owner of the certificate is obliged to provide the Pension Fund with a certificate of state registration of the apartment in his name. It is extremely difficult to include fictitious housing in the state register. |

| Fictitious purchase of housing from relatives | The law prohibits only imaginary transactions with close persons. They are determined by the following criteria:

Hint: housing purchased with capital must be registered as the property of all family members of the certificate holder. |

| Overpricing | This includes various transactions that do not improve the living conditions of the family. These include purchase agreements:

|

For information: in rare cases, the law is deceived in more sophisticated ways.

For example, they draw up a fictitious agreement on receiving educational services with familiar owners of private lyceums or courses. In judicial practice, there were also other ways of obtaining money by fraud. Thus, some citizens are engaged in the adoption of children for the purpose of enrichment. They don’t raise children themselves, they just waste government funds. This is detected and punished to the fullest extent. There have been cases of providing fake birth certificates for children. Such facts are now easily identified even at the stage of registration of maternity capital.

What is the penalty for cashing out maternity capital?

Specific punishment for cashing out maternity capital is provided for by the sanctions of Art. 159.2 of the Criminal Code of the Russian Federation, which is devoted to fraud in receiving payments.

If a person has provided knowingly false and (or) unreliable information to receive maternity capital funds, then he faces liability under Part 1 of Art. 159.2 of the Criminal Code of the Russian Federation with the appointment of one of the following penalties:

- fine up to 120 thousand rubles. or in the amount of salary for up to 1 year

- compulsory work for up to 360 hours

- corrective labor for up to 1 year

- restriction of freedom up to 2 years

- forced labor for up to 2 years

- arrest up to 4 months

If the criminal actions in question are committed by a group of persons, the qualification of the actions will be carried out under Part 2 of Art. 159.2 of the Criminal Code of the Russian Federation with the appointment of one of the following penalties:

- fine up to 300 thousand rubles. or in the amount of salary for up to 2 years

- compulsory work up to 480 hours

- correctional labor for up to 2 years

- forced labor for up to 5 years with or without restriction of freedom for up to 1 year

- imprisonment for up to 4 years with or without restriction of freedom for up to 1 year

If the acts under Part 1 and Part 2 of the above article are committed on a large scale, i.e. the size exceeds 250 thousand rubles. (maternal capital is obtained, as a rule, in an amount greater than the specified amount), then the person may be sentenced to:

- fine from 100 thousand rubles. up to 500 thousand rubles or in the amount of salary for a period of 1 to 3 years

- forced labor for up to 5 years with or without restriction of freedom for up to 2 years

- imprisonment for up to 6 years with a fine of up to 80 thousand rubles. or in the amount of salary for up to 6 months or without it and restriction of freedom for up to 1.5 years or without it

If the act in question is committed by an organized group or on a particularly large scale, i.e. in the amount of 1 million rubles, persons face punishment in the form of imprisonment for up to 10 years with a fine of up to 1 million rubles. or in the amount of salary for a period of up to 3 years or without it, with or without restriction of freedom for up to 2 years.

How to prove and where to go in case of maternity capital fraud

In most cases, the detection of fraud using MK occurs on behalf of the guardianship authorities or the Pension Fund. After completing the purchase and sale transaction, it is possible to conduct an inspection of the purchased property and the targeted allocation of funds.

Despite the above, there are situations where certificate holders are deceived by third parties in order to seize funds. Where to go in this case and how to prove that you are right?

The injured party must submit a written application to the prosecutor's office, providing information about the persons who committed fraudulent acts and fully describing the current situation. Evidence may include a signed contract, photographs or video materials.

Professional help Do you have any clarifying questions about the text of the article? Ask them in the comments! ASK A QUESTION TO AN SPECIALIST>>

Where to report misuse of maternity capital?

If the maternity capital was used by a person for other than its intended purpose, then you can report this to the pension fund.

You can also report misuse of maternal capital to the prosecutor's office, which will conduct an inspection and, if necessary, send the materials to the investigative authorities for a criminal legal assessment.

Since the use of maternity capital for purposes other than those provided for by law is most often of a criminal nature and is illegal, the crime committed can be reported to the police, who will first check the report of the crime, and then the issue of whether there are signs of a crime will be decided and initiation of criminal proceedings.

Is it possible to legally buy housing from relatives?

The law does not prohibit investing maternal capital in the purchase of apartments from relatives, if they are not spouses.

Consequently, the transaction is recognized as legitimate and not fraudulent. However, it should be completed according to all the rules. In this case, an important point is the re-registration of ownership. For example, a woman with many children lives with her mother, the owner of the apartment. They decided to receive maternity capital in cash. To do this, a contract for the sale and purchase of an apartment is drawn up. The funds are transferred to the mother's account. Next, you need to do the following:

- discharge the former owner from the property;

- register ownership of the daughter of a saleswoman with children.

If everything is done correctly, then law enforcement agencies will not find signs of fraud in such “cash.” However, the scheme itself is connected with the fact that the grandmother of minors will be left homeless. She will have to look for another place of registration, although in fact she will be able to live with her family.

Attention: apartments and houses in which government money is invested can be resold only with the permission of the guardianship and trusteeship authority. Contacting one may provoke another check of the legality of using the certificate.

Can they force me to return maternity capital?

If you illegally used maternity capital and this was established by a court verdict, then you will be forced to return the maternity capital. There are 2 options: either voluntarily return the maternity capital, or it will be recovered through legal proceedings. After the court makes a decision and it comes into force, the bailiffs will get involved in the work and will have to collect the appropriate funds.

