Maternity capital has become a good measure to support Russian families. After its implementation, many were able to acquire their own housing or pay for the education of minor children. Despite this, maternity capital fraud is thriving in the country.

Today, on almost every pillar and entrance of an apartment building, you can find tempting advertisements from unknown companies offering assistance in receiving money from a certificate. What they offer, what methods of illegally cashing out maternity capital exist and what punishment they face, we will discuss further.

Legal ways to use maternal capital

Before talking about the illegal use of maternal capital, we should immediately note the permitted purposes of its legal use.

Funds from the certificate can be sent to:

- Purchase of residential real estate;

- Down payment on mortgage;

- Children's education;

- The funded part of the mother's pension

The owner of the certificate is not given money in hand. This rule cannot be circumvented. Funds are transferred to the recipient's account. It could be a real estate seller, an educational institution, or a private or public pension fund. Let us make a reservation that transactions between husband and wife (former spouses, cohabitants) are prohibited. If this fact is revealed, the owner of the certificate will have to answer to the fullest extent of the law.

In judicial practice, there have been numerous cases of fictitious separation of relations by spouses, which was followed by registration of the purchase and sale of an apartment using MK. In such situations, the deal does not go through. Pension Fund employees refuse to transfer funds, and the certificate is confiscated from the owner without the right to restore it.

Parents can easily pay for their child’s stay in a kindergarten, private school, lyceum, or higher education institution at the expense of MK. This will require collecting a certain list of documents, personally contacting the Pension Fund and waiting for approval of payments.

Transactions that are not included in the above list will be considered illegal. These include the purchase of a car , land , cottages and other things. Despite this, citizens find their own ways of cashing out money from a certificate, based on the main purposes of its use.

Incentive to break the law

Is it possible to cash out mat capital? Is it legal to cash out mat capital?

The state attaches special importance to the issues of permitted use of subsidies. At the same time, the options where you can use the money received from the budget are not numerous.

Parents, according to Federal Law 256, are allowed to:

- use the money received to purchase or build new housing;

- invest in renovation of existing residential premises;

- spend capital on children's education;

- turn it into mom's retirement savings;

- used for rehabilitation or social adaptation of a disabled child.

Many subsidy owners believe that the state overly restricts them, depriving them of the opportunity to independently decide where to invest funds so that the money brings real benefits to the family.

The main arguments against bans:

- The amount of capital is not large enough to limit its use. If parents do not have personal savings, it is almost impossible to buy quality housing with a subsidy, even in remote regions.

- Education and retirement expenses assume some future family support. Whereas it is necessary at the current moment, while children are small and require significant expenses for their maintenance.

- In addition to strictly defined areas of spending, a special receipt scheme has been developed for the subsidy, introducing bureaucratic red tape into the process.

In an effort to avoid the possibility of recipients spending funds for other purposes, money is not given to the family in cash.

Pension Fund:

- keeps the due budget money at home;

- strictly controls where parents intend to apply the subsidy;

- has the right to approve or prohibit payment if the conditions do not comply with the law or raise suspicions of fraud.

Cunning citizens, even with existing legal restrictions, manage to find an opportunity to cash out family capital. For scammers, an amount of almost half a million rubles is a “tidbit.”

What is meant by fraud using maternity capital?

Any actions of the certificate holder that do not comply with Art. 7 Federal Law No. 256.

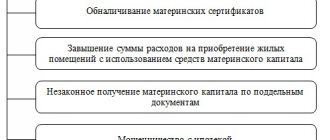

Types of fraud:

- Purchasing housing not intended for living (for example, a summer house);

- Purchase of land;

- Conspiracy with third parties to provide false information to the Pension Fund;

- Real estate transactions concluded between husband and wife (cohabitees, divorced);

- Deliberately inflating the cost of housing;

- Sale of real estate previously purchased for MK, without prior allocation of shares to children and approval from the guardianship authorities;

- Purchasing a small share in real estate;

- Other actions aimed at obtaining funds illegally

You cannot use maternity capital to buy an apartment from your former (current) husband or cohabitant. Transactions between other close relatives are not prohibited. This provides a small loophole for cashing out funds.

Thus, a daughter may well “buy” an apartment from her parents, who, after receiving the money, will give it to the former owner of the certificate. Such transactions may be considered imaginary, but they are extremely difficult to prove. As a rule, in such cases there is no punishment.

Example: Citizen Simonenko S. M. lives in a civil marriage with citizen Sleponenko L. V. The family has two common minor children. Citizens entered into a criminal conspiracy to cash out funds from MK, having drawn up a purchase and sale agreement for an apartment owned by a man. The attempt at deception was discovered when checking documents by Pension Fund employees, in particular the paternity records in the children’s birth certificates.

Buying a share in an apartment owned by several owners is impossible and is considered fraud. The exception is cases when, after acquiring part of the real estate, it completely becomes the property of the certificate holder.

It is also not possible to buy a non-residential apartment or house for MK, in which it is impossible to register (register). The building must be suitable for accommodation of minor children, i.e. All vital communications are connected to it. It is not necessary to have a bathroom inside the house; it can be located outside. However, the building itself must comply with SNiP and SanPin standards.

After purchasing real estate for MK, parents are obliged to allocate shares to their children. This rule cannot be ignored.

If such an apartment (house) is sold, the transaction will be considered fraud. However, if parents want to buy another home, they can resolve the issue with the guardianship authorities; if they agree, the children are allocated shares in the new home, and the one purchased for MK is sold.

Thus, we can conclude that the line between legal and illegal use of maternity capital is very fragile. In fact, citizens who carried out the transaction according to all the rules may also be suspected of fraud. At the same time, it is important to have a strong evidence base. Without it, it is impossible to hold the certificate holder accountable.

Answers to the most popular questions

How to use maternity capital funds for construction without a loan from the CCP?

There are two options, the first is when you involve a construction organization. In this case, the Pension Fund will need to provide documents for the land plot, a construction permit and a contract.

Second, if you are planning construction on your own. In this case, the Pension Fund will transfer funds to MK in two tranches - 50% before the start of construction, and 50% 6 months after completion of preliminary work. Simultaneously with submitting the application, you must provide documents for the land plot, a building permit and the recipient’s details.

How long does it take for maternity capital to be transferred to the CPC?

If an application for disposal of maternal (family) capital funds is submitted to the Pension Fund of the Russian Federation, then the maximum period is 20 days.

If the application is submitted through the MFC, then the period for transferring funds, taking into account the delivery of documents, increases by 4 days and is 24 days.

If one of the parents has a bad credit history, will the cooperative issue a loan to improve housing conditions using maternity capital funds?

Cooperatives are loyal to the credit history of borrowers. If the loan amount is equal to or slightly more than the remaining maternity capital, then there will be no problems.

Is it legal to cash out maternity capital through a cooperative?

Any scheme for cashing out maternity capital funds is illegal; these actions are subject to liability under Art. 159.2 of the Criminal Code of the Russian Federation and it does not matter whose funds you use in this scheme: a loan from a bank or a loan from a cooperative. However, if your actions are truly aimed at improving the living conditions of your family, then there is nothing to fear.

How to remove the encumbrance from housing after paying maternity capital to the CCP?

After repaying the loan, the Cooperative can independently remove the encumbrance (as a rule, there are no problems with this), but it will not be superfluous if you remind about this. This can be done either verbally or by submitting a written application. If the cooperative ignores your requests, then the encumbrance can be removed through the court, and all expenses will be recovered from the cooperative.

What is the commission fee in a cooperative for a loan against maternity capital?

As a rule, the cooperative's remuneration consists of two parts: interest on the use of the loan amount (as of 09/06/2021 no more than 17%) and membership fees. On average, 35,000 rubles from an MK amount of 483,882 rubles, and 40,000 rubles from an amount of 639,432 rubles.

If the commission amount significantly exceeds the market average, then you should familiarize yourself with the conditions in more detail or look for another cooperative.

Which credit cooperatives can work with maternity capital?

Firstly, the cooperative must have been operating for at least 3 years. Secondly, the cooperative must be a member of the SRO and, thirdly, it must be included in the register of the Central Bank (the current list can be downloaded on the website of the Central Bank of the Russian Federation at the link ).

What happens if the Pension Fund refuses to transfer maternity capital funds?

You will have to fulfill the obligations assumed under the loan agreement yourself. Those. return funds borrowed the cooperative. The owner of the maternal certificate retains the right to appeal in court the decision of the Pension Fund of Russia to refuse to dispose of MK funds. Depending on the situation and the reason for the refusal, there is positive judicial practice to recognize such a refusal as unlawful.

I know that many questions arise, since I have been working closely with maternity capital for 4 years now. Therefore, if you have not found the answer to your question, then ask it in the comments to this article. I’ll answer, discuss and add the most interesting ones to the body of the article!

Punishment for fraud with maternity capital

A criminal case may be initiated against the certificate holder under Article 159.1 of the Criminal Code of the Russian Federation. No matter how many people were involved in the fraud, each of them will receive the punishment they deserve.

However, for the most part it will still affect the owner of the MK. The state will act as the injured party, so if there is evidence, the perpetrators will have to answer for their actions to the fullest extent of the law.

Punishment for the illegal use of MK depends on the severity of the crime and the amount of damage caused to the state.

For example:

- For providing false information about oneself or the property being purchased, the owner of the certificate will not only receive a justified refusal to use the funds, but will also lose the right to maternal capital. The document will simply be confiscated;

- Entering into a conspiracy with third parties for the purpose of cashing out funds from MK is punishable by imprisonment for up to 5 years, as well as a fine of 100-500 thousand rubles. As practice shows, in such cases the certificate is confiscated from the owner, they are forced to return the entire amount withdrawn from it, and they are also given a suspended or real sentence;

- Organizational groups that mislead citizens in order to seize funds with the MK or the certificate itself face punishment in the form of imprisonment for up to ten years and a fine of up to 1 million rubles

Most cases of MK fraud occur when purchasing a home. Real estate fraud is the most accessible. There are loopholes and carefully thought-out schemes for cashing out money from a certificate.