In addition, there is judicial practice when the pension fund recovers maternity capital funds in situations where the child’s share in the property is not registered, if the purchase and sale of housing transaction is declared invalid. In this case, there is a fact of illegal enrichment of a person at the expense of budget funds and misuse of appropriate funds.

REMEMBER: the use of budget funds is subject to separate control and when there are grounds to return funds issued from the budget back, this chance will not be missed by the competent authorities. In addition, if the law establishes the receipt of certain funds for specific purposes and in connection with specific circumstances, then there is no need to come up with ways to circumvent the law and use budget money for other purposes.

Legislation

The right to maternal capital is written down in Article 3 of Law No. 256-FZ of December 29, 2006. Persons who gave birth to or adopted a second child can apply for budget funds (from 01/01/07):

- mothers (mostly);

- fathers;

- guardians;

- adoptive parents.

Attention: in exceptional cases, a certificate is issued to the child himself, who gave his mother or father the right to receive it (after adulthood). This happens if the main applicant did not have time to issue a certificate or spend money due to:

- of death;

- deprivation:

- parental rights;

- legal capacity;

- recognition as missing.

Article 7 of the above law outlines the purposes for which funds can be spent. They are strictly defined and controlled by law enforcement agencies. There are several goals:

- improving the living conditions of the family;

- payment for educational services for any child;

- purchasing rehabilitation means for disabled children (the order does not matter);

- formation of a funded pension for mother.

Hint: from 01/01/18 it is allowed to receive money in cash monthly in the established amount.

The payment procedure is described in Law No. 418-FZ of December 28, 2017. Maternity capital fraud is a criminal offense. Moreover, all participants in fraud with budget money are held accountable.

Judicial practice has accumulated many examples of cashing out and other illegal use of funds under the maternal certificate. Most of them are related to direct fraud, that is, forgery of documents. Misuse of maternity capital is less common. Such an act is not always characterized by malicious intent. Unfortunately, I do not exempt citizens from liability under the Criminal Code (CC) of the Russian Federation.

Download for viewing and printing:

Federal Law of December 29, 2006 N 256-FZ (as amended on March 7, 2018)

Federal Law of December 28, 2017 N 418-FZ On monthly payments

Special nuances of the law

Government funds are not issued in cash (with the exception of the new clause on monthly benefits). The owner of the certificate can dispose of money only through the branch of the Pension Fund (PFR). You must bring a package of documents to the government agency justifying the legality of the expenditure. After verification, the money will be transferred to the addressee (service representative or seller of the residential premises). In general, the right to dispose of a certificate occurs after the child is three years old. This does not apply to mortgage interest payments. You can spend government benefits on them from the date the certificate is issued.

For further consideration of liability for violation of the law regarding the use of maternal capital, it is necessary to cite the norm of the Criminal Code. The text of the document provides a gradation of damage that affects the amount of punishment. In particular, the paragraphs contain the concept of major damage. This is recognized as a stolen amount exceeding RUB 250,000.0.

Attention: in 2022, the amount of maternity capital is 466,600.0 rubles. Fraud with such an amount falls into the category of major damage caused to the state. The latter circumstance can also aggravate the guilt.

What to do if you are accused of illegally cashing out maternity capital?

A reasonable question arises as to how to defend against accusations of this crime:

- it is necessary to prove the reality of the transaction being concluded

- prove that maternity capital was sold for its intended purpose ; to confirm this, in addition to documents, you can also provide testimony, in particular from the seller, if we are talking about improving living conditions

- At the same time, we should not forget about the materials characterizing the accused, because these circumstances significantly influence the final judicial act in terms of punishment

In any case, you should contact our fraud lawyer as quickly as possible to solve your problem. Therefore, call us now and we will begin your task: professionally, on favorable terms and on time.

Can bailiffs arrest and take away social capital?

According to Federal Law No. 229 “On Enforcement Proceedings”, social subsidies are not included in the list of funds that can be seized by bailiffs. In addition, maternity capital funds are stored in pension fund accounts, so they cannot be seized or physically seized.

A maternity capital certificate is not money, but the right to dispose of the money received. Based on this, the actions of the bailiffs to confiscate maternity capital will be considered illegal.

REFERENCE. If the bailiffs are going to seize the money that has been deposited into your account, this is also illegal. At any stage of receiving MSC, it is not your money, but the state’s money, you only decide how to use it.

Ways to get money from maternity capital legally

There are no direct legal ways to receive the designated measure of government support in the form of cash. However, the law provides for the possibility of receiving money from MK in the form of monthly payments, which are transferred to the parent’s bank account and in fact are “cash out”, but not a one-time payment.

The procedure and conditions for making such payments are determined by a separate law No. 418-FZ, signed by the President on December 28, 2017.

In accordance with this regulatory document, you can apply for a monthly benefit if the following conditions are met:

- the mother or father (in some exceptional cases) of the second child has received a certificate for MK;

- the second child was born no earlier than 01/01/2018;

- the child has not reached the age of 3 years;

- the average income for each family member (including all minors and minors) is less than the subsistence level in the region for the corresponding category of citizens, multiplied by two.

If the specified criteria are met, the certificate holder applies to the Pension Fund with the appropriate application and attaches supporting documents.

Reference! The amount of the child benefit will be the subsistence minimum for children, approved for the 2nd quarter of the year preceding the payment.

For example, in the Nizhny Novgorod region in the 2nd quarter of 2022, the cost of living per child was 10,658 rubles. Accordingly, the amount of the benefit will be equal to this amount, and even if it does not increase in the following years, then in 3 years you can “cash out” almost the entire MK (10,658 * 36 months = 383,688 rubles).