The certificate holder, in some cases, may also be punished under Article 291 of the Criminal Code of the Russian Federation. It talks about giving a bribe to an official. This may mean an employee of the Pension Fund, a realtor, or a bank employee who took out a mortgage loan .

Small land on credit

Oksana, a 25-year-old mother of two children from the Ryazan region, spoke about another scheme. The scammers convinced her to purchase a plot of several hundred square meters with a loan. The land cost almost three times less than the amount of capital.

“After all this, I absolutely stopped trusting people. After receiving the certificate, they called me and offered to receive the money faster than required by law. They invited me to a meeting - the funny thing is that their office was in the same building as the Pension Fund,” the woman noted.

The government approved "father's maternity capital"

Read more…

It was written on the door of the office that this was a cooperative that also provided legal services - this convinced Oksana of the veracity and legality of their actions.

“I was offered to buy a small piece of land on credit at 0.9% per day. They say the plot itself costs only 70 thousand rubles, and the loan is quickly repaid, and the rest will be paid to me after the purchase. My mother and sister became my guarantors - this was one of the conditions,” the woman shared.

As a result, Oksana bought and registered the land, but she was summoned to the Pension Fund and threatened with fraud charges, since the amount of capital was obviously greater than the cost of the plot.

MatkapOnal: how not to become an accomplice to a crime

Read more…

“The deal was cancelled, but difficulties arose with the company. While the problems with the land were being resolved, my debt grew to 320 thousand rubles, and the scammers threatened to sue to recover the full amount. My lawyer is trying to stop all this, but so far there are no guarantees,” she clarified.

According to the Ministry of Internal Affairs, there are other methods of deception that are actively practiced by scammers. For example, consumer cooperatives buy land for pennies somewhere in the wilderness, line it up by three or four hundred square meters and issue it to the owners of the certificate - the cost of such a plot is a maximum of 10-15 thousand rubles. At the same time, companies take 100-150 thousand rubles from the recipient of maternal capital. Then they give a loan to build a house and supposedly cover it with capital without doing anything.

How to prove and where to go in case of maternity capital fraud

In most cases, the detection of fraud using MK occurs on behalf of the guardianship authorities or the Pension Fund. After completing the purchase and sale transaction, it is possible to conduct an inspection of the purchased property and the targeted allocation of funds.

Despite the above, there are situations where certificate holders are deceived by third parties in order to seize funds. Where to go in this case and how to prove that you are right?

The injured party must submit a written application to the prosecutor's office, providing information about the persons who committed fraudulent acts and fully describing the current situation. Evidence may include a signed contract, photographs or video materials.

Professional help Do you have any clarifying questions about the text of the article? Ask them in the comments! ASK A QUESTION TO AN SPECIALIST>>

Responsibility for illegal withdrawal of funds

There are 2 types of liability for illegal actions of MK certificate holders:

- Loss of the right to use a support measure in the event of detection of dishonest illegal actions to cash it out.

- Criminal liability for committing fraudulent acts.

The second type of liability has not yet been applied in practice by the majority of practicing lawyers and advocates on the part of the state. But given the existing norm of the Criminal Code, you should not tempt fate and resort to unreasonable risks.

Fraud schemes involving third party companies

Practice shows that the majority of deceived citizens resort to the help of third-party companies.

Typically they offer:

- Buy real estate before the child reaches three years of age;

- Cash out funds from MK and receive them in your hands

In the first case, the owner of the certificate may not be aware that he has come to scammers. For example, a family wants to buy an apartment, but cannot because the child is under 3 years old, and they are not approved for a mortgage.

A third-party company, for a certain amount of remuneration, will help you complete the transaction. However, after receiving confirmation of the transfer of funds to her PF accounts, she simply disappears with them.

To avoid such a situation, certificate holders should carefully select companies. Similar companies exist, and they operate quite legally, but there are only a few of them. The rest are scammers. You can determine fraud by finding out information about the company in the Pension Fund in advance, by looking at reviews, or by looking at the statutory documents.

Citizens who want to receive funds from MK in their hands often turn to the services of third parties. They propose to do this by purchasing a plot or house in some remote corner of the Russian Federation. Employees of the companies convince the owner of the microcompany that, in addition to money, property will become his property. For their services, intermediaries charge from 100 thousand rubles or more in the form of remuneration.

Often, after concluding fictitious transactions, the owner of the certificate is left without money. They simply don’t give them to him. Registered property, in practice, may not exist or may be resold to other MK holders a huge number of times.

When faced with such situations, the certificate holder must immediately contact the prosecutor's office. At the same time, do not forget about your participation in cashing out funds. In fact, he may be brought in as an accomplice, and not as an injured party.